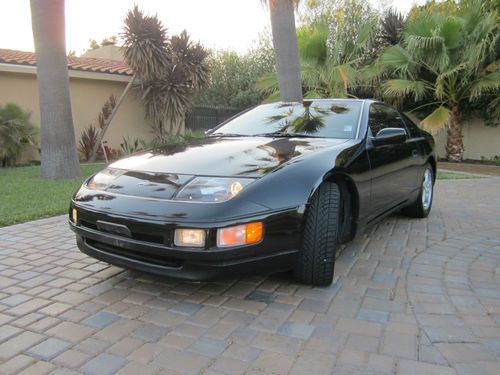

1989 Nissan 300zx 91k Original Miles, Non Turbo!!! on 2040-cars

Belleview, Florida, United States

Body Type:Coupe

Vehicle Title:Clear

Engine:3.0

Fuel Type:Gasoline

For Sale By:Private Seller

Model: 300ZX

Trim: T-TOPS

Options: Cassette Player

Drive Type: REAR WHEEL DRIVE

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Mileage: 91,201

Exterior Color: Black

Interior Color: Black

Warranty: Vehicle does NOT have an existing warranty

Number of Cylinders: 6

CAR WAS FROM ALABAMA, BUT LIVED IN FLORIDA ALL HIS LIFE. I BOUGHT IT FROM THE ORIGINAL OWNER, WHO REPAINTENED ONCE. INTERIOR IS LIKE NEW. EVERYTHING WORKS. THE CAR GETS COMPLIMENTS EVERYWHERE IT GOES, BECAUSE ITS ORIGINALITY AND NATURAL BEAUTY. NEW TIRES. FAST AND STRONG. NO LEAKS , RATTLES OR WEIRD NOISES. DRIVEN DAILY.CAR IS NOT PERFECT, BUT CLOSE.

Nissan 300ZX for Sale

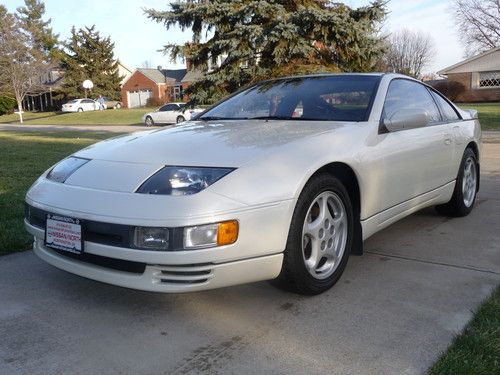

1991 nissan 300zx

1991 nissan 300zx 1995 nissan 300zx california car low mileage 5sp black beauty

1995 nissan 300zx california car low mileage 5sp black beauty Nissan 300zx twin turbo all original 43k(US $14,000.00)

Nissan 300zx twin turbo all original 43k(US $14,000.00) 1984 nissan 300 zx 2+2, low miles, 47k(US $4,800.00)

1984 nissan 300 zx 2+2, low miles, 47k(US $4,800.00) 1987 nissan 300zx base coupe 2-door 3.0l(US $850.00)

1987 nissan 300zx base coupe 2-door 3.0l(US $850.00) 300zx 2+2 clean!!(US $5,795.00)

300zx 2+2 clean!!(US $5,795.00)

Auto Services in Florida

Wildwood Tire Co. ★★★★★

Wholesale Performance Transmission Inc ★★★★★

Wally`s Garage ★★★★★

Universal Body Co ★★★★★

Tony On Wheels Inc ★★★★★

Tom`s Upholstery ★★★★★

Auto blog

Uber promises 100% electric cars by 2040, commits $800 million to help drivers switch

Tue, Sep 8 2020Uber Technologies Inc on Tuesday said every vehicle on its global ride-hailing platform will be electric by 2040, and it vowed to contribute $800 million through 2025 to help drivers switch to battery-powered vehicles, including discounts for vehicles bought or leased from partner automakers. Uber said that vehicles on its rides platform in the United States, Canada and Europe will be zero-emission by 2030, taking advantage of the regulatory support and advanced infrastructure in those regions. Uber, which as of early February said it had 5 million drivers worldwide, said it formed partnerships with General Motors and the Renault-Nissan-Mitsubishi alliance. In addition to the vehicle discounts, Uber said the $800 million includes discounts for charging and a fare surcharge for electric and hybrid vehicles, the cost of which would be partially offset by an additional small fee charged to customers who request a "green trip." The deals with GM and the Renault alliance focus on the U.S., Canada and Europe. Uber said it was discussing partnerships with other automakers. Uber's plan follows years of criticism by environmental groups and city officials over the pollution and congestion caused by ride-hail vehicles and calls for fleet electrification. Lyft Inc, Uber's smaller U.S. rival, in June promised to switch to 100% electric vehicles by 2030, but said it would not provide direct financial support to drivers. Uber said its goal is to reduce the overall cost of ownership for electric vehicles, which are currently more expensive than gasoline cars. The company also released data on its emission footprint and said it would publish reports going forward. Before the pandemic, electric cars accounted for only 0.15% of all U.S. and Canadian Uber trip miles — roughly in line with average U.S. electric car ownership. At around 12%, the share of plug-in hybrid and hybrid cars was roughly five times as high as the U.S. average. Ride-hail trips overall account for less than 0.6% of transportation-sector emissions, according to U.S. data, but the total number of on-demand vehicles has significantly increased since Uber's launch nearly a decade ago, with 7 billion trips last year, according to Uber's February investor presentation. Uber said its U.S. and Canadian trips with a passenger produce 41% more carbon dioxide per mile than an average private car once miles spent cruising between passengers are included. Uber's plans could be a boon to the auto industry.

Nissan could report first quarterly loss since March 2009

Wed, Feb 12 2020TOKYO — Nissan may report its first quarterly loss in more than a decade on Thursday because of slumping sales, sources familiar with the company said, adding more pressure on efforts to rebuild the company after Carlos Ghosn's ouster. Deteriorating profits underscore the challenges facing Nissan, which is unwinding many of the expansionist strategies championed by ex-Chief Executive Officer and Chairman Ghosn by slashing jobs, production sites and product offerings to save cash and ensure its survival. In addition to slumping sales, production disruptions caused by China's coronavirus outbreak could also drag profits lower. Three senior officials at Japan's No. 2 automaker told Reuters that they anticipate a poor results announcement on Thursday, with one of them calling the figures "dismal". Two of the officials cautioned that there is the possibility of an operating loss, which would be the first quarterly loss since the period ending in March 2009. Nissan said it could not comment on its financial results ahead of its official announcement. The company is likely to report operating profit of 48.6 billion yen ($442.5 million) for the quarter ending in December, less than half the 103 billion yen profit a year ago, according to SmartEstimate's survey of three analysts, who revised their forecasts in January. However, those forecasts were issued before the release of the December vehicle sales figures on Jan. 30, which show third-quarter sales dropped by 11% from the year earlier period, according to Reuters calculations. That is the biggest quarterly slump of its current sales downturn that began two years ago. That sales decline led one auto equities analyst based in Japan to scrap his forecast and also warn that Nissan could post a loss. "It will be a question of whether there will be a profit or a loss. For the quarter, a loss is a possibility," he said, declining to be named as his forecast had not been updated to reflect his latest view. One of the three Nissan officials said there is a risk the automaker may cut its full-year profit forecast of 150 billion yen, which would be an 11-year low. The company announced that forecast in November after an initial 230 billion yen outlook.

For next Nissan CEO, priority is profit before Renault partnership

Tue, Sep 10 2019The next head of Nissan Motor Co will need to prioritize a recovery in profits at the troubled Japanese firm ahead of trying to fix its relationship with top shareholder Renault SA, executives and analysts say. Reviving earnings would strengthen the carmaker’s hand in negotiations with its French partner, and is something Renault itself would welcome as the owner of a 43.4% stake in Nissan. JapanÂ’s second-largest automaker said on Monday CEO Hiroto Saikawa would step down on Sept. 16 after he admitted to being overpaid in breach of company rules. ItÂ’s another heavy blow for Nissan, which is already reeling from the arrest of former chairman Carlos Ghosn last year and a subsequent plunge in earnings. Its stock is down 20% this year. For SaikawaÂ’s yet-to-be-named replacement, the top priority will be lifting profits from a more than decade low. Earnings have been undercut by years of heavy discounts and low-margin sales to rental firms that have cheapened NissanÂ’s brand image. Renault, which has unsuccessfully sought a full-blown merger with its larger partner, is likely to give the Japanese firm time to focus on its turnaround, a Nissan executive said. “It goes without saying recovery is the biggest priority,” the executive said, declining to be identified because the information is not public. “We have RenaultÂ’s understanding on that.” Tensions in the Nissan-Renault partnership worsened after GhosnÂ’s arrest. He is awaiting trial in Tokyo on financial misconduct charges that he denies. The strain has sparked investor concern about the future of the Franco-Japanese automaking alliance at a time when car companies desperately need scale to keep up with sweeping technological changes like electric vehicles and ride-hailing. Nissan executives have long complained about their unequal partnership with Renault, which saved the Japanese firm from bankruptcy in 1999. Nissan holds a 15% stake in Renault, but without voting rights. Tokyo is also seen as being uneasy about the French governmentÂ’s 15% holding in Renault, which makes Paris an indirect shareholder in Nissan. “Profitability is likely to remain under pressure and it (Nissan) is unlikely to promptly reach an agreement with Renault over the future shape of the alliance,” analysts at Standard & PoorÂ’s said in a note. Tensions worsened when Renault tried to in vain to merge with Nissan and then Fiat Chrysler.