2014 Toyota Rav4 Limited on 2040-cars

2550 N Shadeland Ave., Indianapolis, Indiana, United States

Engine:2.5L I4 16V MPFI DOHC

Transmission:6-Speed Automatic

VIN (Vehicle Identification Number): 2T3DFREV4EW128835

Stock Num: E0282

Make: Toyota

Model: RAV4 Limited

Year: 2014

Exterior Color: Blizzard Pearl

Options: Drive Type: AWD

Number of Doors: 4 Doors

Mileage: 3

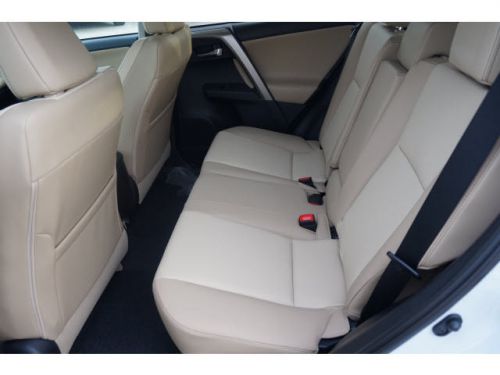

Load your family into the 2014 Toyota RAV4! It comes equipped with all the standard amenities for your driving enjoyment. Toyota infused the interior with top shelf amenities, such as: front fog lights, power moon roof, and seat memory. It features an automatic transmission, all-wheel drive, and a 2.5 liter 4 cylinder engine. We have a skilled and knowledgeable sales staff with many years of experience satisfying our customers needs. They'll work with you to find the right vehicle at a price you can afford. Call now to schedule a test drive. If saving money is important to you, visit O'Brien Toyota Scion, Indy's only 13-time President's Award-winner! We always have a great selection of new and used vehicles with low prices and professional customer service. Come see how "Our Family Works for You! Since 1933." For special internet pricing contact Steve Kovacs, Internet Sales Manager, at 877-801-9217.

Toyota RAV4 for Sale

2014 toyota rav4 limited(US $31,285.00)

2014 toyota rav4 limited(US $31,285.00) 2011 toyota rav4(US $17,960.00)

2011 toyota rav4(US $17,960.00) 2011 toyota rav4(US $19,860.00)

2011 toyota rav4(US $19,860.00) 2014 toyota rav4 le(US $25,590.00)

2014 toyota rav4 le(US $25,590.00) 2014 toyota rav4 le(US $26,236.00)

2014 toyota rav4 le(US $26,236.00) 2014 toyota rav4 xle(US $26,776.00)

2014 toyota rav4 xle(US $26,776.00)

Auto Services in Indiana

Vawter`s Automotive Service ★★★★★

Usa Muffler Shops ★★★★★

USA Muffler & Brakes ★★★★★

Twin City Upholstery Ltd. ★★★★★

Tire Central Avon ★★★★★

Taylorsville Tire Inc ★★★★★

Auto blog

Watch this video diary of a 900-hp Toyota Supra build

Sat, 08 Jun 2013If you've ever looked at a car with nearly 1,000 horsepower and wondered why anyone needs that amount of thrust, you may want to take a look at the video below. In it, one gentleman details his descent into Toyota Supra madness, starting with a pristine factory example and stumbling down the rabbit hole of modification. What makes this particular clip interesting is just how honest the owner is as he explains the evolution of his car. He doesn't just prattle off a list of parts like he's reading the menu at an IHOP.

Instead, he painstakingly pulls us through the car's growth, detailing each iteration and what pushed him to the next stage of the build every time. From this point of view, it looks less like someone walked into a shop and lit a massive stack of $100 bills on fire and more like a quasi-logical progression of events. Or at least it does to me. You can check out the build in the video below, complete with plenty of Fast and the Furious references and racing. Win, win, win.

US Congress lets $8,000 hydrogen vehicle tax credit expire

Mon, Dec 22 2014When Toyota introduced the 2016 Mirai last month in preparation for a launch late next year, it said that the hydrogen car will have a $57,500 MSRP and that there will be a federal tax credit available worth up to $8,000. The problem, as we noted at the time, is that that federal credit was set to expire at the end of 2014. The technical language of the current rule says that someone who buys a fuel cell vehicle, "may claim a credit for the certified amount for a fuel cell vehicle if it is placed in service by the taxpayer after Dec. 31, 2005, and is purchased on or before Dec. 31, 2014." With the 113th Congress now finished up for the year and legislators headed home for the holidays, we know one thing for certain: the federal tax credit for hydrogen vehicles was not updated and will end as we're all singing Auld Lang Syne next week. All of this isn't to say that Mirai buyers won't be able to take $8,000 off the price of the car 12 months from now. For proof of that, we only need to look at other alternative fuel tax incentives and realize that this Congress simply isn't moving fast enough to deal with things that are expiring right now. One of the last things that the 113th Congress did in December was to take up the tax credits that expired at the end of 2013 and renew some of them. Jay Friedland, Plug In America's senior policy advisor, told AutoblogGreen that PIA and other likeminded organizations worked with Congress to extended the electronic vehicle charging station (technically: EVSE) tax credit that was part of the Alternative Refueling Tax Credit in IRS Section 30(C) through the end of 2014. "Individuals can deduct 30 percent of the cost of purchasing and installing an EVSE up to $1,000; businesses, 30 percent up to $30,000," he said. "This tax credit is applied to any system placed into service by 12/31/14 and is retroactive to the beginning of the year. So go out and buy your favorite EV driver an EVSE for the holidays," he said. An electric motorcycle credit was killed at the last minute as Congress was getting ready to leave, but H.R. 5771 did extend the Alternative Fuels Excise Tax Credits for liquefied hydrogen and other alternative fuels. These sorts of tax credit battles happen all year long. In July, Blumenthal introduced the Fuel Cell and Hydrogen Infrastructure Act of 2014, which never got out of the Finance Committee. Back to the hydrogen vehicle situation.

General Motors became second-largest US advertiser in 2013

Fri, 28 Mar 2014General Motors might be mired in several recalls, as well as the ongoing investigations from the National Highway Traffic Safety Administration and Congress into the automaker's response to those recalls. However, the company can celebrate taking the title of the US' second-largest advertiser in 2013. According to Ad Week examining a recently released study, total advertising spending in the US posted its fourth consecutive year of rising expenditures with 0.9-percent growth to $140.2 billion. Of that, the auto industry spent $15.2 billion to promote its goods in 2013, up 3.8 percent.

The country's biggest advertiser was Procter and Gamble, which dropped $3.17 billion in 2013, an increase of 11.8 percent. GM became the nation's second largest promoter with $1.794 billion in spending, up 10 percent. The biggest proportion of that money went to sell Cadillac and GMC. AT&T barely lost out with $1.793 billion in advertising, 15.2 percent growth. The 10 businesses with the highest ad investments spent a cumulative $15.9 billion during the year, 6.6 percent higher than 2012. Toyota came in eighth place making it the only other automaker to rank in the top 10.

The study also indicates that there is a shift in advertising spending from television and print to the Internet. There was 15.7 percent more money outlaid to promote products online in 2013 than the previous year. In comparison, television dropped 0.1 percent, newspapers were down 3.7 percent and radio fell 5.6 percent.