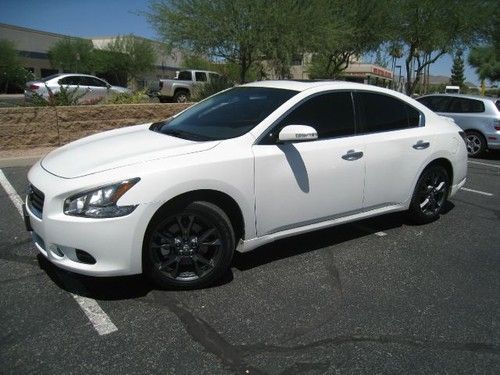

2012 Nissan Maxima S Limited Edition Package Low Miles Factory Warranty Best Buy on 2040-cars

Scottsdale, Arizona, United States

Body Type:Sedan

Vehicle Title:Lemon & Manufacturer Buyback

Engine:V6 3.5L

For Sale By:Dealer

Make: Nissan

Model: Maxima

Mileage: 8,847

Warranty: Vehicle has an existing warranty

Sub Model: 3.5 S Limited Edition Package

Doors: 4

Exterior Color: White

Fuel: Gasoline

Interior Color: Black

Drivetrain: FWD

Nissan Maxima for Sale

2012 nissan maxima 3.5 sv sport package---white---sunroof alloys---free shipping(US $17,450.00)

2012 nissan maxima 3.5 sv sport package---white---sunroof alloys---free shipping(US $17,450.00) 1996 nissan maxima gxe sedan 1 owner only low 68k miles 28 mpg great car look(US $4,990.00)

1996 nissan maxima gxe sedan 1 owner only low 68k miles 28 mpg great car look(US $4,990.00) 2002 nissan maxima gxe/loaded!wow!warranty!nice!(US $4,550.00)

2002 nissan maxima gxe/loaded!wow!warranty!nice!(US $4,550.00) Very nice nissan maxima

Very nice nissan maxima 2000 nissan maxima gle. leather sunroof only orig 60k 917 349 8611 no reserve

2000 nissan maxima gle. leather sunroof only orig 60k 917 349 8611 no reserve Nissian maxima(US $1,500.00)

Nissian maxima(US $1,500.00)

Auto Services in Arizona

Village Automotive INC ★★★★★

Victory Auto Body ★★★★★

Thunderbird Automotive Services #2 ★★★★★

Thiem Automotive Specialist ★★★★★

Shuman`s Auto Clinic ★★★★★

Show Low Ford Inc ★★★★★

Auto blog

Renault COO Tavares dreams of running GM or Ford

Fri, 16 Aug 2013What do you do if you're in a job with no upward mobility? Admittedly, most of us just stick it out while secretly hoping our boss is sacked for all those paperclips he's been swiping, netting us a nice, shiny promotion. Then again, most of us aren't the number two at Renault, like Carlos Tavares.

Tavares is the right-hand man to Renault CEO, Carlos Ghosn, and like a lot of us, he's ready for another challenge. As Ghosn is only 59 years old and doesn't have a boss to fire him for paperclip theft, though, it's pretty unlikely that he'll be going anywhere anytime soon. Tavares doesn't seem too concerned, based on an interview he gave to Automotive News. "We have a big leader and he is here to stay," Tavares told AN.

What's surprising is where Tavares wants to go, "Why not GM? I would be honored to lead a company like GM." The Renault exec also mentioned Ford, and as AN points out, both organizations make a lot of sense. Both are led by CEOs that are approaching or are already past retirement age, and should be looking for dedicated replacements in the not-so-distant future. That doesn't mean Tavares is a shoe-in, though.

Nissan VP suggests next Z will offer multiple engines

Thu, Dec 4 2014Roel de Vries, the corporate vice president and global head of marketing and brand strategy for Nissan, told Australia's CarAdvice that as far as he's concerned, any engine in the 370Z "[needs] to deliver on what the car stands for and if the 370Z stands for real performance and real driving I think it doesn't need a V6 to do that." At first read, it could look like de Vries is softening us up for a next-generation Z that doesn't come with a V6, a move that would disappoint a lot of the coupe's fans. Or, what if de Vries was actually getting us ready for a Z with multiple engine options, instead of only a V6, in order to expand its global appeal? That appeared to be the gist of his comments, the exec saying that they couldn't sell a V6-engined Z in Europe, but even if they offer a four-cylinder there, the V6 could live on because, "why should we give it up?" With the coupe's current name a factor of the 3.7-liter displacement of it's V6, though, what is the future for a car with several engine options? Said de Vries, "We [will] definitely keep the Z name, but when we did 350 to 370 it was because of the capacity, but who says the next-generation doesn't have three engines and its not just called Z?" This kind of talk has been going on all year, the real question being how many engines will the car get and what's the endgame. At the beginning of the year, ex product chief Andy Palmer said the car codenamed Z35 would use a "downsized four-cylinder turbocharged engine." In August, Motor Trend reported that the next Z would offer "a mixture of smaller but powerful engines," including a hybrid, but that a V6 would remain the headliner. Two weeks later, MT said that Nissan wanted to transition customers from the naturally aspirated V6 to a turbocharged four-cylinder with the same power, eventually, but would begin with both on the menu. Parallel to that are Shiro Nakamura's out-loud musings about how to merge the next Z and the IDx concepts into "a more affordable, more approachable sports car." The answers, whatever they are, will be a big deal for the brand.

Recharge Wrap-up: Nissan Leaf top environmental performer, 50,000th Renault Zoe

Thu, Apr 21 2016Renault has produced its 50,000th Zoe electric car. A Frenchwoman named Sylvie took ownership of the milestone vehicle at the Flins plant where it rolled of the line. She says her children helped convince her to buy the all-electric vehicle, which Sylvie intends to use as a daily driver. The Renault Zoe is Europe's best selling EV since its launch in 2013. Renault reports a 98-percent satisfaction rate with the Zoe. Read more in the press release from Renault. Toyota will use a biosynthetic rubber called biohydrin in its engine and drive system hoses beginning in May 2016. Jointly developed by Toyota, biohydrin is a plant-based rubber with a 20-percent reduction in material lifecycle carbon emissions compared to petroleum-based rubber. Toyota plans to use the compound in even more components in the future, including brake and fuel line hoses. Read more from Toyota. So far in 2016, only 27.5 percent of hybrids and EVs are traded in for another electrified vehicle, according to Edmunds. That's down from 38.5 percent in 2015. 33.8 percent of electrified vehicles are traded in for SUVs. Despite the trend of EV and hybrid owners switching back to traditionally powered vehicles, average fuel economy isn't suffering. "This is an economics trend, since today's low cost of gas no longer makes it worth paying the price premium of hybrids and EVs," says Edmunds Director of Industry Analysis Jessica Caldwell. "And there are so many fuel-efficient vehicles on the market today that environmental concerns weigh less than they might have in years past. When you're buying a vehicle that can get over 30 mpg, you can still say you're doing your part to help the environment." Read more from Edmunds. Environmentally, electrified vehicles outperform their conventional combustion counterparts throughout their lifecycle. A study from the Automotive Science Group (ASG) finds that while production of advanced powertrains comes with a greater financial burden, most vehicles make up for it through efficiencies during their use phase. The ASG lists the 2016 Nissan Leaf as its best performer, with 47 percent fewer greenhouse gas emissions than the best-performing conventionally powered car, the Honda Fit. Rounding out the ASG's top five environmental performers are the Ford Focus Electric, Chevrolet Volt, Toyota Prius Two Eco, and Hyundai Sonata Plug-In Hybrid.