2012 Nissan Maxima S on 2040-cars

12101 St Charles Rock Rd, Bridgeton, Missouri, United States

Engine:3.5L V6 24V MPFI DOHC

Transmission:Automatic CVT

VIN (Vehicle Identification Number): 1N4AA5AP5CC839709

Stock Num: TT346

Make: Nissan

Model: Maxima S

Year: 2012

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 19151

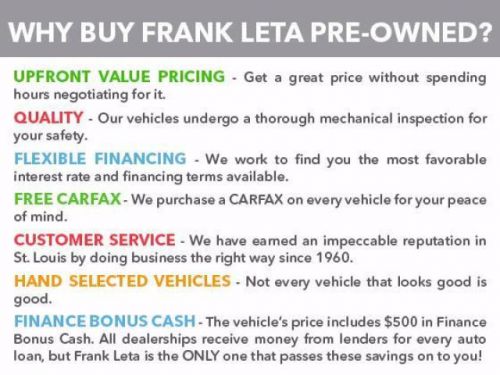

Price includes finance bonus cash! See dealer for details Think all dealerships are the same? Think again! Frank Leta has been serving the St. Louis area for almost 50 years. Our philosophy is to deliver an excellent product with excellent customer service 100% of the time. We have a proven track record of excellence, and a lot of our sales come from referrals. Come let us show you the Frank Leta difference! And remember...You Can't Beat a Leta!!!

Nissan Maxima for Sale

2010 nissan maxima s(US $19,300.00)

2010 nissan maxima s(US $19,300.00) 2014 nissan maxima sv(US $37,485.00)

2014 nissan maxima sv(US $37,485.00) 2014 nissan maxima(US $32,190.00)

2014 nissan maxima(US $32,190.00) 2014 nissan maxima sv(US $39,285.00)

2014 nissan maxima sv(US $39,285.00) 2001 nissan maxima gle

2001 nissan maxima gle 2010 nissan maxima sv(US $21,877.00)

2010 nissan maxima sv(US $21,877.00)

Auto Services in Missouri

Warehouse Tire & Muffler ★★★★★

Uptown Auto Sales ★★★★★

Toyota Of West Plains ★★★★★

T & B Auto ★★★★★

Springfield Freightliner Sales ★★★★★

Spectrum Glass Inc ★★★★★

Auto blog

Infiniti will move back to Japan from Hong Kong in 2020

Wed, May 29 2019BEIJING – Nissan's premium brand Infiniti is relocating its headquarters back to Japan from Hong Kong, its home since 2012, to create "more operational efficiencies" with its parent company, according to a document seen by Reuters on Wednesday. The move planned for mid-2020, and expected to be publicly announced later on Wednesday, will help the Japanese automaker cut costs amid a slump in its global earnings in the year ended March 31. "The relocation will further integrate (Infiniti) with global design, research and development and manufacturing functions based in Japan," Nissan said in the statement, adding that Infiniti would continue to "operate independently". The move also was "crucial" for Nissan to follow through on its strategy to electrify the Infiniti lineup, the document said, with plans for every premium model launched from 2021 to be either all-electric or "e-Power" hybrid. A Nissan official, speaking on condition of anonymity, said that while there was a "fair amount of platform and other base technology sharing" between Infiniti and the main volume brand Nissan, "there could be more". Nissan's global operating profit plunged 45% in the last fiscal year and would likely drop another 28% to "rock bottom" in the current one, according to company filings earlier this month. Infiniti's move back to Japan will reverse a decision made under ousted leader Carlos Ghosn to dilute the premium brand's Japanese origins in order to foster a more global image. Its Hong Kong headquarters has about 180 employees who were told about the move back to Yokohama earlier on Wednesday, according to the Nissan official. The Hong Kong headquarters and the global image it was intended to promote were seen as critical for Infiniti to make inroads in China, where being Japanese can sometimes be a handicap because of historical animosities. In 2012, Infiniti and other Japanese brands took a battering in the wake of diplomatic spats over disputed islets known as Diaoyu in China and Senkaku in Japan. Since then, Japan's bilateral relationship with China has steadily improved and Japanese automakers including Nissan and Toyota are seeing their businesses expand, even as China's overall auto market has slumped over the past year. (Reporting by Norihiko Shirouzu; Editing by Stephen Coates)

Renault selling part of Nissan stake to partner for $824 million

Tue, Dec 12 2023Renault SA is selling around 5% of its stake in partner Nissan Motor Co., offloading the stock as part of a share buyback by the Japanese carmaker. The move follows last month’s finalization of a plan for Renault to reduce its interest in Nissan. The stake sale is valued at around ˆ765 million ($824 million), but will result in a capital loss of ˆ1.5 billion, the French company said Tuesday. Eventually, the two carmakers aim to equalize their cross-shareholdings at 15%, loosening the ties that kept them together in a carmaking alliance for two decades. The partnership between Nissan and Renault was jolted in 2018 by the arrest of Carlos Ghosn, chairman of both companies. Since then, they have drifted apart and are now charting separate paths. Given that NissanÂ’s shares are trading below the Tokyo Stock ExchangeÂ’s guideline of maintaining a price-to-book ratio above 1, the buyback will “help improve the situation,” said Bloomberg Intelligence analyst Tatsuo Yoshida. The cash will bolster Chief Executive Officer Luca de MeoÂ’s efforts to get Ampere, RenaultÂ’s electric-vehicle and software arm, going as he seeks to split off the unit and list it as a separate public entity as soon as April or May. Nissan has also agreed to invest in Ampere. Renault transferred its 28.4% stake in Nissan into a trust in early November to pave the way for a reduction of its holding. Even so, there will still be lock-up and standstill obligations. De Meo said last month that Renault would begin offloading the stake “very soon” in early 2024, so TuesdayÂ’s announcement was slightly earlier than anticipated. For Nissan, the buyback is well within the value of cash and equivalents, which stood at JPY1.6 trillion ($11 billion) yen at the end of September. Nissan said it will cancel all acquired shares. “ItÂ’s good news for the stock that Nissan will retire the equivalent of 5% of its outstanding shares,” Yoshida said. The Japanese carmaker is paying JPY568.5 for each share, the price at the close of trading in Tokyo on Tuesday. While NissanÂ’s stock has climbed 36% this year, itÂ’s at roughly half of its value from early 2017. Earnings/Financials Nissan Renault

2011-2012 Nissan Leaf class-action lawsuit finally settled

Tue, Jul 21 2015In 2012, a group of Nissan Leaf owners sued the automaker in a class-action lawsuit over the "wilting Leaf" issue. That describes the steadily decreasing battery capacity of the electric vehicle's battery pack, which didn't line up with drivers' expectations. At the time, Nissan said the lawsuit was without merit but the legal wranglings continued. A new, $24-million settlement will give Leaf owners a new (not repaired) battery if their current pack drops down to fewer than nine bars of energy capacity. There are also options for 90 days of free charging at some of the No Charge To Charge locations or, if they don't live near any of those, a $50 check. One of the main complaints of the lawsuit was that the initial ads for the EV were less-than-clear, telling people the car could go 100 miles when fully charged but, and here's the problem, the automaker recommended that Leaf owners not charge their cars up all the way in hot climates. The class action suit was filed on behalf of Leaf owners in California and Arizona. It reads, in part: Before purchase or lease, Nissan failed to disclose its own recommendations that owners avoid charging the battery beyond 80% in order to mitigate battery damage and failed to disclose that Nissan's estimated 100 mile range was based on a full charge battery, which is contrary to Nissan's own recommendation for battery charging. Following early reports of the wilting problem in warm climates and the initial filing of the lawsuit, Nissan upgraded its battery warranty. It also improved the EV's battery chemistry. The class action suit says that it's this new chemistry that needs to go into any "wilting Leafs" that are affected by the suit. There's more information at the class-action site. Nissan told AutoblogGreen it does not typically discuss litigation. Related Video: Nissan Leaf Battery Explanation 01:18 Embed 00:00 01:18 Play Mute Full Screen Visit AOL On Debug Info Featured Gallery 2011 Nissan Leaf View 20 Photos Government/Legal Green Nissan Electric battery lawsuit class action lawsuit