Like New 2012 Mitsubishi I-miev Se With Only 125 Miles And Ready To Go Today!!!! on 2040-cars

Fort Worth, Texas, United States

Mitsubishi i-MiEV for Sale

Electric car low miles low price like new warranty finance maroon we finance

Electric car low miles low price like new warranty finance maroon we finance Electric car great gas mileage white only 39 miles low price warranty we finance(US $16,500.00)

Electric car great gas mileage white only 39 miles low price warranty we finance(US $16,500.00) 2012 pre-owned mitsubishi i-miev se(US $15,795.00)

2012 pre-owned mitsubishi i-miev se(US $15,795.00) 2012 pre-owned mitsubishi i-miev es(US $15,995.00)

2012 pre-owned mitsubishi i-miev es(US $15,995.00) 2012 i-miev all electric vehicle

2012 i-miev all electric vehicle Es electric 4 doors 4-wheel abs brakes 66 hp horsepower air conditioning

Es electric 4 doors 4-wheel abs brakes 66 hp horsepower air conditioning

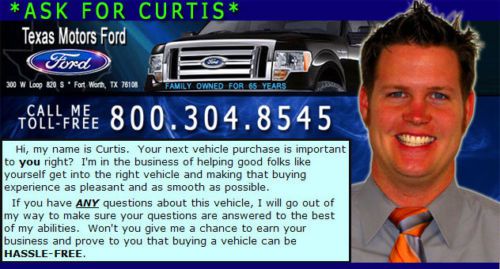

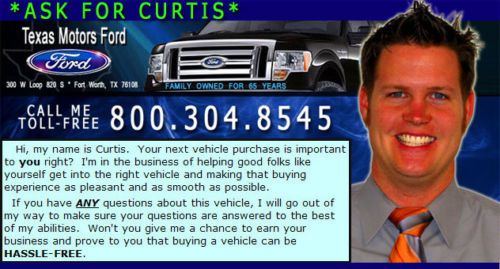

Auto Services in Texas

Xtreme Customs Body and Paint ★★★★★

Woodard Paint & Body ★★★★★

Whitlock Auto Kare & Sale ★★★★★

Wesley Chitty Garage-Body Shop ★★★★★

Weathersbee Electric Co ★★★★★

Wayside Radiator Inc ★★★★★

Auto blog

Mitsubishi expects a massive loss this year due to the coronavirus pandemic

Mon, Jul 27 2020TOKYO — Mitsubishi Motors reported Monday a $1.7 billion (176 billion yen) loss for April-June, and forecast more red ink for the fiscal year, as the coronavirus pandemic slammed auto demand around the world. The Japanese automaker had posted a profit of 9.3 billion yen for the fiscal first quarter the previous year. Quarterly sales shrank 57% to $2.2 billion (229.5 billion yen). The maker of the Outlander sport utility vehicle and I-MiEV electric car expects to chalk up a $3.4 billion (360 billion yen) loss for the fiscal year through March 2021, because of the fallout from the outbreak. This would be MitsubishiÂ’s biggest loss in at least 18 years, according to company financial records dating back to 2002. “To pave the way to recovery, the top priority of all executives is to share a sense of crisis with employees to execute cost reductions,” Chief Executive Takeo Kato told reporters. The shaky results come as Mitsubishi MotorsÂ’ alliance partners Nissan and Renault of France work to recover from the downfall of their former chairman, Carlos Ghosn. Ghosn was out on bail, awaiting trial on various financial misconduct allegations in Tokyo, when he fled late last year to Lebanon. He has said he is innocent of the allegations of under-reporting future compensation and breach of trust. Mitsubishi Motors has denounced Ghosn. Mitsubishi officials, in a news conference relayed in a call to reporters, promised a turnaround, pursuing growth in Southeast Asian markets, where its profitability is relatively strong, and building on its strength in four-wheel drive and “off road performance.” They said they expect the companyÂ’s results to recover next fiscal year, once COVID-19 is brought under control. Product development will leverage “synergies” with alliance partners, and labor costs will be cut through pay cuts, hiring freezes and voluntary retirements, the automaker said. Tokyo-based Mitsubishi also said itÂ’s working on innovative technology, such as improved diesel engines, electric vehicles and autonomous driving. Its electric vehicles are a strength as environmental standards continue to toughen, especially in major markets like China, it said. But it warned the outbreakÂ’s impact on auto demand was worse than what the auto market suffered during the 2008 financial crisis and so a recovery will take time.

Mitsubishi boss confirms new Mirage for US; i EV enduring dismal sales

Mon, 12 Nov 2012

By March, Mitsubishi expects to have sold just 55,000 cars in the US this fiscal year. That's a tiny sum - by comparison, Honda has sold over 276,000 Civic models thus far this year - and that's just one vehicle, not an entire brand. Mitsubishi president Osamu Masuko recognizes this is not a tenable position, and he's hoping the company will shift 80,000 units next fiscal year. Warding off speculation, Masuko has repeatedly stated that his company will not retreat from the US market like competitor Suzuki.

We reported on one part of Masuko's plan, the updated Outlander, and now he has confirmed that the small Mirage will be sold in the US beginning next September. The cut-price hatchback is selling well enough that Mitsu's Thailand plant is at its full capacity of 150,000 cars. "And even at that level it's not keeping up with orders," Masuko tells Automotive News. Masuko went on to say the plant would be expanded next year to handle an extra 50,000 units. We can also expect the Outlander plug-in early 2014.

Renault-Nissan-Mitsubishi pool $200 million to invest in tech startups

Fri, Jan 5 2018PARIS — The Renault-Nissan-Mitsubishi alliance is setting up a $200 million mobility tech fund, three sources said, in the latest move by major carmakers to adapt to rapid industry change by investing in startups through their own venture capital arms. The fund, due to be unveiled by Chief Executive Carlos Ghosn at the CES tech industry show in Las Vegas next Tuesday, will be 40 percent financed by Renault, 40 percent by Nissan and 20 percent by Mitsubishi. "It will allow us to move faster on acquisitions ahead of our competition," one of the alliance sources told Reuters. Frederique Le Greves, a spokeswoman for the Renault-Nissan-Mitsubishi alliance, declined to comment. The traditional auto industry model based on individual ownership is threatened by pay-per-use services such as Uber, as well as ride- and car-sharing platforms, a challenge heightened by parallel shifts towards electrified and self-driving cars. Wary carmakers are struggling to embrace changes and technologies that some of their executives are only beginning to grasp. To accelerate the process, many are investing directly in the new services — and gaining access to intellectual property — via their own corporate venture capital (CVC) funds. BMW has purchased stakes in a plethora of ride-sharing, smart-charging and autonomous vehicle software firms through its 500 million euro ($600 million) iVentures fund, the biggest such in-house facility belonging to a carmaker. Among others that have been increasingly active are General Motors' GM Ventures, with $240 million, and Peugeot-maker PSA Group's 100 million-euro investment arm. CVC funds, a familiar feature of innovative sectors such as tech and pharmaceuticals, have become more commonplace among carmakers since the 2008-9 financial crisis. They let companies skip some of the formalities otherwise required for new investments, and pounce more swiftly on promising startups. The Renault-Nissan-Mitsubishi venture will also obviate the current need to thrash out the ownership split for each new alliance acquisition. It represents a further step in the integration of the carmakers as they pursue 10 billion euros in annual synergies by 2022. France's Renault holds a 43.4 percent stake in Nissan, which in turn controls Mitsubishi. Ghosn heads Renault and chairs all three.