No Reserve 2004 Toyota Sequoia Limited 4x4 4.7l V8 Auto Handymans Special on 2040-cars

Rockaway, New Jersey, United States

Vehicle Title:Clear

Engine:4.7L 4663CC 285Cu. In. V8 GAS DOHC Naturally Aspirated

For Sale By:Dealer

Body Type:Sport Utility

Fuel Type:GAS

Make: Toyota

Warranty: Vehicle does NOT have an existing warranty

Model: Sequoia

Trim: Limited Sport Utility 4-Door

Options: Sunroof

Safety Features: Side Airbags

Drive Type: 4WD

Power Options: Power Windows

Mileage: 160,759

Sub Model: Limited 4X4

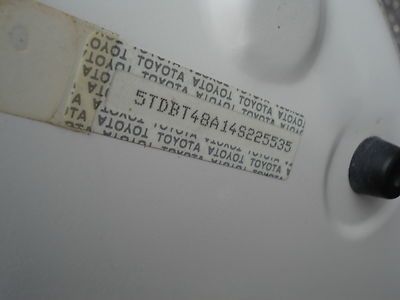

Exterior Color: White

Number of Cylinders: 8

Interior Color: Tan

Toyota Sequoia for Sale

2002 toyota sequoia limited sport utility 4-door 4.7l

2002 toyota sequoia limited sport utility 4-door 4.7l 2003 toyota sequoia sr5 ** sunroof/leather**(US $7,350.00)

2003 toyota sequoia sr5 ** sunroof/leather**(US $7,350.00) 2006 toyota sequoia 4dr limited(US $15,991.00)

2006 toyota sequoia 4dr limited(US $15,991.00) 2004 toyota sequoia sr5 sport utility 4-door 4.7l

2004 toyota sequoia sr5 sport utility 4-door 4.7l 2011 platinum toyota sequoia w/extended warranty. black.

2011 platinum toyota sequoia w/extended warranty. black. 2010 toyota sequoia platinum nav rear cam dvd 20's 44k texas direct auto(US $40,980.00)

2010 toyota sequoia platinum nav rear cam dvd 20's 44k texas direct auto(US $40,980.00)

Auto Services in New Jersey

Yonkers Honda Corp ★★★★★

White Dotte ★★★★★

Vicari Motors Inc ★★★★★

Tronix Ii ★★★★★

Tire Connection & More ★★★★★

Three Star Auto Service Inc. ★★★★★

Auto blog

Junkyard Gem: 1991 Lexus ES 250

Sun, Sep 19 2021When the Lexus LS 400 first appeared here in late 1989 (as a 1990 model), sellers of German-made luxury sedans broke out in the shaky sweats and car shoppers flocked to see — and buy — this well-built statusmobile that retailed for about 60% of the price of the cheapest S-Class. Not attracting nearly as much attention at the time was the other introductory vehicle of the Lexus brand: the ES 250. Sold here for just the 1990 and 1991 model years, the first-generation ES was the most Camry-like of its kind and the hardest to find today. Here's a '91 in a San Francisco Bay Area yard. All of the ESs for the model's first couple of decades were based on the Camry, so they benefited from the Camry's famous reliability while suffering from its not-so-exciting image. Toyota made a good effort to make the 1990-1991 cars look something like their LS big brothers, but their Camry origins are quite obvious from most angles. Later ESs got more distinctive body panels and sales got stronger when that happened. Power came from this 2.5-liter V6, which was the hairiest engine available in the 1991 US-market Camry. 159 horsepower, which was pretty good for a car like this in the early 1990s. A five-speed manual transmission could be had in the ES 250 and ES 300 through the 1993 model year, but those early-1990s American car shoppers wishing for a midsize luxury sedan with three pedals generally opted for an Audi or BMW, with most of the rest settling on the Acura Legend. I'll keep looking out for a five-speed ES in a car graveyard, of course, but finding any first-gen ES has been a tough challenge in itself. This one got within 252 miles of the 200,000 mark, not bad for a typical 1991 car but also not especially impressive for a member of the Camry family. The interior was much nicer than what you got in any Camry, but junkyard shoppers have hit this one hard and its opulence no longer shines through. Toyotas had some variation of this switch from the late 1970s and into our current century. This version comes straight out of the Cressida. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. That Lexus noise-testing room sure is impressive! This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Good in the rain, too. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Ford fights back against patent trolls

Fri, Feb 13 2015Some people are just awful. Some organizations are just as awful. And when those people join those organizations, we get stories like this one, where Ford has spent the past several years combatting so-called patent trolls. According to Automotive News, these malicious organizations have filed over a dozen lawsuits against the company since 2012. They work by purchasing patents, only to later accuse companies of misusing intellectual property, despite the fact that the so-called patent assertion companies never actually, you know, do anything with said intellectual property. AN reports that both Hyundai and Toyota have been victimized by these companies, with the former forced to pay $11.5 million to a company called Clear With Computers. Toyota, meanwhile, settled with Paice LLC, over its hybrid tech. The world's largest automaker agreed to pay $5 million, on top of $98 for every hybrid it sold (if the terms of the deal included each of the roughly 1.5 million hybrids Toyota sold since 2000, the company would have owed $147 million). Including the previous couple of examples, AN reports 107 suits were filed against automakers last year alone. But Ford is taking action to prevent further troubles... kind of. The company has signed on with a firm called RPX, in what sounds strangely like a protection racket. Automakers like Ford pay RPX around $1.5 million each year for access to its catalog of patents, which it spent nearly $1 billion building. "We take the protection and licensing of patented innovations very seriously," Ford told AN via email. "And as many smart businesses are doing, we are taking proactive steps to protect against those seeking patent infringement litigation." What are your thoughts on this? Should this patent business be better managed? Is it reasonable that companies purchase patents only to file suit against the companies that build actual products? Have your say in Comments.

US Congress lets $8,000 hydrogen vehicle tax credit expire

Mon, Dec 22 2014When Toyota introduced the 2016 Mirai last month in preparation for a launch late next year, it said that the hydrogen car will have a $57,500 MSRP and that there will be a federal tax credit available worth up to $8,000. The problem, as we noted at the time, is that that federal credit was set to expire at the end of 2014. The technical language of the current rule says that someone who buys a fuel cell vehicle, "may claim a credit for the certified amount for a fuel cell vehicle if it is placed in service by the taxpayer after Dec. 31, 2005, and is purchased on or before Dec. 31, 2014." With the 113th Congress now finished up for the year and legislators headed home for the holidays, we know one thing for certain: the federal tax credit for hydrogen vehicles was not updated and will end as we're all singing Auld Lang Syne next week. All of this isn't to say that Mirai buyers won't be able to take $8,000 off the price of the car 12 months from now. For proof of that, we only need to look at other alternative fuel tax incentives and realize that this Congress simply isn't moving fast enough to deal with things that are expiring right now. One of the last things that the 113th Congress did in December was to take up the tax credits that expired at the end of 2013 and renew some of them. Jay Friedland, Plug In America's senior policy advisor, told AutoblogGreen that PIA and other likeminded organizations worked with Congress to extended the electronic vehicle charging station (technically: EVSE) tax credit that was part of the Alternative Refueling Tax Credit in IRS Section 30(C) through the end of 2014. "Individuals can deduct 30 percent of the cost of purchasing and installing an EVSE up to $1,000; businesses, 30 percent up to $30,000," he said. "This tax credit is applied to any system placed into service by 12/31/14 and is retroactive to the beginning of the year. So go out and buy your favorite EV driver an EVSE for the holidays," he said. An electric motorcycle credit was killed at the last minute as Congress was getting ready to leave, but H.R. 5771 did extend the Alternative Fuels Excise Tax Credits for liquefied hydrogen and other alternative fuels. These sorts of tax credit battles happen all year long. In July, Blumenthal introduced the Fuel Cell and Hydrogen Infrastructure Act of 2014, which never got out of the Finance Committee. Back to the hydrogen vehicle situation.