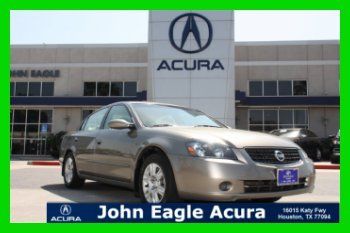

2008 2.5 S 2.5l Blue on 2040-cars

Burkburnett, Texas, United States

Vehicle Title:Clear

Engine:2.5L 2500CC l4 GAS DOHC Naturally Aspirated

Body Type:Coupe

Fuel Type:GAS

Interior Color: Black

Make: Nissan

Model: Altima

Warranty: Vehicle does NOT have an existing warranty

Trim: S Coupe 2-Door

Number of Doors: 2

Drive Type: FWD

Mileage: 67,012

Number of Cylinders: 4

Exterior Color: Blue

Nissan Altima for Sale

2009(09) nissan altima s power moonroof! heated seats! clean! like new! save big(US $14,995.00)

2009(09) nissan altima s power moonroof! heated seats! clean! like new! save big(US $14,995.00) 2013 nissan altima s cloth int. pw pl cruise no money down financing

2013 nissan altima s cloth int. pw pl cruise no money down financing 2007 nissan altima 4dr(US $11,995.95)

2007 nissan altima 4dr(US $11,995.95) 2003 altima bad motor plus motor and parts car no reserve

2003 altima bad motor plus motor and parts car no reserve 2006 2.5l i4 16v front-wheel drive auto sedan(US $8,991.00)

2006 2.5l i4 16v front-wheel drive auto sedan(US $8,991.00) 2007 nissan altima(US $14,270.00)

2007 nissan altima(US $14,270.00)

Auto Services in Texas

Zepco ★★★★★

Xtreme Motor Cars ★★★★★

Worthingtons Divine Auto ★★★★★

Worthington Divine Auto ★★★★★

Wills Point Automotive ★★★★★

Weaver Bros. Motor Co ★★★★★

Auto blog

YouTuber TJ Smith is your singing Lyft driver in Nissan Sentra ad

Fri, 11 Jul 2014Perhaps you've seen Nissan's latest commercial, promoting the Sentra. It's a fairly simple little spot, showing the compact's driver blaring Billy Idol's Mony Mony, singing along and encouraging other motorists to join in.

We'd have been fine had it been left at that. It's a simple commercial that shows the car with a catchy tune and smiling people. Nissan couldn't leave well enough alone, though, and has come back with this. Starring TJ Smith - the driver from the original ad and an apparent YouTube celebrity famous for the kind of thing shown in the original commercial - the new ad expands on the old, with more people, and more Mony Mony. This time round, Smith is serving as a driver for the Lyft service, who just happens to break into song with his fares in the car.

Scroll down for the full video. If you've no idea what we're talking about, we've also included the original commercial.

Infiniti brand will finally make its debut in Japan, but not the name

Thu, 14 Nov 2013Nissan left the automotive media scratching its collective head when it announced that its Infiniti luxury brand would be renaming all of its vehicles, with cars wearing the Q designation and CUVs/SUVs wearing the QX badge. So the G Sedan became the Q50, and the G Coupe became the Q60. The QX56, meanwhile, became the QX80, and the FX crossover became the QX70. It is still thoroughly confusing nearly a year later.

Not content to confuse its US customers alone, Nissan will be fiddling with the name of one of its most revered Japanese-market models - the Skyline. Rebadged for the US as the Q50, and before that as the G Sedan/Coupe, the new Skyline will wear an Infiniti badge. What makes this truly confusing, though, is that the car won't be called the Infiniti Skyline, despite its badging. It won't even be called the Nissan Skyline, anymore. It's now just the Skyline. Apparently, Nissan thinks it can capitalize on the Skyline's link to the Japanese royal family (the Skyline was originally a product of Prince Motors, which provided vehicles for the Emperor and his family), by ditching any brand names and referring to it as its own model, according to Automotive News.

Now, confusion aside, there are things about Infiniti badging in Japan that make sense. Badging all the Nissans that eventually become Infinitis as Infinitis in the first place goes a long way to make the brand seem separate and distinct from its parent company. Speaking to AN, Infiniti's executive vice president of global product planning, Andy Palmer, puts it this way, "We have to treat Infiniti, if you will, in the same [way] that Volkswagen treats Audi. It's not a Nissan-plus. Infiniti has to stand head-to-head with any of those German competitors."

Carlos Ghosn asks why Japanese don't question him in Lebanon

Tue, Jan 5 2021BEIRUT — Former Renault-Nissan boss Carlos Ghosn said in an interview aired Monday that French investigators are coming to question him in Lebanon over some legal challenges in France, asking why don't the Japanese do the same thing. GhosnÂ’s comments came two weeks after a Lebanese justice ministry official said a team of French investigators will come to Beirut in January to participate in interrogating the former auto executive. Ghosn, who is a Lebanese, Brazilian and French national, fled Japan in a dramatic escape that drew headlines in late 2019, arriving in Lebanon on Dec. 30 of that year. In addition to his trial in Japan, the 66-year-old businessman is facing a number of legal challenges in France, including tax evasion and alleged money laundering, fraud and misuse of company assets while at the helm of the Renault-Nissan alliance. Ghosn said there is neutrality in Lebanon, where he has been living since fleeing Japan, adding that Lebanese authorities have asked Japanese officials to send the charges against him but Tokyo did not. “What does that mean?” asked Ghosn insisting that he is innocent and was the victim of JapanÂ’s judicial system. “Now the French have charges,” Ghosn said. “They (French) are coming and they will question me. The Japanese are not doing this.” “I consider all the charges to be false,” Ghosn said. After leading the Japanese automaker Nissan for two decades, Ghosn was arrested in Japan in November 2018 on charges of breach of trust, misusing company assets for personal gains and violating securities laws by not fully disclosing his compensation. He denied wrongdoing and fled Japan while out on bail awaiting trial. He is unlikely to be extradited from Lebanon, where he has been since last year. Ghosn said in the interview with the local LBC TV that Lebanon, which is passing through its worst economic and financial crisis in its modern history, “proved that it protects it citizens.” He added: “I am a French citizen, and the French state did not defend me.” At least two Ghosn-related investigations were opened in France. One focused on suspicious transactions between Renault and a distributor in Oman, as well as suspected payments for private trips and events paid by Renault-NissanÂ’s Netherlands-based holding company RNBV. Another investigation focused on suspected misuse of company funds for a party for Ghosn at Versailles.