4dr Sdn I4 C 2.5l Cd 4 Cylinder Engine 4-wheel Abs 4-wheel Disc Brakes A/c on 2040-cars

Norwood, Massachusetts, United States

Body Type:Sedan

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Make: Nissan

Model: Altima

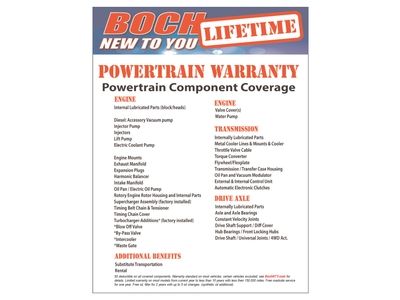

Warranty: Unspecified

Mileage: 30,578

Sub Model: 4dr Sdn I4 C

Options: CD Player

Exterior Color: Other

Power Options: Power Windows

Interior Color: Other

Number of Cylinders: 4

Nissan Altima for Sale

Pre-owned 2013 altima 2.5sl, bose, remote start, ipod, leather, 4304 miles

Pre-owned 2013 altima 2.5sl, bose, remote start, ipod, leather, 4304 miles 7-days *no reserve* '13 altima 3.5 s v6 keyless go warranty like brand new carfa

7-days *no reserve* '13 altima 3.5 s v6 keyless go warranty like brand new carfa 1999 nissan altima, no reserve

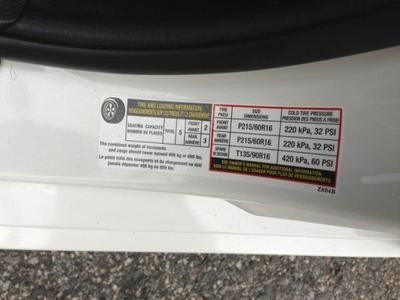

1999 nissan altima, no reserve Carfax 1 owner no accidents, white, warranty, mp3 input, keyless start(US $17,887.00)

Carfax 1 owner no accidents, white, warranty, mp3 input, keyless start(US $17,887.00) S coupe low miles 2 dr gasoline 2.5l i4 fi dohc 16v navy blue metallic

S coupe low miles 2 dr gasoline 2.5l i4 fi dohc 16v navy blue metallic 32 mpg, clean autocheck history, mp3 jack, power windows, 10 2.5 s

32 mpg, clean autocheck history, mp3 jack, power windows, 10 2.5 s

Auto Services in Massachusetts

Westgate Tire & Auto Center ★★★★★

Stewie`s Tire & Auto Repair ★★★★★

School Street Garage ★★★★★

Saugus Auto-Craft ★★★★★

Raffia Road Service Center ★★★★★

Quality Auto Care ★★★★★

Auto blog

Nissan and Mitsubishi reportedly working on a 1-ton pickup for the U.S.

Mon, Apr 1 2024We can probably consider it a testament to how far ex-Nissan Renault CEO Carlos Ghosn veered the conglomerate off the straight and narrow that Nissan continues to restate its global aims. Four years ago, Ghosn successor CEO Makoto Uchida announced Nissan Next, part of the plan's global initiatives to "[Focus] on global core model segments including enhanced C and D segment vehicles, electric vehicles, sport cars," "Introduce 12 models in the next 18 months," and "[Expand] presence in EVs and electric-motor-driven cars, including e-POWER, with more than 1 million electrified sales units expected a year by end of FY23." About 18 months later, the automaker expanded on detail with Ambition 2030, which would invest 2 trillion yen ($13.2 billion U.S.) through 2026, part of which would pay for launching 23 new electrified models, 15 of those pure-electric and planned to hit the market by 2027. It's been a tough row to hoe. Now, at the end of Nissan's fiscal year in March, Uchida announced a revised business plan called The Arc. This would put 30 new models on the market by the end of fiscal year 2026 (March 2027), 16 of which will be electrified. Note the climbdown: Ambition 2030 wanted to put 23 electrified vehicles on the market, 15 of them pure-electric, The Arc wants 30 total vehicles, 16 electrified, eight of them pure-electric. A report in Automotive News says one of those BEVs could be an electric one-ton pickup that Nissan will develop with Mitsubishi for the North American market, as well as a plug-in hybrid powertrain that will power an unknown body style and could also serve the pickup. The PHEV would come first, no surprise based on trends in the EV market. Mitsubishi would develop the PHEV powertrain, perhaps an evolution of the system sold in the Outlander PHEV here and the Eclipse Cross PHEV in international markets like Australia. Bringing a PHEV would give Mitsu a third plug-in model, and give Nissan a second to go along with the China-specific Venucia-brand PHEV that launched last year. Beyond giving Nissan a much needed hybrid to sell in the U.S. — the automaker doesn't sell any here now — it would give Mitsubishi dealers some much needed new product. The pickup, on the other hand, would employ Nissan's EV expertise. It's planned for our market sometime between March 31, 2027, and the same date in 2031. This could make it a part of Nissan's planned family of next-gen modular EVs that debut after the eight models coming by 2026.

Check out Nissan's clever digital Smart Rearview Mirror

Fri, 28 Feb 2014Using cameras in place of a car's rearview mirrors has long been a feature of pie-in-the-sky concept cars, although so far, it's failed to translate into the world of production vehicles. Nissan is looking to change that, though, with its new Smart Rearview Mirror.

With a flick of a switch, drivers can jump back and forth between what they'd normally see through the rearview mirror and the camera's feed from the back of the car.

The Smart Rearview Mirror blends everything we know about traditional reflective glass mirrors with a video feed from the rear of the car into a form factor that's immediately recognizable to the average motorist. With a flick of a switch, drivers can jump back and forth between what they'd normally see through the rearview mirror and the camera's feed from the back of the car. The mirror itself features an integrated LCD display with a four-to-one aspect ratio.

2014 Nissan 370Z pricing announced, MSRP reduced by $3,000

Fri, 26 Jul 2013Nissan is up to something. The company announced pricing for the 2014 Nissan 370Z, 370Z Nismo, and 370Z Roadster, which isn't out of the ordinary. What is, is that the standard, hardtop 370Z has received a $3,130 reduction in price for 2014. The upmarket Touring model, meanwhile, has been dropped $2,550.

That means, excluding the $790 for destination and handling, a base, six-speed manual 370Z is only $29,990. That is an excellent deal. Adding an automatic will bump the price to $31,290, while the Touring model starts at $35,270 for DIY shifters and $36,570 for autos. The top-of-the-range Nismo runs $43,020. The Roadster, meanwhile, starts at $41,470.

So what does this mean in the grand scheme? Automakers don't just slash $3,000 off the price of a desirable sportscar because they're feeling generous.Could this be a move to clear out stock before a replacement to the current Z arrives?