Le 4-speed A on 2040-cars

Staten Island, New York, United States

Toyota Corolla for Sale

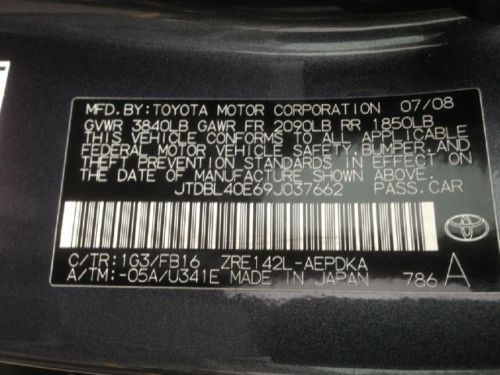

2006 toyota corolla s sedan 4-door 1.8l must sell, make offer!!(US $7,999.00)

2006 toyota corolla s sedan 4-door 1.8l must sell, make offer!!(US $7,999.00) 2011 toyota corolla le sedan automatic(US $13,992.00)

2011 toyota corolla le sedan automatic(US $13,992.00) 2003 le used 1.8l i4 16v automatic fwd sedan(US $5,995.00)

2003 le used 1.8l i4 16v automatic fwd sedan(US $5,995.00) 2006 toyota corolla ce sedan 4-door 1.8l

2006 toyota corolla ce sedan 4-door 1.8l 2003 toyota black corolla s 1 owner - reliable car - great gas mileage - clean!!(US $5,750.00)

2003 toyota black corolla s 1 owner - reliable car - great gas mileage - clean!!(US $5,750.00) 2004 toyota corolla ce sedan 4-door 1.8l(US $5,600.00)

2004 toyota corolla ce sedan 4-door 1.8l(US $5,600.00)

Auto Services in New York

Willowdale Body & Fender Repair ★★★★★

Vision Automotive Group ★★★★★

Vern`s Auto Body & Sales Inc ★★★★★

Valvoline Instant Oil Change ★★★★★

Valanca Auto Concepts ★★★★★

V & F Auto Body Of Keyport ★★★★★

Auto blog

Toyota Camry incentives and fleet sales cranked to keep sales crown, insiders worried

Mon, 01 Jul 2013We've been watching for some time now as Toyota has piled more incentives on the hood of its Camry sedan, and Automotive News reports that the we're not the only ones with raised eyebrows. The current Camry hasn't even been on the market for two years, but the family sedan segment is more hotly contested than it has been in years. It's that high level of competition that has led the automaker to uncharacteristically add more money on the hood in order to assure it maintains its long-held title of America's Best-Selling Car, a mantle it has owned for a dozen years. It's ramping up fleet sales, too.

According to the analysts at TrueCar, Toyota has bumped incentives per unit every month this year, now totaling some $2,750 as of May, a 38-percent hike over this time last year. That's more spiff money than the segment's other best sellers, the Nissan Altima ($2,400), Ford Fusion ($2,300) and Honda Accord ($1,400), all of whom have actually decreased their incentive spend by 20- to 40-percent over the same period.

The ramp up in incentive spending and fleet sales has analysts concerned that Toyota will tarnish the Camry's historically sterling resale value. ALG pegs the 2013 Camry's current 36-month residual value at 54.4 percent, well ahead of the segment average's 50.9 percent (but shy of the Accord's 55.6 percent). However, analysts are concerned that as the current generation ages, their resale values will eventually plummet if incentives continue to increase as Toyota looks to keep the Camry's best-selling car crown going forward.

2014 Toyota Highlander recalled over seatbelt anchors

Mon, 10 Mar 2014Toyota has announced a small recall of its redesigned, 2014 Highlander over issues with one of its seat belts. The affected vehicles, which were built from November 20, 2013 to January 18, 2014, could have a seatbelt assembly in the middle seat of the third row that wasn't properly secured to a floor anchorage at the factory.

In total, 7,067 of the new Highlanders are included in the recall, which was discovered not after a crash, but during a post-build inspection at the factory. It's unclear if there have been any injuries as a result of the faulty seat belts.

Toyota is set to inform owners of the affected vehicles as well as dealers with the recalled Highlander models in their inventory. Naturally, repairs will be performed free of charge. For the full bulletin form the National Highway Traffic Safety Administration, scroll down.

Toyota ending Prius Plug-In production in June

Fri, May 1 2015The fourth-generation Toyota Prius and it's potential 58 miles per gallon fuel economy isn't due until later this year at the earliest, and some folks suspect it will be well into next year. But at least you'll still be able to buy one until it arrives; the same can't be said for the plug-in Prius - "Pip" to its friends - that will cease production this June. Nathan Kokes, a marketing representative in Toyota's Advanced Technology division, made the announcement on the forum Prius Chat without giving any reason for the decision. Inside EVs says there about 1,100 Prius PHVs in stock at dealers, which would last for just under three months at the average sales rate this year. Assuming no changes in production to boost stocks, that would give you until the end of summer to fulfill your first-generation Prius PHV dreams, then there'd be a drought for an unknown length of time. For the conspiracy theorists looking to the sales numbers or the Mirai launch for cause, Kokes did join the chat thread once after the announcement to say that "will have plenty of Prius Plug-in Hybrids to sell long after [June]," and, "production plans and product cadence are in no way timed to any external incentive (i.e., CA HOV sticker), competitive product or the upcoming Mirai launch." With Toyota having delayed the standard car to get it just right, there's no telling how long the plug-in version will take since it aims to satisfy high-order customer demands like wireless charging and more electric range, and perhaps the rather long list of "minor" changes that include things like more paint options, HVAC operation, the placement of the charge port, and more driver convenience features. Related Video: News Source: Prius Chat via Inside EVs Green Plants/Manufacturing Toyota Car Buying Hatchback Hybrid toyota prius plug-in