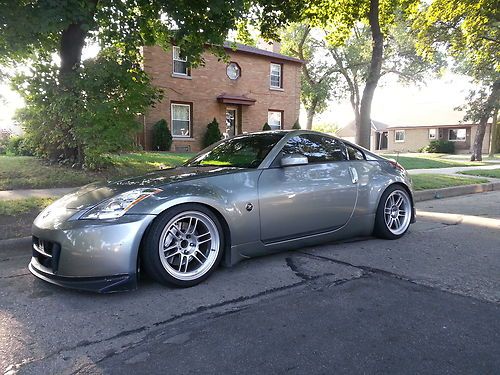

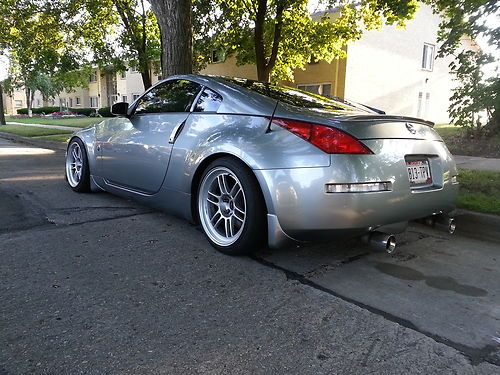

2004 Nissan 350z Touring Supercharged 400whp Low Miles 40,000 on 2040-cars

Milwaukee, Wisconsin, United States

Body Type:Coupe

Vehicle Title:Clear

Engine:3.5L 3498CC V6 GAS DOHC Naturally Aspirated

Fuel Type:GAS

For Sale By:Private Seller

Make: Nissan

Model: 350Z

Warranty: Vehicle does NOT have an existing warranty

Trim: Touring Coupe 2-Door

Options: Cassette Player, Leather Seats, CD Player

Drive Type: RWD

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Mileage: 40,500

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Exterior Color: Silver

Interior Color: Orange

Number of Cylinders: 6

Number of Doors: 2

Nissan 350Z for Sale

2005 nissan 350z grand touring convertible 2-door 3.5l

2005 nissan 350z grand touring convertible 2-door 3.5l 2004 nissan 350z enthusiast coupe 2-door 3.5l(US $9,900.00)

2004 nissan 350z enthusiast coupe 2-door 3.5l(US $9,900.00) 2004 nissan 350z touring roadster 6-spd leather nav 46k texas direct auto(US $15,980.00)

2004 nissan 350z touring roadster 6-spd leather nav 46k texas direct auto(US $15,980.00) We finance 03 touring 6 spd leather heated seats xenons cd changer keyless entry(US $9,000.00)

We finance 03 touring 6 spd leather heated seats xenons cd changer keyless entry(US $9,000.00) 04 nissan 350z convertible touring 6 speed manual power top bose stereo(US $9,500.00)

04 nissan 350z convertible touring 6 speed manual power top bose stereo(US $9,500.00) 2006 nissan 350z roadster grand touring manual(US $14,444.00)

2006 nissan 350z roadster grand touring manual(US $14,444.00)

Auto Services in Wisconsin

Wendt`s Auto Body ★★★★★

VIP Auto Sales ★★★★★

Stags Repair ★★★★★

South St Paul Automotive ★★★★★

Silver Spring Collision Center ★★★★★

Showroom Auto Detailing ★★★★★

Auto blog

Ghosn calls Renault and Nissan financial results 'pathetic'

Mon, Jul 20 2020PARIS Former Nissan Chairman Carlos Ghosn took a swipe at his old employers in a newspaper interview on Sunday, calling the Renault and Nissan results "pathetic," driven as much by a lack of joint leadership than the COVID-19 pandemic. Ghosn, who was also the chairman of Mitsubishi Motors, was arrested in Japan in late 2018 on charges of underreporting his salary and using company funds for personal purpose  charges he denies. He fled to Lebanon from Japan. "There is a market confidence problem in the alliance. Personally, I find the results of Nissan and Renault pathetic. The two companies are looking inwards. There is no longer any real mix of management between Renault and Nissan, but a distrustful distance," he told Le Parisien newspaper. Ghosn compared the share price fall from November 2018 to June 2020 of competitors General Motors and Toyota of 12% and 15% respectively to Nissan dropping 55% and Renault 70%. "All of these manufacturers are facing the same COVID crisis, but Renault and Nissan are being punished more than the others,' he said. Ghosn fled Japan to Lebanon, his childhood home, in December as he awaited trial on charges of underreporting earnings, breach of trust and misappropriation of company funds, all of which he denies. Ghosn was questioned in Lebanon in January. He has said he will cooperate fully with the Lebanese judicial process, but it is unclear what cooperation there will be between Tokyo and Beirut. French prosecutors have also stepped up their investigation into alleged misappropriation by Ghosn of funds at Renault and had summoned him in France on July 13, but he did not attend. "There is a technical obstacle. My passport is in the hands of the attorney general in Lebanon, because Japan has issued an international arrest warrant for me," Ghosn said. "I also want to be sure that my security is assured and that I am guaranteed freedom of movement." Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. CES 2020 and Carlos Ghosn | Autoblog Podcast #609

Nissan edges out Tesla for most ZEV credits sold in California

Wed, Oct 22 2014When it comes to California zero-emissions vehicle (ZEV) credits last year, Nissan was selling and Mercedes-Benz was buying. The California Air Resources Board (CARB) put out its ZEV-credits numbers for the year that ended September 30, which is why we now know that Nissan, maker of the battery-electric Leaf, transferred 663.6 ZEV credits out of its account last year. That just edged out the 650.195 credits that Tesla sold. Chrysler's Fiat affiliate was a distant third, but its limited-production Fiat 500E was still able to generate some ZEV credits and then transfer out 235.2 of them. We don't know how much the buyers paid for these credits, since those details are kept private. It's an ever-changing rulebook over at CARB, anyway. On the flip side, Mercedes-Benz had to buy 663.6 ZEV credits in order to comply with clean vehicle-sales mandates in the most populous US state, indicative of the German automaker's gas-guzzling tendencies. Honda has cars that get better fuel economy than your average Benz, but its plug-in vehicles represent just a fraction of total sales and so it had to shell out for 542.5 ZEV credits. Chrysler-Fiat basically tread water, since the 237.8 ZEV credits it required for compliance canceled out gains on the other side of the ledger. Those Dodge Ram pickup trucks don't exactly help matters. Last year, Tesla sold the most ZEV credits while GM purchased the most. Overall, Californians bought about 3.5 million vehicles for the year that ended September 30, including 38,000 battery-electric vehicles, 30,000 plug-in hybrids and 570,000 conventional hybrids. The longstanding ZEV program means that California now has more than 100,000 ZEVs on its roads. Read this for more details on ZEV credit transfers in California. Featured Gallery 2013 Nissan Leaf View 55 Photos News Source: California Air Resources Board via Green Car Congress Government/Legal Green Mercedes-Benz Nissan Tesla Electric California zev credits

Renault selling part of Nissan stake to partner for $824 million

Tue, Dec 12 2023Renault SA is selling around 5% of its stake in partner Nissan Motor Co., offloading the stock as part of a share buyback by the Japanese carmaker. The move follows last months finalization of a plan for Renault to reduce its interest in Nissan. The stake sale is valued at around Â765 million ($824 million), but will result in a capital loss of Â1.5 billion, the French company said Tuesday. Eventually, the two carmakers aim to equalize their cross-shareholdings at 15%, loosening the ties that kept them together in a carmaking alliance for two decades. The partnership between Nissan and Renault was jolted in 2018 by the arrest of Carlos Ghosn, chairman of both companies. Since then, they have drifted apart and are now charting separate paths. Given that NissanÂs shares are trading below the Tokyo Stock ExchangeÂs guideline of maintaining a price-to-book ratio above 1, the buyback will Âhelp improve the situation, said Bloomberg Intelligence analyst Tatsuo Yoshida. The cash will bolster Chief Executive Officer Luca de MeoÂs efforts to get Ampere, RenaultÂs electric-vehicle and software arm, going as he seeks to split off the unit and list it as a separate public entity as soon as April or May. Nissan has also agreed to invest in Ampere. Renault transferred its 28.4% stake in Nissan into a trust in early November to pave the way for a reduction of its holding. Even so, there will still be lock-up and standstill obligations. De Meo said last month that Renault would begin offloading the stake Âvery soon in early 2024, so TuesdayÂs announcement was slightly earlier than anticipated. For Nissan, the buyback is well within the value of cash and equivalents, which stood at JPY1.6 trillion ($11 billion) yen at the end of September. Nissan said it will cancel all acquired shares. ÂItÂs good news for the stock that Nissan will retire the equivalent of 5% of its outstanding shares, Yoshida said. The Japanese carmaker is paying JPY568.5 for each share, the price at the close of trading in Tokyo on Tuesday. While NissanÂs stock has climbed 36% this year, itÂs at roughly half of its value from early 2017. Earnings/Financials Nissan Renault