2015 Ram 1500 Quad Cab 4wd Express on 2040-cars

West Chester, Pennsylvania, United States

Engine:5.7L 8-Cyl Engine

Fuel Type:Gasoline

Body Type:Pickup Truck

Transmission:Automatic

For Sale By:Dealer

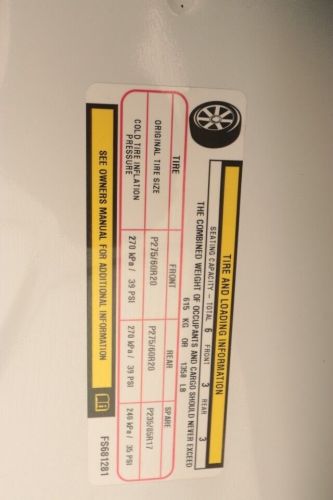

VIN (Vehicle Identification Number): 1C6RR7FT1FS681281

Mileage: 102986

Make: Ram

Model: 1500 Quad Cab 4WD

Trim: Express

Drive Type: 4WD

Features: --

Power Options: --

Exterior Color: White

Interior Color: Black

Warranty: Unspecified

Auto Services in Pennsylvania

Young`s Auto Body Inc ★★★★★

West Shore Auto Care ★★★★★

Village Auto ★★★★★

Ulrich Sales & Svc ★★★★★

Trust Auto Sales ★★★★★

Steve`s Auto Body & Repair ★★★★★

Auto blog

Stellantis reports $15B profit in first year of merger

Wed, Feb 23 2022FRANKFURT, Germany — Automaker Stellantis said Wednesday that it made 13.4 billion euros ($15.2 billion) in its first year after it was formed from the merger of Fiat Chrysler Automobiles and PSA Group. The earnings nearly tripled profits compared with its pre-merger existence as two separate companies, as the maker of Jeep, Opel and Peugeot vehicles exploited cost efficiencies from combining the businesses. The result compared to a combined 4.79 billion euros for the separate companies in 2020 before the merger, which took effect on Jan. 17, 2021. Revenue for the combined business rose 14%, to 152 billion euros. CEO Carlos Tavares said the results “prove that Stellantis is well positioned to deliver strong performance" and had overcome “intense headwinds” during the year. Automakers have struggled with shortages of key parts such as semiconductor electronic components and rising costs for raw materials as the global rebound from the worst of the coronavirus pandemic brings more demand. The company said the benefits of the merger were worth some 3.2 billion euros during the year. Mergers can lead to streamlined costs as companies combine functions and spread fixed costs over a larger revenue base. The company accelerated its rollout of battery-powered vehicles, with sales of low-emission vehicles reaching 388,000 — an increase of 160%. Stricter environmental regulations in Europe and China are pushing automakers to roll out more electric vehicles with longer range. Stellantis started production of a hydrogen fuel cell commercial van under its Opel brand in December. Stellantis' other brands include Chrysler, Citroen, DS, Fiat, Maserati, Ram and Vauxhall. Related video: Earnings/Financials Chrysler Dodge Ferrari Fiat Jeep RAM Citroen Opel Peugeot Vauxhall

Fiat Chrysler dumped 40,000 unordered vehicles on dealers

Thu, Nov 14 2019In a move that echoes recent history, Fiat Chrysler has been making more cars and trucks than dealers in the U.S. are willing to accept, with Bloomberg reporting that at one point the automaker had built up a glut of around 40,000 unordered vehicles. That’s led some dealers to accuse FCA of reviving the dreaded “sales bank” accounting practice of obscuring inventory to improve the balance sheet. The company reportedly began building up its inventory of unordered cars this summer despite an industrywide slowdown in sales and an eagerness by some dealers to thin their inventories because rising interest rates are making it more expensive to hold unsold cars. The inventory build-up also coincided with Fiat ChryslerÂ’s efforts to find a merger partner, first with Renault, which fell through, then last monthÂ’s announcement that it will merge with FranceÂ’s PSA Group. FCA denies any such scheme and tells Bloomberg the rising inventory is down to a new predictive analytics system designed to better square supply with demand from dealers that is helping the company save money and narrow the numbers of unsold vehicles. The company recently agreed to pay a $40 million civil penalty to the U.S. Securities and Exchange Commission to settle a complaint that it paid dealers to report fake sales figures over a span of five years. While no one is suggesting that FCA is in dire financial straits — the company saw higher than expected earnings in the third quarter and record profits in North America — the practice has strong historical precedent by Chrysler, which built up bloated inventories in the run-up to its two federal bailouts, in 1980 and 2009. It was also common at GM and Ford during the 2000s, when all three Detroit automakers struggled with excess manufacturing capacity and plummeting sales in the lead-up to the Great Recession. Back in 2012, CFO Magazine wrote about a report that explained automakersÂ’ rationale for the practice and how it works: Say fixed costs for a given factory are $100, and that the factory can make 50 cars. Consumers, however, demand only 10. Under absorption costing, if the company makes all 50 cars, its cost-per-car is $2. If it makes only up to demand, or 10 cars, the cost-per-car is $10. Although each car adds variable costs for steel and other parts, if those costs are low, the company still has an incentive to make more cars to keep the cost-per-car down.

Fiat Chrysler's profit boosted by Ram and Jeep in North America

Wed, Jul 31 2019MILAN/DETROIT — Fiat Chrysler took the market by surprise by sticking to its full-year profit guidance on Wednesday after a strong performance from its Ram pickup truck in North America helped it defy an industry slowdown. Chief Executive Mike Manley, in FCA's first earnings release since a failed attempt to merge with France's Renault, also left the door open to that or other deals. "We are open to opportunity," Manley said on a call with analysts. "I have no doubt why there still would be interest in it," he added, when pressed on what it would take to revive talks with Renault. Manley declined to comment further. FCA last month abandoned its $35 billion merger offer for Renault, blaming French politics for scuttling what would have been a landmark deal to create the world's third-biggest automaker. Manley said a merger was not a must-have and Fiat Chrysler's business plan was strong. The company said it remained confident its adjusted earnings before interest and tax (EBIT) would top last year's 6.7 billion euros ($7.5 billion). Given disappointing forecasts from other automakers this earnings season, FCA's confirmation of the outlook sent Milan-listed shares in the Italian-American automaker, whose other brands include Jeep, up over 4%. A broad-based auto sales downturn has rattled the sector, forcing FCA's competitors — including Renault, Daimler and Aston Martin — to cut their sales forecasts after second-quarter results, while U.S. carmaker Ford gave a weaker-than-expected 2019 profit outlook. Japan's Nissan, a long-term partner of Renault, said it would cut 12,500 jobs by 2023 after its earnings collapsed. In the second quarter FCA's adjusted EBIT totaled 1.52 billion euros, versus analysts' expectations of 1.43 billion euros, according to a Reuters poll. FCA's U.S. shipments were down 12% in the second quarter but the group said that the successful performance of its Ram brand resulted in an enhanced share of the large pickup truck market of 27.9%, up 7 percentage points from last year. Adjusted EBIT margin in North America rose to 8.9% from 6.5% in the first quarter, thanks to strong demand for the heavy-duty Ram and the new Jeep Gladiator pickup. Chief Financial Officer Richard Palmer also said FCA expected to report up to 10% margins in the region in both the third and fourth quarters.