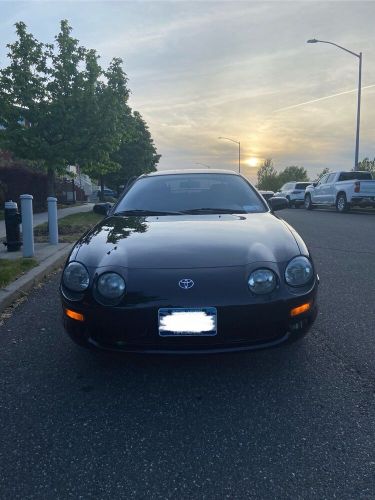

1994 Toyota Celica on 2040-cars

College Point, New York, United States

Transmission:Automatic

Fuel Type:Gasoline

For Sale By:Private Seller

Vehicle Title:Clean

VIN (Vehicle Identification Number): JT2ST07NXR0013040

Mileage: 16788

Model: Celica

Make: Toyota

Interior Color: Black

Number of Seats: 4

Number of Cylinders: 4

Exterior Color: Black

Car Type: Collector Cars

Number of Doors: 2

Toyota Celica for Sale

2004 toyota celica 3dr lb gt auto (natl)(US $9,491.00)

2004 toyota celica 3dr lb gt auto (natl)(US $9,491.00) 1985 toyota celica gts convertible(US $8,995.00)

1985 toyota celica gts convertible(US $8,995.00) 1985 toyota celica 2dr convertible gts 5-spd(US $15,000.00)

1985 toyota celica 2dr convertible gts 5-spd(US $15,000.00) 1994 toyota celica gt(US $510.00)

1994 toyota celica gt(US $510.00) 1983 toyota celica(US $7,000.00)

1983 toyota celica(US $7,000.00) 1977 toyota celica gt liftback(US $27,500.00)

1977 toyota celica gt liftback(US $27,500.00)

Auto Services in New York

YMK Collision ★★★★★

Valu Auto Center (ORCHARD PARK) ★★★★★

Tuftrucks and Finecars ★★★★★

Total Auto Glass ★★★★★

Tallman`s Tire & Auto Service ★★★★★

T & C Auto Sales ★★★★★

Auto blog

Toyota raises Japanese base wages for first time since 2008

Fri, 14 Mar 2014Toyota is on track for record profits, and in return, its Japanese workers are receiving their first increase in base wages since 2008, plus higher pay based on seniority and a larger bonus for 2014. The Japanese automaker predicts the average laborer will net a 2.9 percent income gain.

The average Toyota employee will earn 2,700 yen ($26.28) more each month, a 0.8 percent increase from last year. Workers will also receive about 7,300 yen ($71.09) more monthly based on seniority and promotions. Finally, the company's union pushed through a median bonus of 2.44 million yen ($23,768) for 2014, the highest in 6 years.

The pay boost comes as Toyota forecasts a record 1.9-trillion yen ($18.5 billion) profit for the fiscal year ending on March 31, according to Bloomberg. It has been helped by the Japanese government's efforts to weaken the yen on international markets and expand inflation. Prime Minister Shinzo Abe has been asking businesses to increase compensation to end years of deflation and offset upcoming higher sales taxes. Honda and Nissan have also raised their wages there in recent months.

2021 Ford F-150 goes hybrid and we drive the Cadillac CT4-V | Autoblog Podcast #633

Fri, Jun 26 2020In this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Senior Editor, Green, John Beltz Snyder and Associate Editor Byron Hurd. They start with the big news of the week: Ford unveiling the 2021 F-150, complete with a powerful hybrid powertrain. The guys have been driving some eclectic vehicles, including the Cadillac CT4-V, Toyota Prius AWD-e and a 1967 VW Samba Microbus. To finish things off, Greg springs a few trivia questions on his guests. We'll post those in the comments, and you can see if you'd have gotten those right. Autoblog Podcast #633 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown 2021 Ford F-150 revealed Read more about the heavy-hitting hybrid Cars we're driving: 2020 Cadillac CT4-V 2020 Toyota Prius AWD-e 1967 Volkswagen Samba Trivia Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video:

Toyota's fuel pump recall now covers nearly 6 million vehicles globally

Thu, Oct 29 2020Toyota expanded a worldwide fuel pump recall to a total of 5.84 million vehicles for a defect that could cause the part to fail. In the United States, the total number of vehicles involved in this safety recall is now approximately 3.34 million vehicles. On January 13, 2020, Toyota announced a safety recall for 695,541 Lexus and Toyota models. In March of 2020, the Japanese automaker added an additional 1.1 million vehicles to the previous recall. Now, the largest Japanese automaker adds another 1.52 million U.S. vehicles to the recall that was first announced in January and covers numerous models built between July 2017 through September. Here is a full list of vehicles that are now included in the expanded recall: 2013-2015 Model Year Lexus LS 460; 2013-2015 Model Year Lexus GS 350; 2014 Model Year Toyota FJ Cruiser, Lexus IS-F; 2014-2015 Model Year Toyota 4Runner, Land Cruiser; Lexus GX 460, IS 350, LX 570; 2015 Model Year Lexus NX 200t, RC 350; 2017 Model Year Lexus IS 200t, RC 200t GS 200t; 2017-2019 Model Year Toyota Highlander; Lexus GS 350; 2017-2020 Model Year Toyota Sienna and Lexus RX 350 2018-2019 Model Year Toyota 4Runner, Land Cruiser; Lexus GS 300, GX 460, IS 300, IS 350, LS 500h, LX 570, NX 300, RC 300, RC 350; 2018-2020 Toyota Avalon, Camry, Corolla, Sequoia, Tacoma, Tundra; Lexus ES 350, LC 500, LC 500h, LS 500, RX 350L 2019 Model Year Toyota Corolla Hatchback and Lexus UX 200 2019-2020 Model Year Toyota RAV4 Toyota said the vehicles that have a fuel pump that may stop operating and could result in a vehicle stall, and the vehicle may be unable to be restarted. Dealers will replace the fuel pump with an improved version. Toyota's customer support is available to owners with affected vehicles by calling the Toyota Brand Experience Center at 1 800 331-4331. Related Video: Recalls Lexus Toyota Truck Coupe Crossover SUV Sedan