2007 Gray Touring Leather,chrome Rims,heated Seats Local Trade on 2040-cars

Bettendorf, Iowa, United States

Nissan 350Z for Sale

Silver, roadster touring excellent condition 64,000 miles summer use only!!!!!!!(US $15,500.00)

Silver, roadster touring excellent condition 64,000 miles summer use only!!!!!!!(US $15,500.00) Silver, base model, custom fit dual exhaust, 6 speed manual, fun and fast!!(US $8,000.00)

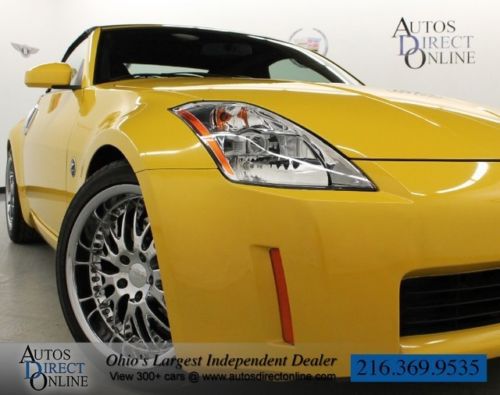

Silver, base model, custom fit dual exhaust, 6 speed manual, fun and fast!!(US $8,000.00) Clean carfax heated leather seats power soft top bose audio brembo brakes xenons(US $16,500.00)

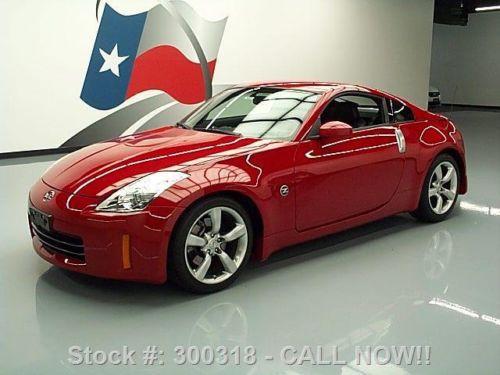

Clean carfax heated leather seats power soft top bose audio brembo brakes xenons(US $16,500.00) 2006 nissan 350z touring coupe auto htd leather 12k mi texas direct auto(US $18,780.00)

2006 nissan 350z touring coupe auto htd leather 12k mi texas direct auto(US $18,780.00) 2004 nissan 350z(US $7,000.00)

2004 nissan 350z(US $7,000.00)

Auto Services in Iowa

Toyota Of Des Moines ★★★★★

Road Runner Auto Sales and Service ★★★★★

Mysak Transmission ★★★★★

Michael`s Automotive Authority ★★★★★

Heartland Restoration and Towing ★★★★★

Fast Action Towing & Recovery ★★★★★

Auto blog

Renault to propose joint holding company with Nissan, Nikkei reports

Fri, Apr 26 2019TOKYO — Renault SA will propose to Nissan Motor Co a plan to create a joint holding company that would give both firms equal footing as the French automaker seeks further integration with its Japanese partner, the Nikkei newspaper reported on Friday. Under the proposal, both firms would nominate a nearly equal number of directors to the new company in which ordinary shares in both Nissan and Renault would be transferred on a balanced basis, the newspaper said, without citing sources. This would effectively dilute the stake held by the French government in Renault to around 7-8 percent, from its current 15 percent, it added. The new company would be headquartered in a third country, such as Singapore. Renault plans to make the proposal to Nissan soon, the Nikkei said, having modified an earlier merger idea that Nissan rejected on April 12. Nissan declined to comment on the issue. The Financial Times newspaper reported that both Nissan and the Japanese government have refused to engage in merger talks with Renault. The report of the proposal comes as the outlook for the alliance — one of the world's top automaking partnerships — has clouded since the arrest in November of its main architect, Carlos Ghosn, for suspected financial misconduct. It also comes as Nissan's financial performance struggles following years of focusing on volume sales over building its brand, particularly in the United States, its biggest market. Nissan slashes its forecast This week, the Japanese automaker slashed its profit forecast for the year just ended to its lowest in nearly a decade, citing weakness in its U.S. operations. Renault for years has been vying for a closer merger with Nissan, which it rescued from the brink of bankruptcy two decades ago. Ghosn had been working to achieve a deeper integration before his arrest on financial misconduct charges in November last year. While the automakers have been consolidating many of their operations over the past decade, including procurement and production, many executives at Nissan have opposed an all-out merger with Renault. Instead, Nissan has argued for a more equal footing with Renault, which holds a 43 percent stake in its bigger partner. Nissan holds a 15 percent stake in Renault. It was unclear whether Renault would hold the casting vote in major decisions at the new company, as it did in Renault-Nissan B.V., a strategic management company jointly held by both companies that oversaw operations for the partnership.

Nissan reports $4.13B net income for 2012

Sat, 11 May 2013The news for Nissan is good when it comes to the company's results for the 2012 financial year that ended on March 31. Even though the numbers were down in many of the world's major markets, increased sales in the US, Brazil and the Middle East, ten new models and a strong fourth quarter allowed Nissan to hit its target for the year and notch record sales of 4.914 million units globally. On net revenue of $116 billion, Nissan posted net income of $4.13 billion and an operating profit of $6.31 billion.

There are upward-looking projections for this year, Nissan forecasting a 7.8-percent jump in sales to 5.3 million units, with $117.89 billion in net revenue and $4.42 billion in net income. That net revenue number probably won't actually match what's reported next year, though, because Nissan is changing its accounting method and won't include revenue and operating profit results from its joint venture with China's Dongfeng. Net income doesn't change under the new method, but the adjusted net revenue forecast is $109.16 billion.

There's a press release and two videos below with more details for those of you who go gaga for annual reports.

Renault selling part of Nissan stake to partner for $824 million

Tue, Dec 12 2023Renault SA is selling around 5% of its stake in partner Nissan Motor Co., offloading the stock as part of a share buyback by the Japanese carmaker. The move follows last month’s finalization of a plan for Renault to reduce its interest in Nissan. The stake sale is valued at around ˆ765 million ($824 million), but will result in a capital loss of ˆ1.5 billion, the French company said Tuesday. Eventually, the two carmakers aim to equalize their cross-shareholdings at 15%, loosening the ties that kept them together in a carmaking alliance for two decades. The partnership between Nissan and Renault was jolted in 2018 by the arrest of Carlos Ghosn, chairman of both companies. Since then, they have drifted apart and are now charting separate paths. Given that NissanÂ’s shares are trading below the Tokyo Stock ExchangeÂ’s guideline of maintaining a price-to-book ratio above 1, the buyback will “help improve the situation,” said Bloomberg Intelligence analyst Tatsuo Yoshida. The cash will bolster Chief Executive Officer Luca de MeoÂ’s efforts to get Ampere, RenaultÂ’s electric-vehicle and software arm, going as he seeks to split off the unit and list it as a separate public entity as soon as April or May. Nissan has also agreed to invest in Ampere. Renault transferred its 28.4% stake in Nissan into a trust in early November to pave the way for a reduction of its holding. Even so, there will still be lock-up and standstill obligations. De Meo said last month that Renault would begin offloading the stake “very soon” in early 2024, so TuesdayÂ’s announcement was slightly earlier than anticipated. For Nissan, the buyback is well within the value of cash and equivalents, which stood at JPY1.6 trillion ($11 billion) yen at the end of September. Nissan said it will cancel all acquired shares. “ItÂ’s good news for the stock that Nissan will retire the equivalent of 5% of its outstanding shares,” Yoshida said. The Japanese carmaker is paying JPY568.5 for each share, the price at the close of trading in Tokyo on Tuesday. While NissanÂ’s stock has climbed 36% this year, itÂ’s at roughly half of its value from early 2017. Earnings/Financials Nissan Renault