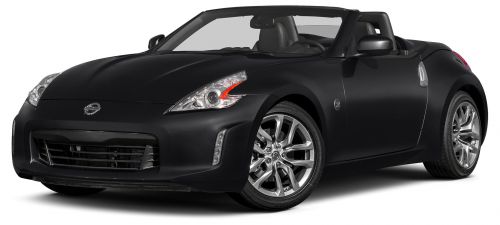

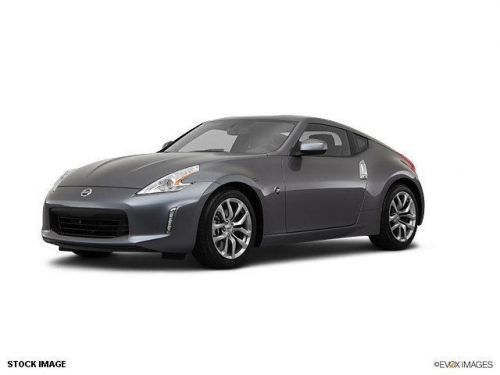

2014 Nissan 370z Touring on 2040-cars

1700 Siebarth Dr, Lake Charles, Louisiana, United States

Engine:3.7L V6 24V MPFI DOHC

Transmission:7-Speed Automatic

VIN (Vehicle Identification Number): JN1AZ4FH4EM620495

Stock Num: 24890

Make: Nissan

Model: 370Z Touring

Year: 2014

Exterior Color: Magnetic Black

Options: Drive Type: RWD

Number of Doors: 2 Doors

We're Making Deals Everyday!

Nissan 370Z for Sale

2013 nissan 370z touring(US $31,126.00)

2013 nissan 370z touring(US $31,126.00) 2014 nissan 370z touring(US $45,363.00)

2014 nissan 370z touring(US $45,363.00) 2010 nissan 370z touring(US $25,000.00)

2010 nissan 370z touring(US $25,000.00) 2014 nissan 370z base(US $43,209.00)

2014 nissan 370z base(US $43,209.00) 2014 nissan 370z base(US $31,242.00)

2014 nissan 370z base(US $31,242.00) 2009 nissan 370z(US $22,988.00)

2009 nissan 370z(US $22,988.00)

Auto Services in Louisiana

University Car Care Center ★★★★★

Top Shop The ★★★★★

Tim`s Auto Salvage ★★★★★

Steve`s Lube & Tire Center LLC ★★★★★

Sterling Auto Repair ★★★★★

Service Plus Auto Glass ★★★★★

Auto blog

Renault to Nissan: Stop trying to contact our board members

Wed, Dec 12 2018TOKYO/PARIS — Renault told alliance partner Nissan to stop contacting the French company's directors ahead of a Thursday board meeting as the Japanese automaker tried to share evidence of wrongdoing by its ousted chairman, Carlos Ghosn, two sources said. Ever since Ghosn's Nov. 19 arrest in Japan, Renault and the French government, the automaker's biggest shareholder, have demanded to see the findings of a Nissan internal investigation that include allegations of financial misconduct by the 64-year-old executive. Ghosn was charged on Monday in Japan for failing to declare deferred income he had agreed to receive for the five years ending March 2015. While Nissan fired him as chairman days after his arrest, he remains chairman and CEO of its French partner. Renault's board meets on Dec. 13, and the findings of Nissan's investigation will be shared at the meeting where Ghosn's future could be also debated, one of the sources with knowledge of the matter said. The French firm told Nissan not to contact its directors ahead of the meeting, because such contact was outside the agreed channels for communication of the sensitive findings, the source said. Nissan offered last week to brief Renault's board about findings on what it considers proof of wrongdoing by Ghosn, said a second source who has knowledge of the matter but declined to be identified as it was confidential. But Renault advised Nissan to brief its lawyers instead, which led to a meeting between the Japanese firm's officials and Renault's legal teams early this week in Paris, the person said. The Japanese automaker later invited Thierry Bollore, who was named Renault's deputy CEO with the same powers as Ghosn a day after his arrest, as well as board members, to examine the contents of the findings, said the source. Bollore, though, told Nissan on Tuesday to "refrain from contacting the board," the source said. The exchange between Renault and Nissan is another example of the testy relationship between the two automakers, despite assurances by executives on both sides to preserve the alliance. The alliance, of which Ghosn has been the driving force, is widely seen as vital for the members' long-term survival. Board members invited to see the evidence included Martin Vial, who heads the French state shareholdings agency, interim Chairman Philippe Lagayette and independent director Patrick Thomas, the second source said. A Renault spokesperson declined to comment.

Nissan, Renault in talks to merge as one company

Thu, Mar 29 2018Nissan and Renault have been tied together as an alliance for nearly 20 years, but now the Japanese and French automakers are discussing whether to merge. Bloomberg, citing unidentified sources familiar with the confidential talks, reports that the idea is to form a larger, single publicly traded company to better compete against giants like Toyota and Volkswagen. It would also mark the end of the alliance that first began in 1999 and also includes Mitsubishi, in which Nissan acquired a controlling interest in 2016. A full merger would help the companies pool resources to develop electric vehicles, autonomous vehicles and car-sharing services. It would involve Nissan giving Renault shareholders stock in the new company, with Nissan shareholders also gaining shares in the new company, Bloomberg reports. The new company would be run by Carlos Ghosn, the current chairman of both companies. But any such merger, as you might expect, would be complicated, in part by geopolitics. The French government owns a 15-percent stake in Renault, and both the French and Japanese governments might be reluctant to let go of their respective home-grown brands. Currently, Renault owns a 43-percent stake in Nissan, while Nissan owns 15 percent of its French partner. Reuters reported recently that Ghosn proposed buying most of the French government's stake in Renault as part of plans for a closer tie-up. The Renault-Nissan-Mitsubishi alliance already has been working to establish a $200 million mobility tech fund to invest in startups, a reflection of how seismic changes in the auto industry have left many legacy companies scrambling to stay current. Nissan in 2016 paid a reported $2.3 billion to acquire 34 percent of Mitsubishi in order to share platforms, technology, manufacturing and other resources. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Image Credit: Patrick T. Fallon/Bloomberg Earnings/Financials Government/Legal Green Mitsubishi Nissan Renault car sharing merger

Nissan posts $6.2 billion annual loss and unveils plan to cut costs

Thu, May 28 2020TOKYO — Nissan outlined a new plan on Thursday to become a smaller, more cost-efficient carmaker after the coronavirus pandemic exacerbated a slide in profitability that culminated in its first annual loss in 11 years. Under a new four-year plan, the Japanese manufacturer will slash its production capacity and model range by about a fifth to help cut 300 billion yen from fixed costs. It will shut plants in Spain and Indonesia, leave the South Korean market and pull its Datsun brand from Russia as part of a strategy unveiled on Wednesday to share production globally with its partners Renault and Mitsubishi. "I will make every effort to return Nissan to a growth path," Nissan Chief Executive Makoto Uchida said, adding that the company had learned from its past mistakes of chasing global market share at all costs. "We must admit failures and take corrective actions," he said, adding that starting with top-level managers, the company had to break its inward-looking culture which in the past has stymied efforts to deepen cooperation with France's Renault. Uchida said improving the company's cash flow was its biggest challenge. He reiterated that Nissan's cash liquidity was good even though it had negative free cash flow of 641 billion yen in the year ended in March. Nissan declined to give any forecasts for its current financial year which started in April due to the uncertainty created by the coronavirus pandemic. It also declined to give details on how many jobs it was cutting. In what is Nissan's second recovery plan in less than a year, Uchida pledged a return to profitability with a core operating profit margin above 5% and a sustainable global market share of 6%. Nissan posted an annual operating loss of 40.5 billion yen for the year to March 31, its worst performance since 2008/09. Its operating profit margin was -0.4%. The automaker said on Thursday that it sold 4.9 million vehicles last year, up from an earlier estimate of 4.8 million. That was still the second decline in a row and a fall of 11% from the previous period but meant Nissan clung on to its position as Japan's second biggest carmaker, just ahead of Honda and a long way behind Toyota. Pandemic pressure Even before the spread of the novel coronavirus, Nissan's slumping profits had forced it to row back on an aggressive expansion plan pursued by ousted leader Carlos Ghosn. The pandemic has only piled on the urgency to downsize.