2013 Avalon Xle Certified Pre-owned Financing Available on 2040-cars

Columbia, Missouri, United States

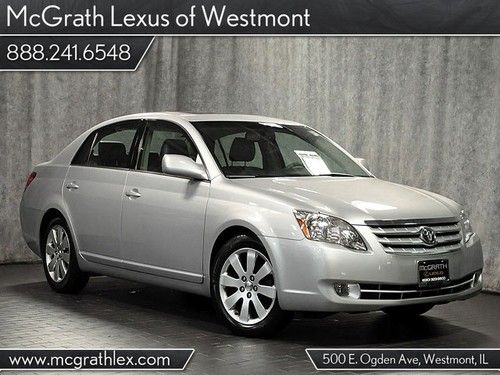

Body Type:Sedan

Engine:gasoline

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Number of Cylinders: 6

Make: Toyota

Model: Avalon

Warranty: No

Drive Type: Front Wheel Drive

Mileage: 2,913

Exterior Color: Gray

Interior Color: Gray

Toyota Avalon for Sale

1998 toyota avalon xl sedan 4-door needs work

1998 toyota avalon xl sedan 4-door needs work Leather sunroof factory warranty back up camera keyless entry off lease only(US $21,999.00)

Leather sunroof factory warranty back up camera keyless entry off lease only(US $21,999.00) 2005 avalon xls leather low miles one owner(US $19,000.00)

2005 avalon xls leather low miles one owner(US $19,000.00) Leather factory warranty bluetooth cd player cruise control off lease only(US $20,999.00)

Leather factory warranty bluetooth cd player cruise control off lease only(US $20,999.00) Leather interior, alloy wheels, power seat, v6

Leather interior, alloy wheels, power seat, v6 2011 silver limited avalon! sun roof leather seats(US $24,579.00)

2011 silver limited avalon! sun roof leather seats(US $24,579.00)

Auto Services in Missouri

Xpert Auto Service ★★★★★

Wrench Teach GV ★★★★★

Twin City Toyota ★★★★★

Trux Unlimited Inc ★★★★★

The Tint Shop ★★★★★

The Automotive Shop of Melbourne ★★★★★

Auto blog

Toyota prepped to spend $1.3B on plants in Mexico and China

Tue, Apr 7 2015Toyota is getting set to expand its manufacturing operations in a big way, with a pair of sources reporting to Reuters that the company was preparing to make a roughly $1.3-billion investment to add two new factories in China and Mexico. If Reuters sources turn out to be correct and the company's upper management decides to greenlight the two new factories, Toyota's annual output would grow by 300,000 units per year. Two-thirds of the capacity would come from the new Mexican factory, where the company may produce the next-generation Corolla, due in 2019. That facility would be in the state of Guanajuato, in the central part of the country, the sources told Reuters. The Chinese factory, meanwhile, would likely be built in Guangzhou, and may become a source of Yaris production sometime in 2018.

Legal approach in $1.2 billion Toyota settlement could impact handling of GM recall cases

Wed, 26 Mar 2014In the past, if an automaker did something wrong, they were usually prosecuted by the US government through something called the TREAD Act. Short for Transportation Recall Enhancement, Accountability and Documentation Act, it basically requires automakers to report recalls in other countries, along with any and all serious injuries or deaths, to the National Highway Traffic Safety Administration.

Failing to report or attempting to conceal anything when there's been a death or serious injury constitutes a criminal liability. The idea is that this setup puts the onus on manufacturers to keep NHTSA apprised of safety related issues before they become a problem in the US, thereby allowing the regulator to better protect consumers.

In theory, it sounds like a relatively airtight set of rules for dealing with misbehaving automakers. That didn't stop the US Department of Justice from ignoring TREAD in its prosecution of Toyota's handling of the unintended acceleration recall, though. The result of this new approach, which charged Toyota with wire fraud, was a $1.2 billion settlement. Now, the wire-fraud approach could be used for the expected case between the US government and General Motors, based on the statements of Attorney General Eric Holder, who specifically mentioned "similarly situated companies" when discussing Toyota.

US Congress lets $8,000 hydrogen vehicle tax credit expire

Mon, Dec 22 2014When Toyota introduced the 2016 Mirai last month in preparation for a launch late next year, it said that the hydrogen car will have a $57,500 MSRP and that there will be a federal tax credit available worth up to $8,000. The problem, as we noted at the time, is that that federal credit was set to expire at the end of 2014. The technical language of the current rule says that someone who buys a fuel cell vehicle, "may claim a credit for the certified amount for a fuel cell vehicle if it is placed in service by the taxpayer after Dec. 31, 2005, and is purchased on or before Dec. 31, 2014." With the 113th Congress now finished up for the year and legislators headed home for the holidays, we know one thing for certain: the federal tax credit for hydrogen vehicles was not updated and will end as we're all singing Auld Lang Syne next week. All of this isn't to say that Mirai buyers won't be able to take $8,000 off the price of the car 12 months from now. For proof of that, we only need to look at other alternative fuel tax incentives and realize that this Congress simply isn't moving fast enough to deal with things that are expiring right now. One of the last things that the 113th Congress did in December was to take up the tax credits that expired at the end of 2013 and renew some of them. Jay Friedland, Plug In America's senior policy advisor, told AutoblogGreen that PIA and other likeminded organizations worked with Congress to extended the electronic vehicle charging station (technically: EVSE) tax credit that was part of the Alternative Refueling Tax Credit in IRS Section 30(C) through the end of 2014. "Individuals can deduct 30 percent of the cost of purchasing and installing an EVSE up to $1,000; businesses, 30 percent up to $30,000," he said. "This tax credit is applied to any system placed into service by 12/31/14 and is retroactive to the beginning of the year. So go out and buy your favorite EV driver an EVSE for the holidays," he said. An electric motorcycle credit was killed at the last minute as Congress was getting ready to leave, but H.R. 5771 did extend the Alternative Fuels Excise Tax Credits for liquefied hydrogen and other alternative fuels. These sorts of tax credit battles happen all year long. In July, Blumenthal introduced the Fuel Cell and Hydrogen Infrastructure Act of 2014, which never got out of the Finance Committee. Back to the hydrogen vehicle situation.