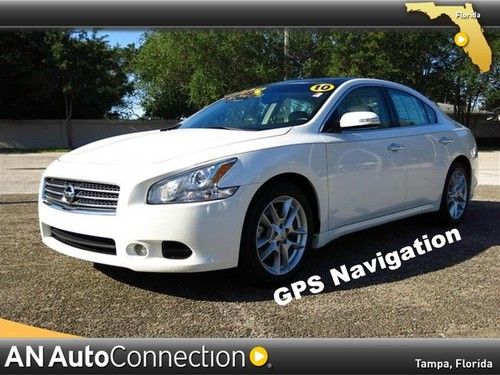

Nissan Maxima Sv on 2040-cars

Tampa, Florida, United States

Engine:6

Fuel Type:Gasoline

For Sale By:Dealer

Transmission:Automatic

Body Type:Sedan

Cab Type (For Trucks Only): Other

Model: Maxima

Mileage: 74,305

Sub Model: SV

Disability Equipped: No

Exterior Color: White

Doors: 4

Interior Color: Tan

Drive Train: Front Wheel Drive

Inspection: Vehicle has been inspected

Nissan Maxima for Sale

Gle cd a/c alloy wheels am/fm abs power locks leather sunroof no fees no reserve

Gle cd a/c alloy wheels am/fm abs power locks leather sunroof no fees no reserve 2007 nissan maxima sl sedan 4-door 3.5l

2007 nissan maxima sl sedan 4-door 3.5l 2002 nissan maxima se sedan 4-door 3.5l

2002 nissan maxima se sedan 4-door 3.5l 2002 nissan maxima se sedan 4-door 3.5l

2002 nissan maxima se sedan 4-door 3.5l 2008 nissan maxima se sedan 4-door 3.5l(US $13,999.00)

2008 nissan maxima se sedan 4-door 3.5l(US $13,999.00) 2010 nissan maxima 3.5 sv sunroof htd leather 36k miles texas direct auto(US $20,780.00)

2010 nissan maxima 3.5 sv sunroof htd leather 36k miles texas direct auto(US $20,780.00)

Auto Services in Florida

Y & F Auto Repair Specialists ★★★★★

X-quisite Auto Refinishing ★★★★★

Wilt Engine Services ★★★★★

White Ford Company Inc ★★★★★

Wheels R US ★★★★★

Volkswagen Service By Full Throttle ★★★★★

Auto blog

Nissan recalling 841k vehicles overseas for steering wheel trouble

Sat, 25 May 2013A possible issue with a steering wheel bolt in the Nissan Micra (shown) and Cube from the 2002 to 2006 model years has Nissan recalling roughly 841,000 units on four continents, as well as Oceania and the Middle East. On the affected cars, the bolt may not have been tightened properly, which could lead to a loss of steering in a worst-case scenario. According to Reuters, there haven't been any reports of accidents or injuries due to the fault, however.

The Micras affected were built in the UK and Japan, the Cubes in Japan. Nissan has yet to say when the recall will begin, but when it does, owners can take their cars to dealers for repairs; the bolt with either be tightened or, if necessary, a new steering wheel installed.

2015 24 Hours of Le Mans live race report

Sat, Jun 13 2015Check back regularly for more race updates every few hours. No, you don't need to stay up for the entire 24 Hours of Le Mans, but if you want to catch any of the action, Autoblog friend Reilly Brennan has a handy guide. And to keep you up to speed on the latest race events, we'll be posting live from Le Mans with regular race reports.Hour 1: Five laps in, Audi breaks up the three Porsches at the front, with the #19 919 Hybrid, driven by Nico Hulkenburg, passed by all three R18s. Hulkenburg eventually took back fifth position only to fall back again after the first pit stop. Meanwhile, clutch trouble kept the #23 Nissan GTR-LM in the pits until 15 minutes into the race. The other two Nissans were forced to start at the back of the grid after failing to the meet the 110 percent qualifying speed regulation. At the end of the first hour, just 7.5 seconds separated the first six cars. Then the factory team #92 Porsche GTE car caught fire, with the the #13 Rebellion P1 car taking frontal damage in the ensuing carnage. With the safety car out, the field is once again bunched up.Hour 2: The slugfest between Audi and Porsche continues, with neither side backing off. Halfway through the second hour the #7 R18 passes both leading Porsches for the top position. After another round of pits stops Porsche regains the lead until lap 30, when the Audi overtake once again and quickly pulls out a three-second gap. Nico Hulkenburg passes the other two Audis to join his Porsche teammates. At the beginning of the third hour it's Audi #7, Porsche #17, #18, and #19, followed by Audi #8 and #9. 33 seconds separates this group, with Toyota a minute back from the front car.Hour 3: On track the action refuses to stop. Although it's early, Audi is looking strong with the overall lead in the #7. What's more is that the Audis run four stints per set of tires, while the Porsche cars have to change rubber every third stop. But after a quick refueling, the lead R18 gets a tire puncture and comes back in 3 laps later, allowing Porsche to take over the top two spots. Then as the hour closes out a yellow flag causes traffic to bunch up and the #8 Audi gets stuck with nowhere to slow down. Driver Loic Duval dives for the side of the road but hits the guard rail and careens across the track, damaging the front and rear bodywork. The rest of the car is still intact, though, and once in the pits Audi replaces the entire front and rear of that in only three minutes.

Google's new Android Autos OS unveiled, will be in cars this year [w/video]

Wed, 25 Jun 2014Connected cars are coming en-masse. We know this much. How, though, remains something of an open question, especially as two of the world's largest tech companies are preparing to battle for control of your car's dashboard. On the one hand, we have Apple and its CarPlay system. And now, we know what Google has been working on with Auto Link.

Its new name is Android Auto, and yes, it's based off the Android architecture that is the primary challenger to Apple's iOS mobile operating system. Announced at Google's I/O conference today, Android Auto functions similarly to CarPlay - owners will need to plug their smartphones into their cars to access the full breadth of capability.

In Android Auto's case, that means a wealth of voice controls to limit distracted driving. Google's marquee apps will be available when the interface arrives in production models later this year, including Google Play Music, Google Maps and voice-activated texting and text playback. Meanwhile, developers will be able to begin designing custom apps for the new system via an upcoming software development kit.