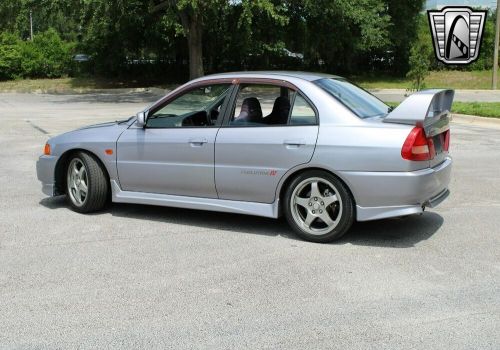

2002 Mitsubishi Lancer Oz Rally on 2040-cars

Teaneck, New Jersey, United States

Fuel Type:Gasoline

For Sale By:Private Seller

Vehicle Title:Clean

Engine:2.0L Gas I4

VIN (Vehicle Identification Number): JA3AJ86E12U062875

Mileage: 168735

Trim: OZ RALLY

Number of Cylinders: 4

Make: Mitsubishi

Drive Type: FWD

Model: Lancer

Exterior Color: Grey

Mitsubishi Lancer for Sale

2006 mitsubishi lancer(US $29,000.00)

2006 mitsubishi lancer(US $29,000.00) 1996 mitsubishi lancer evolution iv gsr(US $40,000.00)

1996 mitsubishi lancer evolution iv gsr(US $40,000.00) 2005 mitsubishi lancer evolution(US $32,000.00)

2005 mitsubishi lancer evolution(US $32,000.00) 2008 mitsubishi lancer(US $16,999.00)

2008 mitsubishi lancer(US $16,999.00) 2014 mitsubishi lancer evolution gsr(US $30,800.00)

2014 mitsubishi lancer evolution gsr(US $30,800.00) 2008 mitsubishi lancer de(US $3,200.00)

2008 mitsubishi lancer de(US $3,200.00)

Auto Services in New Jersey

Zp Auto Inc ★★★★★

World Automotive Transmissions II ★★★★★

Voorhees Auto Body ★★★★★

Vip Honda ★★★★★

Total Performance Incorporated ★★★★★

Tony`s Auto Service ★★★★★

Auto blog

Mitsubishi planning to bring back Lancer as hybrid crossover

Mon, Apr 23 2018It looks like the Mitsubishi Lancer is about to undertake a daring transformation from a ten-year-old sedan to a crossover. The Eclipse has already shed its coupe roots and become the Eclipse Cross, and now it's the Lancer's turn to become a high-rider. The carmaker already teased its future plans with the e-Evolution concept last year (pictured above), again combining a previously successful Mitsubishi nameplate with new crossover intentions. Now, talking to AutoExpress, Mitsubishi's chief operating officer and chief designer both hint of the Lancer taking the shape of the e-Evolution. For Mitsubishi, the Lancer's segment still looks very viable in the next decade, but it doesn't necessarily want to fight the Ford Focus and the VW Golf with a conventional hatchback, let alone a three-box saloon. "We believe we have a solution that could fit the segment", said COO Trevor Mann. "[The segment's] numbers are still expanding in China, so there's appeal. And I think because the segment is so large globally, we've got to take a look at it." The chief designer, Tsunehiro Kunimoto said, "Just because it's C-segment, it doesn't mean it has to be a very conventional hatchback. Maybe we can create a new type of hatchback vehicle. We're thinking quite radically." It is also likely that the Lancer's eventual replacement will use hybrid technology and a Renault-Nissan Alliance platform ó and an all-wheel-drive option would still be a nod to the Lancer Evo's heritage, at least partially justifying any use of the Evolution brand. Trevor Mann says the product timeline is largely set until 2025, and the existing crossovers in the portfolio, the Outlander and the Outlander Sport (known elsewhere as the ASX) will get replacements. The company is now directing its attention to the Lancer and the Montero, both of which have last had a major update over ten years ago. The Lancer was phased out in the U.S. last fall after a very long run. Related Video:

Minivan Mania | Autoblog Podcast #675

Fri, Apr 23 2021In this episode of the Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Senior Editor, Green, John Beltz Snyder and West Coast Editor James Riswick, and this week, it's (almost) all about vans! James recently wrote a head-to-head comparison of the 2021 Toyota Sienna and 2021 Chrysler Pacifica Hybrid, and he talks us through the results. John recently reviewed the 2022 Kia Carnival, which is replacing the Kia Sedona. After discussing the minivan field as a whole, our editors identify some reasonable minivan alternatives in the SUV and crossover realms. Moving along, they talk about driving the long-term Hyundai Palisade and the new Mitsubishi Outlander before discussing their favorite highlights from the 2021 Shanghai Auto Show. Autoblog Podcast #675 Get The Podcast iTunes¬†Ė Subscribe to the¬†Autoblog¬†Podcast in iTunes RSS¬†¬Ė Add the¬†Autoblog¬†Podcast feed to your RSS aggregator MP3¬†¬Ė Download the MP3 directly Rundown Minivans! 2021 Toyota Sienna vs 2021 Chrysler Pacifica Hybrid 2022 Kia Carnival The rest of the field Ute alternatives Cars we're driving 2022 Mitsubishi Outlander 2021 Hyundai Palisade road trip Shanghai Auto Show Lincoln Zephyr Toyota bZ4X Honda SUV e:prototype Feedback Email ¬Ė Podcast@Autoblog.com Review the show on iTunes Autoblog¬†is now live on your smart speakers and voice assistants with the¬†audio¬†Autoblog¬†Daily Digest. Say ¬ďHey Google, play the news from¬†Autoblog¬Ē or "Alexa, open¬†Autoblog" to get your favorite car website in audio form every day. A narrator will take you through the biggest stories or break down one of our comprehensive test drives. Related video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Here's what you had to say about the Tokyo Motor Show

Fri, Oct 27 2017We obsessively covered the 2017 Tokyo Motor Show. You, our readers, provided the color commentary. Read on and, of course, leave your comments below. Subaru Viziv Performance Concept: Remember the WRX concept they showed in 2013, and what the production version looked like in 2015? Pepperidge Farm remembers. wooootles 2 foot high wing on the trunk or gtfo :) sc0rch3d Mazda Kai Concept : Dear Honda, this is how you dynamically style a hatchback. Thank you. Dfelix70 Kudos to KODO design. There are so many things I love about this "Kai" car: the awesome split panoramic sunroof, the Jaguar-esque tails (sporting an "eyebrow up"... ala The Rock), a sleek family resemblance to the already beautiful CX-5 and CX-9. Seems suspiciously close to being a production ready Mazda3 ó save for a few fanciful bits (door handles, mirrors etc). If it doesn't get too watered down by the time it hits the streets ... take my money! Randy Ross Mitsubishi e-Evolution Concept: As an 06 IX and 12 X owner, this is so upsetting. I will never buy this or care to give it another look. Hope you are glad you killed my favorite track-ready car to produce this electric junk. AcidTonic Picture the GT-R going away for a few years and coming back as an SUV. This is ridiculous. Surely someone in marketing could've came up with another cool name. Evo The Evo sedan is dead, whether this exists or not. I don't mind. Lada1200 Honda Sports EV Concept : I sure would like to see this "less is more" design aesthetic spread to their gas-powered production line. RustyShackleford Love it. I see glimpses of late 1970 Scirocco with Honda flair. Gintonics I just want ONE question answered in the affirmative, and that is... "RWD?" Henadenk AND A FEW FROM FACEBOOK: Toyota's press conference: Wake me up when they talk about the Supra. David Levinson Yamaha Cross Hub Concept: All I can think is modern day Brat, which has its own kind of charm. I'm assuming that it's a unibody design, but it seems happy to be its own thing rather than that crossover pretending to be a pickup called the Ridgeline. Would definitely take the Yamaha over the Honda, although I doubt it'll come to the states. Cole Henry Mazda Vision Coupe Concept: Face: KIA K7, Tail: Aston martin. Harold Shin A bit British, no? Jim Lykas Related Video: News Source: Honda, Toyota, YamahaImage Credit: Subaru, Mazda, Mitsubishi Auto News Green Tokyo Auto Salon Tokyo Motor Show Honda Mazda Mitsubishi Subaru Toyota 2017 tokyo motor show