2022 Nissan Altima 2.5 Sv on 2040-cars

Engine:2.5L 4-Cylinder DOHC 16V

Fuel Type:Gasoline

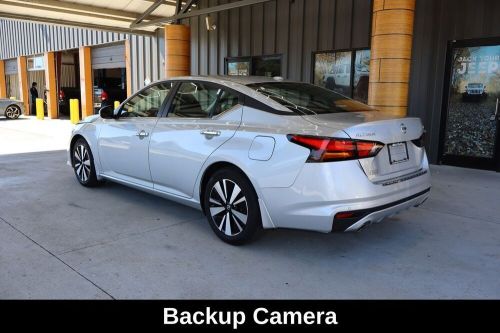

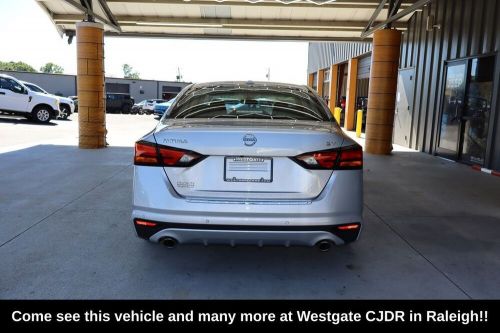

Body Type:4D Sedan

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 1N4BL4DV8NN377656

Mileage: 27003

Make: Nissan

Trim: 2.5 SV

Features: --

Power Options: --

Exterior Color: Silver

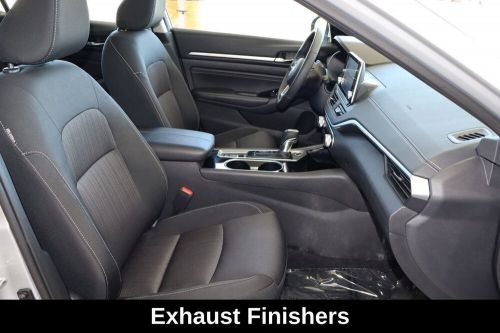

Interior Color: Charcoal

Warranty: Unspecified

Model: Altima

Nissan Altima for Sale

2021 nissan altima 2.5 platinum(US $24,423.00)

2021 nissan altima 2.5 platinum(US $24,423.00) 2012 nissan altima base(US $5,800.00)

2012 nissan altima base(US $5,800.00) 2015 nissan altima 2.5(US $11,000.00)

2015 nissan altima 2.5(US $11,000.00) 2012 nissan altima base(US $6,750.00)

2012 nissan altima base(US $6,750.00) 2015 nissan altima(US $8,900.00)

2015 nissan altima(US $8,900.00) 2023 nissan altima 2.5 sl(US $26,821.00)

2023 nissan altima 2.5 sl(US $26,821.00)

Auto blog

Suppliers love Toyota and Honda: Why that matters to you

Mon, May 15 2017You might think that a survey of automotive suppliers and their relationship with OEMs is the automotive equivalent of nerd prom. In some ways that's what the North American Automotive OEM-Supplier Working Relations Index (WRI) is. The study, the 17th annual conducted by Planning Perspectives Inc., is based on input from 652 salespeople from 108 Tier One suppliers, or, PPI points out, 40 of the top 50 automotive suppliers in North America. Suppliers to General Motors, Ford, FCA, Toyota, Honda, and Nissan. But the results have consequences in terms of tens of millions of dollars for OEMs - and in the quality, technology, and cost of the next vehicle you buy. There are a couple of ways to look at the results of the WRI. One is, "So what else is new?" And the other is, "Damn! How did that happen?" The study looks at five relationship areas — OEM Supplier Relationship; OEM Communication; OEM Help; OEM Hindrance; Supplier Profit Opportunity — within six purchasing areas — Body-in-White; Chassis; Electrical/Electronics; Exterior; Interior; Powertrain. In the overall rankings, Toyota is on top for the 15 th time in 17 years, with a score of 328. Honda, the only company to best Toyota (in 2009 and 2010), comes in second, at 319. Those two companies, explains John Henke, president of PPI, have collaborative working arrangements with colleagues and suppliers alike built into the very fabric of their cultures. This, however, is not a situation where one can readily conclude it is about "Japanese companies," because the third company with headquarters on the island of Honshu, Nissan, came in dead last. This is the "How did that happen?" portion. The Nissan score of 203 puts it 125 points behind Toyota. There hasn't been a number that low since the then-Chrysler Corp. scored 187 in 2010, when the company was clawing its way out of the recession. Clearly, the suppliers don't feel particularly engaged by the buyers at Nissan. Henke explains that whether a company does well or not on the WRI is rather simple. All people do things based on what they're measured on. "If you're measured on taking 10% out of your annual buy, you immediately know how to do it. But if you're also measured on improving relations, suddenly there is a new dynamic as to what you can do to achieve both.

Nissan, Fisker in advanced talks on investment, partnership

Sat, Mar 2 2024Nissan is in advanced talks to invest in electric vehicle maker Fisker in a deal that could provide the Japanese automaker with access to an electric pickup truck while giving the struggling startup a financial lifeline, according to two people familiar with the negotiations. The deal could close this month, said the sources, who asked not to be identified because the talks are ongoing and have not been finalized. Terms being discussed include Nissan investing more than $400 million in Fisker's truck platform and building Fisker's planned Alaska pickup starting in 2026 at one of its U.S. assembly plants, one of the sources said. Nissan would build its own electric pickup on the same platform, the source said. Nissan has U.S. assembly plants in Mississippi and Tennessee. Fisker said on Thursday, when it announced it might not be able to continue as a going concern and would cut 15% of its workforce, that it was in talks with a large automaker for a potential investment and joint development partnership. It did not name the automaker. A Fisker spokesman said the company does not comment on speculation, while Nissan officials were not immediately available to comment. Fisker shares had been down about 45% before the Reuters report but pared those losses and were trading down about 25% with a market capitalization of more than $295 million. The term sheet is ready and the deal is going through due diligence, one of the sources said. Nissan was an EV pioneer with its fully battery powered Leaf hatchback in 2010 but has since struggled in the face of nimbler new entrants. A deal with Fisker would help it move into the growing U.S. electric pickup market. Nissan's talks with Fisker comes in the wake of the former's “rebalanced” relationship with its long-time alliance partner Renault. Last year, Nissan and Renault finalised terms of a restructured alliance after months of negotiations. They aim to have cross-shareholdings of 15% as part of the deal. The more limited alliance removes certain restrictions and has opened the door for Nissan to develop growth plans in areas such as EVs and software independent of Renault, said one of the sources, who is familiar with Nissan's thinking. The Yokohama-headquartered automaker is scouring “many, many opportunities,” the person said.

Ghosn's legacy: one of the auto industry's most effective execs

Wed, Nov 21 2018"Bob Lutz ... estimated that carrying out the Nissan operation would be the equivalent, for Renault, of putting $5 billion in a container ship and sinking it in the middle of the ocean." So wrote Carlos Ghosn in "SHIFT: Inside Nissan's Historic Revival," which was published in the U.S. in late 2004. Two points about that observation: It is in keeping with Lutz's "Often wrong but never in doubt." It shows that Ghosn is a remarkable executive, given that he was able to take Nissan from the edge of financial oblivion to one of the foremost automotive companies (although with alliance partners Renault and, more recently, Mitsubishi). In 1999, Ghosn created what was named the "Nissan Revival Plan." It could have just as well been called the "Nissan Resuscitation Plan." Things were that bad. Now Ghosn is in the midst of legal trouble, accused of financial improprieties of some sort. There is no indication that this is at anything near the scale of what happened at Volkswagen Group. There's malfeasance. And then there's malfeasance. It is likely that this is going to be the end of Ghosn's career, but at age 64, and as a man who has spent nearly the past quarter-century essentially on airplanes, it is probably a good time to leave the stage. What his next act will be — to court or even prison — is an open question. But arguably, Ghosn's performance in the transformation of Nissan and Renault, which also needed some strong medicine to keep it from collapse in the early '00s (although one suspects that the French government would have done its damnedest to keep it propped up), makes him one of the all-time most-notable executives in the auto industry. Ghosn closed plants in both France and Japan and he worked to dismantle the Nissan keiretsu network of interlocked companies, things that were absolutely unthinkable. He established plans with stretch goals in their titles, like the "20 Billion Franc Cost-Reduction Plan," and worked with his people to achieve them, despite the pushback that seemed to come along with the announcement of the plan. As in, as he recalled in SHIFT, "Some people said, 'He's off the deep end. He's raving mad. Doesn't he know that at Renault you set the most conservative goals possible so you can be certain to reach them?' My answer to that sort of thinking was 'You're going to get what you ask for. If you set the bar too low, you'll be a low-level performance.