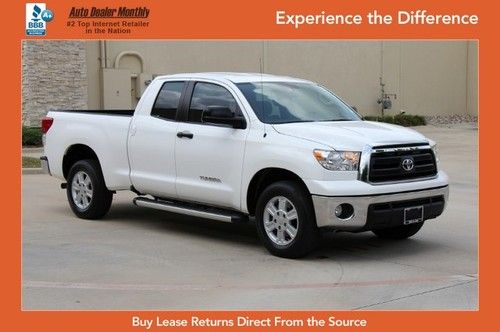

Warranty 1 Owner Non Smoker Double Cab Value Select Offering! on 2040-cars

Carrollton, Texas, United States

Engine:8

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Transmission:Automatic

Make: Toyota

Cab Type (For Trucks Only): Crew Cab

Model: Tundra

Warranty: Vehicle has an existing warranty

Mileage: 18,133

Sub Model: SR5

Exterior Color: White

Disability Equipped: No

Interior Color: Gray

Doors: 4

Drive Train: Rear Wheel Drive

Toyota Tundra for Sale

2006 toyota tundra sr5 crew cab pickup 4-door 4.7l(US $13,800.00)

2006 toyota tundra sr5 crew cab pickup 4-door 4.7l(US $13,800.00) 2008 base double 4x4 navigation tan cloth trailer hitch we finance 90k miles

2008 base double 4x4 navigation tan cloth trailer hitch we finance 90k miles Crew max / navi / 4x4 / 5.7l / dvd / mp3 / bluetooth /(US $33,975.00)

Crew max / navi / 4x4 / 5.7l / dvd / mp3 / bluetooth /(US $33,975.00) 2008 toyota tundra base extended crew cab pickup 4-door 5.7l(US $15,900.00)

2008 toyota tundra base extended crew cab pickup 4-door 5.7l(US $15,900.00) 2010 toyota tundra crewmax sr5 4x4, trd package, flex fuel, more!(US $28,900.00)

2010 toyota tundra crewmax sr5 4x4, trd package, flex fuel, more!(US $28,900.00) Tundra grey pick up low miles clean fog lights alloy wheels(US $16,495.00)

Tundra grey pick up low miles clean fog lights alloy wheels(US $16,495.00)

Auto Services in Texas

Woodway Car Center ★★★★★

Woods Paint & Body ★★★★★

Wilson Paint & Body Shop ★★★★★

WHITAKERS Auto Body & Paint ★★★★★

Westerly Tire & Automotive Inc ★★★★★

VIP Engine Installation ★★★★★

Auto blog

Toyota promoting Mirai as if hydrogen tax credit never went away

Wed, Jan 28 2015At the end of December, the US federal government let the $8,000 tax credit for hydrogen-powered vehicles expire. Despite this little wrinkle, Toyota is still promoting the upcoming 2016 Mirai fuel cell vehicle as a car that will cost under $50,000. In some cases a lot less, since it may also qualify for a $5,000 incentive in California. The car has a $57,500 MSRP, but Nihar Patel, vice president of North American Business Strategy for Toyota Motor Sales, spoke at the 2015 Washington Auto Show last week, and said that the Mirai could cost $44,500 in California. You can see this in the video at around minute four. Toyota knows that the federal incentives have expired, since the real news from the show was Patel's public request to the federal government that the $8,000 tax credit be extended. "We think that the federal credit expiration last year puts [hydrogen] customers in a fairly disadvantageous postion," he said. Plug-in vehicle buyers can still get up to $7,500 tax credit and, "we believe that this inequity needs to be fixed," he said. You can see this in the video at minute 10:20. Toyota said including both the after-incentives price and the call to reinstate those incentives was intentional since it shows a discrepancy between hydrogen and plug-in vehicles in the eyes of the feds. We asked Toyota's director of Energy and Environmental Research, Technical and Regulatory Affairs, Robert Wimmer, for more details on Toyota's request. "[The Mirai] being a ZEV and battery electrics also being ZEVs, we just want to make the playing field as level as possible," he said, adding that any extension would last "for the run of the vehicle," which would be three years. He admitted that the extension might only be for one or two years, if it happens at all. (A Toyota spokesperson clarified to AutoblogGreen that the Mirai program will not end after three years.) And that's the problem. "The tax process is difficult to predict," he said. "The two challenges we have now are that both houses of Congress are Republican and also that there has been talk for a while about comprehensive tax reform. If that moves forward, then extenders would probably be put on the back burner as comprehensive tax reform is discussed." Wimmer would not reveal any details about how Toyota is pressuring the government to act, only saying that Toyota's has people lobbying up on Capitol Hill.

Europe on track to buy more PHEVs than hybrids by 2019

Mon, Apr 27 2015LMC Automotive, formerly the forecasting division of J.D. Power & Associates, predicts that plug-in hybrids will sell better than conventional hybrids by 2019. By 2021, it envisions PHEV sales at 600,000 units yearly compared to 325,000 standard hybrid sales, and by 2024 PHEV sales are expected to account for 1.2 million sales every year. Part of LMC's prediction is based on a few factors, such as that it believes "electric-only operation will come to be seen as a true luxury characteristic and will be prized sufficiently to command significant premiums." Certain PHEVs are helped in countries like the UK and The Netherlands by generous incentives or other perks, like avoiding inner London's congestion charge, that allow them to address their price differences compared to standard offerings. And the number of PHEVs on the market will soon eclipse regular hybrids, coming from makers across the spectrum. Volvo has twice recently, and only belatedly, learned of the popularity of PHEVs: in 2013 it had to triple production of the V60 PHEV, and just this month it said demand for its XC90 PHEV is four times expectations. The Porsche Panamera E-Hybrid is outselling the traditional hybrid Panamera by more than seven-to-one. And then there's Mitsubishi Outlander PHEV, Europe's best-selling PHEV with 19,855 units, a volume more than three times larger than the second-best seller. Although LMC sees hybrid growth slowing, they're still doing well. Toyota and Lexus build the top-five selling traditional hybrids in Europe, combining for 72 percent of European sales, with the new Auris and Yaris hybrids alone selling 123,506 units in 2014. For LMC's forecast to come true, Europe will need a spectacular change in buying habits, since the top ten conventional hybrids tallied 175,847 sales in 2014, and the top ten PHEVs rang up 36,138 sales. Featured Gallery 2015 Volvo XC90 T8 View 14 Photos News Source: Automotive News - sub. req. Green Mitsubishi Toyota Volvo Hybrid ev sales hybrid sales toyota auris hybrid toyota yaris hybrid

The UK votes for Brexit and it will impact automakers

Fri, Jun 24 2016It's the first morning after the United Kingdom voted for what's become known as Brexit – that is, to leave the European Union and its tariff-free internal market. Now begins a two-year process in which the UK will have to negotiate with the rest of the EU trading bloc, which is its largest export market, about many things. One of them may be tariffs, and that could severely impact any automaker that builds cars in the UK. This doesn't just mean companies that you think of as British, like Mini and Jaguar. Both of those automakers are owned by foreign companies, incidentally. Mini and Rolls-Royce are owned by BMW, Jaguar and Land Rover by Tata Motors of India, and Bentley by the VW Group. Many other automakers produce cars in the UK for sale within that country and also export to the EU. Tariffs could damage the profits of each of these companies, and perhaps cause them to shift manufacturing out of the UK, significantly damaging the country's resurgent manufacturing industry. Autonews Europe dug up some interesting numbers on that last point. Nissan, the country's second-largest auto producer, builds 475k or so cars in the UK but the vast majority are sent abroad. Toyota built 190k cars last year in Britain, of which 75 percent went to the EU and just 10 percent were sold in the country. Investors are skittish at the news. The value of the pound sterling has plummeted by 8 percent as of this writing, at one point yesterday reaching levels not seen since 1985. Shares at Tata Motors, which counts Jaguar and Land Rover as bright jewels in its portfolio, were off by nearly 12 percent according to Autonews Europe. So what happens next? No one's terribly sure, although the feeling seems to be that the jilted EU will impost tariffs of up to 10 percent on UK exports. It's likely that the UK will reciprocate, and thus it'll be more expensive to buy a European-made car in the UK. Both situations will likely negatively affect the country, as both production of new cars and sales to UK consumers will both fall. Evercore Automotive Research figures the combined damage will be roughly $9b in lost profits to automakers, and an as-of-yet unquantified impact on auto production jobs. Perhaps the EU's leaders in Brussels will be in a better mood in two years, and the process won't devolve into a trade war. In the immediate wake of the Brexit vote, though, the mood is grim, the EU leadership is angry, and investors are spooked.