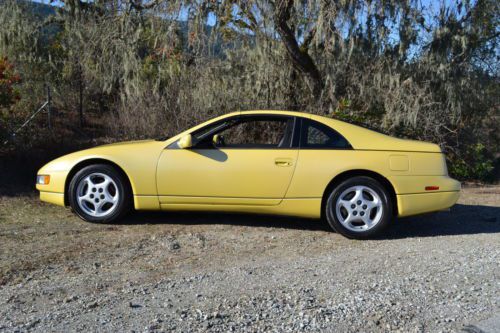

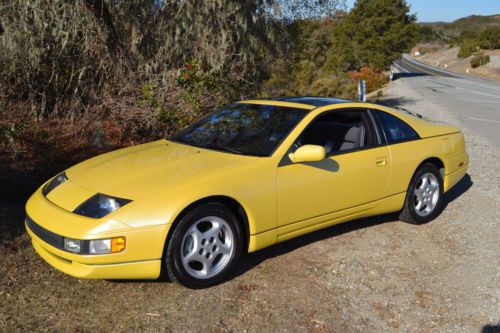

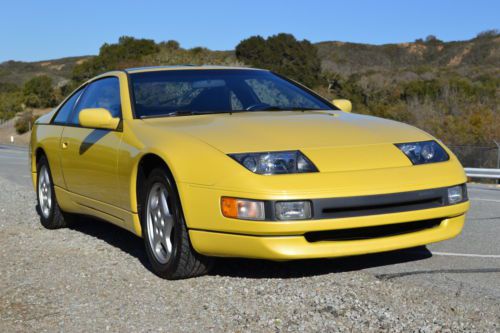

1990 Nissan 300zx 2+2 1 Owner Yellow In Perfect Condition on 2040-cars

Houston, Texas, United States

|

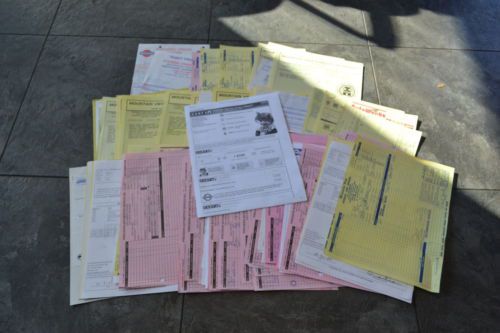

Up for sale 1990 Nissan 300ZX 2+2 5speed very rare color (pearl yellow ) 1 owner car and clean carfax , all maint,service been done, have all paperwork +log book, window sticker and all 3 keys..

interior + exterior in perfect condition ,a/c and heat in working perfect, see all the picture will speak them self please contact me if you have more question about this beauty ** EIGHT THREE 2 -EIGHT SIX SEVEN- 4622 This listing for sale AS-IS no warranty or return - buyer have to pick-up or transport |

Nissan 300ZX for Sale

1989 nissan 300zx base coupe 2-door 3.0l(US $5,250.00)

1989 nissan 300zx base coupe 2-door 3.0l(US $5,250.00) Nissan 300zx turb0 21,000 miles rare red(US $18,779.00)

Nissan 300zx turb0 21,000 miles rare red(US $18,779.00) 1987 nissan 300zx 2+2 coupe 2-door 3.0l

1987 nissan 300zx 2+2 coupe 2-door 3.0l 1991 nissan 300zx twin turbo, 5-speed, no reserve, repo, needs work

1991 nissan 300zx twin turbo, 5-speed, no reserve, repo, needs work 1990 nissan 300zx base coupe 2-door 3.0l(US $2,500.00)

1990 nissan 300zx base coupe 2-door 3.0l(US $2,500.00) 1993 300zx fresh engine, fresh transmission, only 65k miles no reserve

1993 300zx fresh engine, fresh transmission, only 65k miles no reserve

Auto Services in Texas

Zepco ★★★★★

Z Max Auto ★★★★★

Young`s Trailer Sales ★★★★★

Woodys Auto Repair ★★★★★

Window Magic ★★★★★

Wichita Alignment & Brake ★★★★★

Auto blog

China's largest dealer body pushes back against foreign automakers over huge inventories

Mon, Jan 5 2015Do not think for a second that automakers forcing inventory on dealers in order to pad the numbers is a ruse known only in the US. Stories of individual brands have hinted at the trouble Chinese dealerships are having trying to move units as the country's economic growth remains hot but comes off the boil, like the one revealing that 95 percent of Toyota-FAW showrooms are losing money. Yet Toyota isn't the only culprit, and the issue has become so dire that the China Automobile Dealers Association (CADA), the largest dealer body in the country, has written to the government to complain. Chinese car sales are expected to close out the year with an annualized growth of six-percent, down from last year's 14 percent when targets were set, while in the background the pace of overall economic expansion is the slowest its been since the early nineties. Automakers, shipping cars on schedule to make their earlier targets, have blown up inventories such that they are an average of 1.8 times monthly sales, when the preferred multiplier is from 0.9 to 1.2. According to the CADA, the price wars and necessary incentives mean that only 30 percent of dealers are operating in the black. That number is down a whopping forty percent since 2010. In response, Toyota has already said it will not make its 2014 target of 1.1 million cars sold. We're a long way from 2012, when Toyota planned on selling 1.8 million cars in China in 2015, a target that's now as realistic as a manticore. BMW, Honda and Nissan have erased numbers on their spreadsheets, too; BMW growth dropped from 20 percent to 8 percent midyear after it began "reducing wholesale supplies," and Honda has been reworking its plans as sales have decreased each of the past six months. It's a big deal for Chinese dealers to begin protesting publicly, the CADA saying, "In the past, dealers were angry, but dared not speak out. But now, they have to shout because the situation is getting so unbearable." With six-percent growth forecast for next year and dealers unwilling to remain underwater, The Year of the Sheep coming in 2015 could portend meaning beyond the zodiac. News Source: ReutersImage Credit: AP Photo/Andy Wong BMW Honda Nissan Toyota Car Buying Car Dealers

Nissan posts $6.2 billion annual loss and unveils plan to cut costs

Thu, May 28 2020TOKYO — Nissan outlined a new plan on Thursday to become a smaller, more cost-efficient carmaker after the coronavirus pandemic exacerbated a slide in profitability that culminated in its first annual loss in 11 years. Under a new four-year plan, the Japanese manufacturer will slash its production capacity and model range by about a fifth to help cut 300 billion yen from fixed costs. It will shut plants in Spain and Indonesia, leave the South Korean market and pull its Datsun brand from Russia as part of a strategy unveiled on Wednesday to share production globally with its partners Renault and Mitsubishi. "I will make every effort to return Nissan to a growth path," Nissan Chief Executive Makoto Uchida said, adding that the company had learned from its past mistakes of chasing global market share at all costs. "We must admit failures and take corrective actions," he said, adding that starting with top-level managers, the company had to break its inward-looking culture which in the past has stymied efforts to deepen cooperation with France's Renault. Uchida said improving the company's cash flow was its biggest challenge. He reiterated that Nissan's cash liquidity was good even though it had negative free cash flow of 641 billion yen in the year ended in March. Nissan declined to give any forecasts for its current financial year which started in April due to the uncertainty created by the coronavirus pandemic. It also declined to give details on how many jobs it was cutting. In what is Nissan's second recovery plan in less than a year, Uchida pledged a return to profitability with a core operating profit margin above 5% and a sustainable global market share of 6%. Nissan posted an annual operating loss of 40.5 billion yen for the year to March 31, its worst performance since 2008/09. Its operating profit margin was -0.4%. The automaker said on Thursday that it sold 4.9 million vehicles last year, up from an earlier estimate of 4.8 million. That was still the second decline in a row and a fall of 11% from the previous period but meant Nissan clung on to its position as Japan's second biggest carmaker, just ahead of Honda and a long way behind Toyota. Pandemic pressure Even before the spread of the novel coronavirus, Nissan's slumping profits had forced it to row back on an aggressive expansion plan pursued by ousted leader Carlos Ghosn. The pandemic has only piled on the urgency to downsize.

Nissan and Carlos Ghosn settle SEC claims over undisclosed compensation

Mon, Sep 23 2019WASHINGTON — Nissan and its former Chief Executive Carlos Ghosn have agreed to settle claims from the U.S. Securities and Exchange Commission over false financial disclosures related to Ghosn's compensation, an SEC statement said on Monday. Nissan will pay $15 million, while Ghosn agreed to a $1 million civil penalty and a 10-year ban from serving as an officer or director of a publicly traded U.S. company, the SEC statement said. Ghosn was arrested in Japan and fired by Nissan last year. He is awaiting trial in Tokyo on financial misconduct charges that he denies. Former Nissan human resources official Gregory Kelly agreed to a $100,000 penalty and a five-year officer and director ban. Nissan, Ghosn, and Kelly settled without admitting or denying the SEC's allegations and findings. The SEC said in total Nissan in its financial disclosures omitted more than $140 million to be paid to Ghosn in retirement — a sum that ultimately was not paid. The SEC also accused Ghosn in a suit filed in New York that he engaged in a scheme to conceal more than $90 million of compensation. That suit is being settled as part of the agreement announced Monday. Nissan confirmed it had settled the allegations and said it "is firmly committed to continuing to further cultivate robust corporate governance." Nissan provided significant cooperation to the SEC, the agency said. The company now has a new governance structure with three statutory committees — audit, compensation and nomination — and has amended its securities reports for all relevant years. The SEC said beginning in 2004 Nissan's board delegated to Ghosn the authority to set individual director and executive compensation levels, including his own. The SEC said "Ghosn and his subordinates, including Kelly, crafted various ways to structure payment of the undisclosed compensation after Ghosn's retirement, such as entering into secret contracts, backdating letters to grant Ghosn interests in Nissan's Long Term Incentive Plan, and changing the calculation of Ghosn's pension allowance to provide more than $50 million in additional benefits." "Investors are entitled to know how, and how much, a company compensates its top executives. Ghosn and Kelly went to great lengths to conceal this information from investors and the market," said Stephanie Avakian, co-director of the SEC's Division of Enforcement.