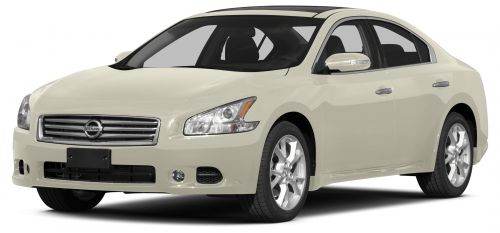

2014 Nissan Maxima Sv on 2040-cars

1700 Siebarth Dr, Lake Charles, Louisiana, United States

Engine:3.5L V6 24V MPFI DOHC

Transmission:Automatic CVT

VIN (Vehicle Identification Number): 1N4AA5AP5EC482888

Stock Num: 25301

Make: Nissan

Model: Maxima SV

Year: 2014

Exterior Color: Gun Metallic

Options: Drive Type: FWD

Number of Doors: 4 Doors

We're Making Deals Everyday!

Nissan Maxima for Sale

2014 nissan maxima s(US $32,005.00)

2014 nissan maxima s(US $32,005.00) 2014 nissan maxima s(US $32,005.00)

2014 nissan maxima s(US $32,005.00) 2014 nissan maxima s(US $32,500.00)

2014 nissan maxima s(US $32,500.00) 2014 nissan maxima sv(US $36,485.00)

2014 nissan maxima sv(US $36,485.00) 2013 nissan maxima sv(US $37,125.00)

2013 nissan maxima sv(US $37,125.00) 2013 nissan maxima sv(US $38,355.00)

2013 nissan maxima sv(US $38,355.00)

Auto Services in Louisiana

Walker`s Wrecking Yard & Auto Parts ★★★★★

Walker Tire ★★★★★

Upholstery Limited ★★★★★

Universal Diesel Service ★★★★★

Tropical Car Wash & Brake Tag Station ★★★★★

Supreme Collision & Towing ★★★★★

Auto blog

The birth of a drifter, meet James Deane

Wed, Apr 1 2015Drifting is sometimes a maligned from of motorsport because it's scored by judges rather than the outcome of shedding tenths off of lap times. But that doesn't mean the people behind the wheel are lacking in skill. In a new documentary series XCar Films interviews European drift champion James Deane, and of course he also shows off his abilities with some smoky slides. Amazingly, Deane got started drifting at just 15 in a Ford Sierra, and a year later, he was already winning championships in a Nissan S14. His current competition weapon combines a Nissan chassis with a turbocharged Toyota 2JZ engine and a NASCAR four-speed gearbox. Deane reckons the setup makes around 650 horsepower. As this video shows, Deane is a master of getting the car to slide just where he wants it to be. Coupled with Xcar's consistently fantastic cinematography, there's an interesting story here of a racer stepping up the ladder of competition. Related Video: News Source: Xcar Films via YouTube Motorsports Nissan Coupe Racing Vehicles Performance Videos drifting xcar xcar films drifter

Nissan could report first quarterly loss since March 2009

Wed, Feb 12 2020TOKYO — Nissan may report its first quarterly loss in more than a decade on Thursday because of slumping sales, sources familiar with the company said, adding more pressure on efforts to rebuild the company after Carlos Ghosn's ouster. Deteriorating profits underscore the challenges facing Nissan, which is unwinding many of the expansionist strategies championed by ex-Chief Executive Officer and Chairman Ghosn by slashing jobs, production sites and product offerings to save cash and ensure its survival. In addition to slumping sales, production disruptions caused by China's coronavirus outbreak could also drag profits lower. Three senior officials at Japan's No. 2 automaker told Reuters that they anticipate a poor results announcement on Thursday, with one of them calling the figures "dismal". Two of the officials cautioned that there is the possibility of an operating loss, which would be the first quarterly loss since the period ending in March 2009. Nissan said it could not comment on its financial results ahead of its official announcement. The company is likely to report operating profit of 48.6 billion yen ($442.5 million) for the quarter ending in December, less than half the 103 billion yen profit a year ago, according to SmartEstimate's survey of three analysts, who revised their forecasts in January. However, those forecasts were issued before the release of the December vehicle sales figures on Jan. 30, which show third-quarter sales dropped by 11% from the year earlier period, according to Reuters calculations. That is the biggest quarterly slump of its current sales downturn that began two years ago. That sales decline led one auto equities analyst based in Japan to scrap his forecast and also warn that Nissan could post a loss. "It will be a question of whether there will be a profit or a loss. For the quarter, a loss is a possibility," he said, declining to be named as his forecast had not been updated to reflect his latest view. One of the three Nissan officials said there is a risk the automaker may cut its full-year profit forecast of 150 billion yen, which would be an 11-year low. The company announced that forecast in November after an initial 230 billion yen outlook.

Weekly Recap: The cost of Tesla's ambitious plans for growth

Sat, Feb 14 2015Tesla has ambitious plans for growth, and they won't come cheap. The electric-car maker said this week it plans to spend $1.5 billion in 2015 to expand production capacity, launch the Model X crossover and continue work on its Gigafactory, which is being built outside of Reno, NV. The company is also investing in its stores, service centers and charging network, which is expected to grow by more than 50 percent this year. Plus, it's still working on the Model 3, which is scheduled to arrive in 2017. "We're going to spend staggering amounts of money on [capital expenditures]," Tesla chairman and CEO Elon Musk said on an investor call. He then added: "For a good reason. And with a great ROI [return on investment]." They're bold plans, and Musk is clearly willing to put Tesla's money where his mouth is. That's why the company is projecting a whopping 70-percent increase in deliveries this year, for a total of 55,000 cars. A large chunk of that growth will come from the addition of the Model X crossover to Tesla's portfolio, and the company already has nearly 20,000 reservations for it. More than 30 Model X prototypes have been built, and it is expected to begin shipping to customers this summer. Musk said he's "highly confident" the vehicle, which has experienced delays, will arrive on time. The company also had more than 10,000 orders for the Model S at the start of the year. The big spending plans caused a stir, even though Tesla spent $369 million on capital expenditures in the fourth quarter alone. In a note to investors, Morgan Stanley analysts called the costs required to keep pace with Tesla's demand "eye-wateringly high," and said the $1.5-billion figure was nearly double their expectations. Still, Musk is not thinking small and suggested that his company could be as big in 10 years as Apple is now if Tesla's growth continues. His optimism comes as the company actually reported a $294-million net loss in 2014, more than its $74-million loss in 2013. The money, however, continues to roll in, and total revenues increased to $3.2 billion in 2014, up from $2 billion in 2013 and a dramatic surge from $413 million in 2012. More of the same is expected this year, and the company could reach $6 billion in revenue. As Morgan Stanley noted, it "seems Tesla is preparing to be a much larger company than we have forecasted." It's certainly spending that way.