2014 Nissan Juke Sv on 2040-cars

5815 Dixie Highway, Fairfield, Ohio, United States

Engine:1.6L I4 16V GDI DOHC Turbo

Transmission:Automatic CVT

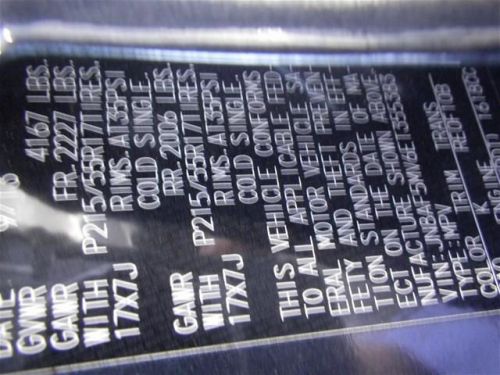

VIN (Vehicle Identification Number): JN8AF5MV6ET355383

Stock Num: M8957

Make: Nissan

Model: Juke SV

Year: 2014

Exterior Color: Graphite

Options: Drive Type: AWD

Number of Doors: 4 Doors

This hardy SV, with its grippy AWD, will handle anything mother nature decides to throw at you! Great safety equipment to protect you on the road: ABS, Traction control, Curtain airbags, Passenger Airbag...It has tons of features such as: Bluetooth, Power locks, Power windows, Sunroof, CVT Transmission...

Nissan Juke for Sale

2014 nissan juke sv(US $24,780.00)

2014 nissan juke sv(US $24,780.00) 2014 nissan juke sl(US $25,858.00)

2014 nissan juke sl(US $25,858.00) 2014 nissan juke sl(US $25,425.00)

2014 nissan juke sl(US $25,425.00) 2014 nissan juke sv(US $23,030.00)

2014 nissan juke sv(US $23,030.00) 2014 nissan juke sl(US $25,530.00)

2014 nissan juke sl(US $25,530.00) 2014 nissan juke sl(US $27,560.00)

2014 nissan juke sl(US $27,560.00)

Auto Services in Ohio

Yonkers Auto Body ★★★★★

Western Reserve Battery Corp ★★★★★

Walt`s Auto Inc ★★★★★

Valvoline Instant Oil Change ★★★★★

Valvoline Instant Oil Change ★★★★★

Tritex Corporation ★★★★★

Auto blog

Infiniti installs Taisuke Nakamura as new design chief

Mon, Aug 26 2019The cubicles and corner offices at Infiniti HQ in Japan continue to change hands. Infiniti Global Design Chief Karim Habib, only in that position for about two years since leaving BMW in 2017, has left the Japanese luxury brand "to pursue other opportunities." In his place, Nissan has elevated Taisuke Nakamura, a 26-year company veteran who is currently Nissan's program design director responsible for global design strategy, and concept car and production vehicle design. Nakamura has a stout design resume in service to both Nissan and Infiniti, having worked on the Qs Inspiration sedan concept (above) shown at the Shanghai Motor Show in April, the QX Inspiration crossover concept shown at the Detroit Auto Show this year (below), and the Prototype 10 speedster concept revealed at Pebble Beach last year (bottom). All of those were electric concepts, making Nakamura the point man for Infiniti's push into electric vehicles and hybrids, and the carmaker's introduction of a new design language. Last year, Infiniti said it would have a new EV on the market in 2021, as well as "e-Power" series hybrids with small battery packs charged by gas-powered generators.  Those EVs should fully embody the brand's new design DNA, seen initially in the recent concepts. The automaker said around the Qs reveal that the new "aesthetics are underpinned by Infiniti's desire to challenge convention and design cars which are engaging, enriching, enabling and enchanting – what the company calls its ‘4ENÂ’ approach to design." At the QX reveal in January, Habib said that as engineers made a "shift towards smarter, more compact and less intrusive powertrains, we were able to create an alternative form with flowing gestures, more engaging in character and more enriching in experience. With its long cabin, balanced proportions and muscular stance, the concept heralds in a new era for Infiniti models.” Infiniti said Nakamura takes up his post next week, Sept. 1, and will report to the same boss he has now, Alfonso Albaisa, Nissan's global design head. Aside from Habib, other top non-Japanese Nissan executives such as Daniele Schillaci, Jose Munoz and Trevor Mann have left the Japanese automaker in the recent past, since the arrest of Carlos Ghosn. The former chairman, who faces charges of fraud and misconduct, is awaiting trial in Japan over charges including enriching himself at a cost of $5 million to Nissan, Japan's No. 2 automaker.

Nissan recalls Rogue, Pathfinder, Infiniti QX60 for seat issue

Mon, Apr 24 2023Nissan and Infiniti are recalling their 2023 Rogue, Pathfinder and QX60 SUVs and CUVs to address a potential defect in their seat frame welds that can allow the frames to fail in the event of a collision. The number of vehicles that potentially shipped with weak welds is rather small — just over 12,000 — but the issue could nonetheless lead to injury if a failure occurs during a collision. "The driverÂ’s powered seat may not be fully secured to the seat frame on certain Nissan Rogue, Pathfinder, and INFINTI QX60 vehicles," Nissan's report to NHTSA said. "As a result of this issue, the seat frame welds may detach from the rear inboard seat bracket. If this condition occurs, it may increase the risk of injury to the occupant in the event of a crash. In addition, the seat frame assembly may not meet certain FMVSS 207 and FMVSS 210 requirements because of this condition," Nissan said. Nissan says there's no easy way for customers to detect the issue ahead of time, and that its seats need to be inspected by a service tech to see whether it is properly secured. Dealers will be instructed to check the driverÂ’s seat rail clearance to the inboard seat bracket, and if necessary, the dealer will remove and replace the affected driverÂ’s seat cushion frame, NIssan said. The entire procedure should take less than two hours. Owners of affected vehicles should look for notices to be delivered no later than June. Related video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Recalls Infiniti Nissan Crossover SUV Luxury

NHTSA investigating 200,000 Sentra, Versa models over brakes

Tue, 27 May 2014The National Highway Traffic Safety Administration has opened a second investigation into Nissan in May. The first covered inaccurate fuel gauges in the 2007 Quest minivan. The latest affects the Sentra and Versa from the 2013 and 2014 model years and the 2014 Versa Note, because of complaints of long brake pedal travel. If NHTSA finds a problem, it could affect an estimated 200,000 vehicles.

At the moment, this is still only a preliminary evaluation "to asses the scope, frequency and safety-related consequences of the alleged defect," according to the report, but it could lead to the full recall. NHTSA is still trying to find whether or not there are accidents, injuries or fatalities related to the problem. At this time, much of the data in the document is still marked Confidential or TBD. Nissan told Reuters in a statement that the company is working with the agency on the investigation and supplying the regulator with further information.

According to NHTSA, its Office of Defects Investigation has received eight complaints about long pedal travel in these models. They allege that the brake pedal goes all the way to the floor when pressed in some cases and doesn't sufficiently slow the vehicle. Autoblog has contacted Nissan for its reaction to the investigation. We will update this story when we receive a reply. Until then, scroll down to read the current investigation report.