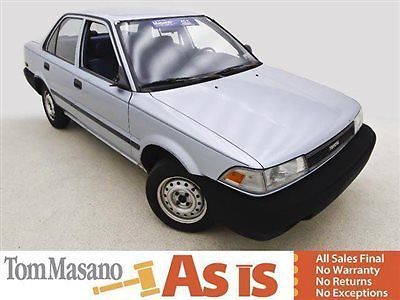

1989 Toyota Corolla Dlx (f10269a) ^^ As Is $5 Sale!!! on 2040-cars

Reading, Pennsylvania, United States

For Sale By:Dealer

Engine:1.6L 1587CC l4 GAS DOHC Naturally Aspirated

Transmission:Manual

Body Type:Sedan

Vehicle Title:Clear

Used

Year: 1989

Power Options: Air Conditioning

Make: Toyota

Model: Corolla

Mileage: 125,897

Doors: 4

Sub Model: Sedan DLX

Engine Description: 1.6L 4 CYLINDER

Exterior Color: Blue

Trim: DLX Sedan 4-Door

Interior Color: Other

Number of Cylinders: 4

Drive Type: FWD

Warranty: Vehicle does NOT have an existing warranty

Toyota Corolla for Sale

2012 toyota corolla s auto sunroof ground effects 26k texas direct auto(US $15,980.00)

2012 toyota corolla s auto sunroof ground effects 26k texas direct auto(US $15,980.00) 2011 toyota corolla s sedan 4-door 1.8l financing in texas only(US $11,100.00)

2011 toyota corolla s sedan 4-door 1.8l financing in texas only(US $11,100.00) 2006 toyota corolla le sedan 4-door 1.8l

2006 toyota corolla le sedan 4-door 1.8l Toyota corolla 2000 stik shift(US $1,300.00)

Toyota corolla 2000 stik shift(US $1,300.00) 2012 toyota corolla le sedan 4-door 1.8l(US $14,250.00)

2012 toyota corolla le sedan 4-door 1.8l(US $14,250.00) Toyota : corolla le sedan 4-door 2004 1.8l 79k miles(US $5,800.00)

Toyota : corolla le sedan 4-door 2004 1.8l 79k miles(US $5,800.00)

Auto Services in Pennsylvania

Young`s Auto Body Inc ★★★★★

Young`s Auto Body Inc ★★★★★

Wilcox Garage ★★★★★

Tint-Pro 3M ★★★★★

Sutliff Chevrolet ★★★★★

Steve`s Auto Repair ★★★★★

Auto blog

Best compact SUVs of 2023 and 2024

Thu, Oct 20 2022Compact SUVs are now the go-to choice for family transportation. Actually, considering how popular they are, they have clearly moved beyond only family duty. With such popularity, though, comes an awful lot of competitors, and it can be difficult to figure out which one might be the best compact SUV for you. It's important to note that by "compact SUV" we're talking about a specific segment. As we describe in our more comprehensive "Best small SUVs" list, there are also subcompact SUVs that vary widely in size amongst themselves, but are clearly smaller than the SUVs below. Frankly, today's segment of compact SUVs isn't exactly compact — some have more cargo space than vehicles that are considered midsize based on their exterior dimensions. They've all grown considerably over the years. While many lists out there just rattle off every vehicle available in a segment, we thought we'd be a bit more helpful and curate your shopping a bit with the top-recommended choices reviewed by Autoblog. We've included both mainstream and compact luxury SUV choices. Best compact SUVs of 2023 and 2024 2024 Honda CR-V Why it stands out: Best-in-class space; excellent hybrid powertrain; sharp interior style; Honda dependabilityCould be better: No lower-price base trim levels; no sporty or off-road niche models; no plug-in hybrid Read our full 2024 Honda CR-V Review Consider the CR-V the baseline for any compact SUV search, and look extra closely at the superb CR-V Hybrid option. Objectively speaking, it's tough to beat due to its massive cargo capacity, voluminous back seat, strong-yet-efficient engines, well-balanced driving dynamics, competitive pricing and features, and well-regarded reliability. It's easy to see why it continues to be such a best-seller: for the vast majority of compact SUV buyers, and especially families, it checks every box. That's been the case for many years now, however. The all-new 2023 Honda CR-V changes things up by adding a bit more style and character, particularly in terms of its interior design and how surprisingly enjoyable the Sport and Sport Touring hybrid trim levels are to drive.

Did Lexus make a BMW? Or did BMW make a Lexus? This and other 2017 surprises

Fri, Dec 29 2017It's that time of year again. The calendar is about to reach its end, Star Trek Cats 2018 is about to take its place, and I'm reflecting about all the cars that graced my driveway this year or summoned me to exotic places. You know, like Stuttgart or Phoenix. In 2017, I drove at least 57, and as I perused the list of them, I started to notice a common refrain: "This car surprised me." Most were pleasant surprises, but there were a few head scratchers and facepalms for good measure. In both cases, it was generally the result of car companies seemingly trying to break out of an existing mold. Nowhere was that more apparent than the pair of Lexuses slathered in Infrared paint: The LS 500 that left me this week and the LC 500 that was my favorite car of 2017. Though Lexus has been trying to shake its crusty, gold-packaged reputation for some time now, its efforts always seemed like an old man choosing Hollister to redo his wardrobe after realizing it hasn't been updated since 1987. I fell in love with the LC, genuinely floored by its near-perfect take on the GT. It's characterful in sound, appearance and tactility. It was at home in the city, in the mountain and on the open road. It was both comfortable and thrilling, and after driving the mechanically related LS 500, I can report that the LC's talents aren't an outlier. The LS 500's turbo V6 may make different noises than the LC's naturally aspirated V8, but it nevertheless invigorates the cabin when the car is placed in Sport+ mode. The steering is truly communicative, body motions are kept in miraculous check, and I absolutely forgot I was in an enormous luxury limo ... and a Lexus one at that. It was everything that the BMW 530e was not. I drove that on the exact same roads and was utterly bored the entire time. Generally doughy, lifeless steering, more distant than Planet 9. And no, the plug-in hybrid powertrain had nothing to do with that. At least it shouldn't. The Porsche Panamera S e-Hybrid I also drove this year proves that, as do the Hyundai Ioniqs, which are surprisingly adept and fun little cars regardless of what powers their wheels (Hyundai + hybrid = fun really blew me away). I would drive that Lexus LS F Sport over the BMW 5 Series any day of the week, which seems like a shocking thing to say in relation to either car. While Lexus is seemingly breaking out of its old crusty mold, BMW seems to be climbing into one.

Recharge Wrap-up: LA Auto Show may feature updated Cadillac ELR, Uber expands Chicago HQ

Tue, Sep 30 2014A Kentucky man has converted his 1939 Dodge pickup to an electric vehicle. Al Gajda of Lexington built the electric truck, which he now uses as his daily driver. "I take advantage of any excuse to drive it; just banging around town, errands, short runs on the interstate, delivering my granddaughter to school in the morning," he says. It is powered by a lithium-ion phosphate battery, which is mounted in a wooden box on the truck bed, and gets about 100 miles per charge. Read more at the Lexington Herald-Leader. Elon Musk will speak at the Automotive News World Congress in January. The Tesla CEO is a featured speaker for the program, "Setting the Pace in a Thriving Market." The event takes place in Detroit, which could lead to an interesting mix of people in the audience, and Musk will speak on January 13. Read more at Automotive News. Production of the Toyota Rav4 EV has ended. The shipment of the final Toyota EVs concludes Toyota's deal to source batteries from Tesla. Of the 2,600 Rav4 EVs to be produced, there are probably just a few hundred left to be sold, most of which are likely to be gone by the end of October. Read more at Inside EVs. Cadillac will likely show an improved version of the ELR at the Los Angeles Auto Show in November. The 2016 ELR will include unspecified "engineering enhancements," according to Cadillac spokesman David Caldwell. There will be no 2015 model, as the 2014 model will be sold until the 2016 ELR goes on sale in the first half 2015. Read more at Edmunds. Uber executives, along with Illinois Governor Pat Quinn, have announced a major expansion of the ride-hailing company's Chicago headquarters. Uber also plans to add 420 jobs by the end of 2016. "Uber's new expanded headquarters will allow the company to continue its rapid growth and serve its riders and drivers throughout Illinois," says Governor Quinn. Last month, Quinn vetoed legislation that would have put restrictions on companies like Uber in the state. Read more in the press release below. Governor Quinn and Uber Announce Major Chicago Headquarters Expansion Innovative Ridesharing Company to Add 420 Jobs by End of 2016 CHICAGO, Sept. 29, 2014 /PRNewswire-USNewswire/ -- Governor Pat Quinn and Uber executives today announced that the ridesharing giant is moving forward with creating 420 new jobs by the end of 2016 in a major expansion of its Chicago regional headquarters.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.063 s, 7929 u