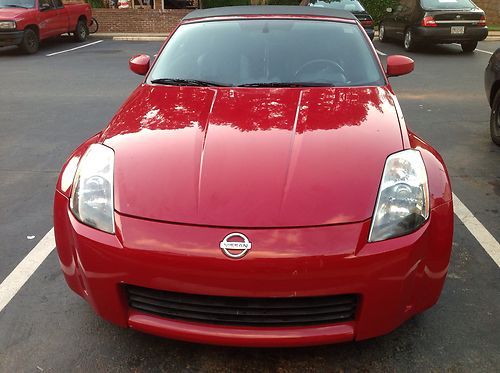

2003 Performance 3.5l V6 6 Speed Manual Coupe Premium No Reserve on 2040-cars

Norwood, Pennsylvania, United States

Body Type:Coupe

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Private Seller

Model: 350Z

Mileage: 50,492

Warranty: No

Sub Model: Performance No Reserve

Exterior Color: Black

Interior Color: Black

Number of Cylinders: 6

Nissan 350Z for Sale

Low mileage, automatic, pearl white(US $11,850.00)

Low mileage, automatic, pearl white(US $11,850.00) Touring convertible(US $16,000.00)

Touring convertible(US $16,000.00) One owner 2005 350z touring coupe ultra yellow nice

One owner 2005 350z touring coupe ultra yellow nice Enthusiast convertible 3.5l cd 6 speakers am/fm cd w/6 speakers am/fm radio(US $18,995.00)

Enthusiast convertible 3.5l cd 6 speakers am/fm cd w/6 speakers am/fm radio(US $18,995.00) 2008 nissan 350z 2dr roadster tour at

2008 nissan 350z 2dr roadster tour at 2006 nissan 350z 65,500 miles(US $13,800.00)

2006 nissan 350z 65,500 miles(US $13,800.00)

Auto Services in Pennsylvania

Young`s Auto Body Inc ★★★★★

Young`s Auto Body Inc ★★★★★

Wilcox Garage ★★★★★

Tint-Pro 3M ★★★★★

Sutliff Chevrolet ★★★★★

Steve`s Auto Repair ★★★★★

Auto blog

Half of Chinese car buyers won't shop Japanese over hard feelings

Mon, May 26 2014The hard feelings between China and Japan is no real secret. Besides modern-day disputes, the two countries have had a long-running enmity that dates back to well before the atrocities of World War II. All things considered, then, it shouldn't be a shock that half of Chinese car buyers wouldn't consider a Japanese car. This survey, conducted by Bernstein Research, found that 51 percent of 40,000 Chinese consumers wouldn't even consider a Japanese car – which, again, isn't really surprising, when you consider stories like this. According to Bernstein, the most troubling thing is the location of these sentiments – smaller, growing cities where the population is going to need sets of wheels. We imagine it wouldn't be as big of an issue in traffic-clogged Shanghai or Beijing, but these small cities are going to become a major focus for automakers. "Nationalistic feelings are an impediment. [Japanese] premium brands will struggle," analyst Max Warburton wrote in a research note, according to The Wall Street Journal. Things will improve for Japanese makes, although China will remain a challenge, with Warburton writing, "the one thing that comes out most clearly is that most Chinese really want a German car. While we expect Japanese brands to continue to recover market share this year, ultimately the market will belong to the Germans." There are a few other insights from the study. According to WSJ, Japanese brands are viewed better than Korean brands, and they're seen as more comfortable than the offerings from Germany or the US, despite the fact that everyone in China apparently wants a German car. This is a tough position for the Japanese makes to be in, as there's really not a lot they can do to win favor with Chinese buyers. It will be interesting to see how this plays out, particularly as the importance of the PRC continues to increase year after year. News Source: The Wall Street Journal - sub. req.Image Credit: Kazuhiro Nogi / AFP / Getty Images Honda Mazda Nissan Toyota Car Buying

FCA-Renault merger talks: France wants job guarantees and Nissan on board

Tue, May 28 2019PARIS — France will seek protection of local jobs and other guarantees in exchange for supporting a merger between carmakers Renault and Fiat Chrysler, its finance minister said on Tuesday, underscoring the challenges facing the plan. Renault Chairman Jean-Dominique Senard arrived in Japan to discuss the proposed tie-up with the French company's existing partner Nissan — another potential obstacle to the $35 billion-plus merger of equals. Renault and Italian-American rival Fiat Chrysler Automobiles (FCA) are in talks to tackle the costs of far-reaching technological and regulatory changes by creating the world's third-biggest automaker. Nissan found out about Renault's merger talks with Fiat Chrysler only days before they became public, four sources told Reuters, stoking fears at the Japanese carmaker that a deal could further weaken its position in a 20-year alliance with Renault. A deal between Renault and FCA would create a player ranked behind only Japan's Toyota and Germany's Volkswagen and target 5 billion euros ($5.6 billion) a year in savings. Some analysts, however, say the companies face a challenge to win over powerful stakeholders ranging from the French and Italian governments to trade unions and Nissan. Patrick Pelata, a former Renault chief operating officer, also criticized the deal plan for undervaluing Renault and threatening to overstretch its engineering resources. By valuing Renault at its market price, the all-share offer attributes a negative 6 billion euro value to Renault operations after deduction of its 43.4% stake in Nissan and 3.1% Daimler holding, Pelata told BFM radio. "That's hardly reasonable," he said. "And I think that shareholders, including the French state, are bound to take issue with this sooner or later." Pelata added: "FCA has big problem because they haven't invested for the future — they have no electric vehicle platform and they've done nothing in autonomous cars." French finance minister Bruno Le Maire told RTL radio on Tuesday that the plan was a good opportunity for both Renault and the European car industry, which has been struggling for years with overcapacity and subdued demand. France sets conditions Le Maire also said the French government would seek four guarantees in exchange for backing a deal that would reduce its 15% stake in Renault to 7.5% of the combined entity. "The first: industrial jobs and industrial sites.

Ghosn orders Nissan USA to double sales by 2017

Mon, 13 May 2013Nissan CEO Carlos Ghosn has just one teensy-weensy request for its United States arm: Double your sales by 2017.

"China was not our biggest, I would say, disappointment. It was mainly the United States. We were expecting a strong year in the United States. It didn't happen," Ghosn said, speaking at a conference after announcing Nissan's 2012 fiscal results, Automotive News reports. Because of this, Ghosn has ordered his US executives to iron out the problems that affected new vehicle launches and to strengthen the company's dealer network.

In 2012, Nissan's US sales rose to 1.1 million units - a five-percent increase, and a record, at that. But the company's overall market share fell from 8.2 percent to 7.7 percent, putting the company further away from its goal of having a 10-percent stake overall.