2004 Mitsubishi Galant Gts. Clean Title on 2040-cars

Meriden, Connecticut, United States

Mileage: 104,000

Model: Galant

Sub Model: GTS

Trim: sedan

Exterior Color: Black

Interior Color: Black

Drive Type: FWD

I am selling my 2004 Mitsubishi Galant GTS. It currently has 104,000 miles on it. It has a alarm system with auto remote starter - Automatic - V6 3.8 liter - 22-24 mpg average - Black Leather interior - tinted windows - moonroof - power seats - power windows - air conditioning. I have photos information 2035070942

Mitsubishi Evolution for Sale

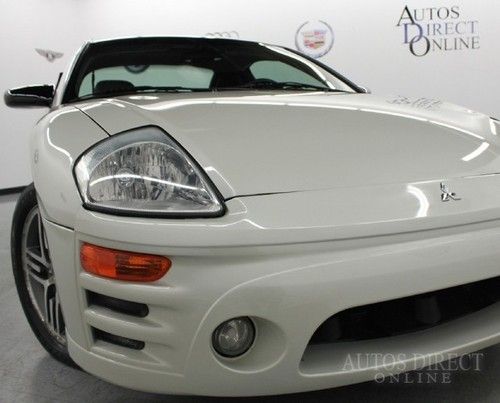

Black mitsubishi eclipse spider. runs great,looks good. many new parts.must see(US $3,000.00)

Black mitsubishi eclipse spider. runs great,looks good. many new parts.must see(US $3,000.00) We finance 05 eclipse gts 5-speed clean carfax sunroof v6 78k miles 6cd changer(US $7,600.00)

We finance 05 eclipse gts 5-speed clean carfax sunroof v6 78k miles 6cd changer(US $7,600.00) 2003 mitsubishi eclipse gt spyder 3.0/v6 convertible needs minor work(US $4,250.00)

2003 mitsubishi eclipse gt spyder 3.0/v6 convertible needs minor work(US $4,250.00) 2003 mitsubishi eclypse spyder - cold a/c - convertible - no reserve!

2003 mitsubishi eclypse spyder - cold a/c - convertible - no reserve! 2003 mitsubishi lancer oz rally 5 spd.

2003 mitsubishi lancer oz rally 5 spd. Ls 3.7l power steering, clock - in-radio display, air co

Ls 3.7l power steering, clock - in-radio display, air co

Auto Services in Connecticut

Tender Car Care ★★★★★

Supreme Auto Collision Inc ★★★★★

Sunoco Ultra Service Center ★★★★★

Pete`s Tire & Oil ★★★★★

Napa Auto Parts - Fair Auto Supply Inc ★★★★★

Moran`s Service Ctr ★★★★★

Auto blog

Japan may aid carmakers facing U.S. tariff threat

Wed, Sep 12 2018TOKYO ó Japan is considering giving carmakers fiscal support including tax breaks to offset the impact from trade frictions with the United States and a sales-tax hike planned for next year, government sources told Reuters on Wednesday. Going into a second round of trade talks with the United States on Sept. 21, Japan is hoping to avert steep tariffs on its car exports and fend off U.S. demands for a bilateral free trade agreement that could put it under pressure to open politically sensitive markets, like agriculture. "If the trade talks pile pressure on Japan's car exports, we would need to consider measures to support the auto industry," a ruling party official said on condition of anonymity because of sensitivity of the matter. The auto industry accounts for about 20 percent of Japan's overall output and around 60-70 percent of the country's trade surplus with the United States, making it vulnerable to U.S. action against Japanese exports. Japan's biggest automakers and components suppliers fear they could take a significant hit if Washington follows through on proposals to hike tariffs on autos and auto parts to 25 percent. Policymakers also worry that an increase in the sales tax from 8 percent to 10 percent planned for October 2019, could cause a slump in sales of big-ticket items such as cars and home. Prime Minister Shinzo Abe has twice postponed the tax hike after the last increase from 5 percent in 2014 dealt a blow to private consumption, which accounts for about 60 percent of the economy. To prevent a pullback in demand after the tax hike, the government may consider large fiscal spending later when it draws up its budget for next year, government sources said. "One option may be to greatly reduce or abolish the automobile purchase tax," one of the government sources said. The government is also considering cuts in the automobile tax and automobile weight tax to help car buyers, the source added. Reporting by Izumi Nakagawa and Tetsushi KajimotoRelated Video: Image Credit: Getty Government/Legal Isuzu Mazda Mitsubishi Nissan Subaru Suzuki Toyota Trump Trump tariffs trade

2022 Mitsubishi Outlander pricing, fuel economy announced

Mon, Mar 1 2021Mitsubishi has announced pricing on what is probably the most compelling ó and important to the company's future ¬ó product in a decade, the 2022 Outlander. As we learned at the reveal, the base ES trim will start at $25,795, or $26,990 when the destination charge is factored in. Fuel economy figures are also in, giving the Outlander a rating of 24 miles per gallon in the city, 31 on the highway and 27 combined for the front-wheel-drive model. Mitsubishi's S-AWC all-wheel-drive system, which is available on any trim for $1,800, drops one mpg highway and combined. By way of comparison, the base 2021 Nissan Roque, which uses a similar engine and platform, gets 27 city, 35 highway and 30 combined in front-wheel drive guise. That combined figure matches that of the Honda CR-V and Toyota RAV4. It's worth noting that the Mitsubishi Outlander comes standard with a third row for seven-passenger seating, so a direct comparison with the Rogue isn't exactly fair. The ES comes with what is now an obligatory suite of tech, like automatic braking forward and rear, blind spot warnings, and Apple CarPlay/Android Auto. 18-inch alloy wheels are standard, but a $1,000 convenience package adds 20-inchers and the Mitsubishi Connect remote services smartphone link (which comes with 24 months free). That places the three-row ES below the Toyota RAV4 but above the Honda CR-V. Next up is the SE trim, ringing in at $28,845 with everything the ES offers and adding 20-inch wheels, heated front seats and side mirrors, proximity unlocking, and a leather steering wheel. Here, the tech content is boosted quite a bit, with the bird's-eye multi-view camera system, parking sensors, and wireless phone charging. You no longer need an upgrade package to get Mitsubishi Connect, and it also has MiPilot Assist which adds adaptive cruise with stop and go in traffic, lane keeping assist, and traffic sign recognition. The touchscreen gets bumped from 8 to 9 inches, and USB charging ports become available for rear passengers as well. A $2,300 SE Tech Package adds a 12.3-inch LCD instrument panel, premium sound system by Bose, and panoramic sunroof.¬† The top-spec SEL stickers at $31,945, building upon the other trims while adding the aforementioned 12.3-inch multi-function display, leather seats, 4-way power seats key-linked to memory, three-zone climate control, roof rails, and heated rear seats.

Junkyard Gem: 1999 Mitsubishi Galant GTZ-V6

Sun, May 26 2024The Mitsubishi Galant first appeared on American streets as the 1971 Dodge Colt and then a bit later with Dodge Challenger and Plymouth Sapporo badges. Mitsubishi Motors finally began selling Galants from its own U.S. showrooms for the 1985 model year, and Galant sales continued here through four more generations before getting the axe in 2012. We saw some interesting and/or quick Galants along the way, including the Sigma, VR-4, GS-X and Ralliart; today's Junkyard Gem is a rare example of the sporty eighth-generation Galant GTZ sedan, found in a North Carolina self-service wrecking yard recently. The final year for the hot-rod all-wheel-drive VR-4 and GS-X Galants in the United States was 1992. By 1998, there were just three levels of new Galant here, all with 141-horse four-cylinder engines driving the front wheels. Then the 1999 model year arrived, and so did the 6G72 V6 engine under Galant hoods. This SOHC (yet still 24-valve) engine was rated at 161 horsepower and 205 pound-feet. It was available in the U.S.-market ES-V6, GTZ-V6 and LS-V6 Galants for the '99. The GTZ was sporty-looking, but not as loaded with luxury features as the LS. 1999 was the first model year for the eighth-generation Galant in North America, and it had finally become big and powerful enough to be considered a genuine rival for the Toyota Camry and Honda Accord (both of which had been available with V6 power for quite a few years). The 1999 Galant got a grille that resembled the one on its upscale Diamante big brother, which had five years to live at the time. The MSRP for this car was $24,300, which comes to about $46,374 in 2024 dollars. The base 1999 Galant DE started at just $16,999, or $32,441 in today's money. Those prices were in the ballpark with the Galant's Camry and Accord rivals; the Camry LE V6 with automatic started at $22,748 ($43,412 now) with automatic transmission, while the Accord LX V6 with automatic was $21,700 ($41,412 today). Both those cars had a lot more power than the Mitsubishi, though: 194 horsepower for the Toyota and 200 for the Honda. The 1999 Galant sold in the United States was not available with a manual transmission, which made the El Cheapo DE trim level a steal compared to the cost of two-pedal base Accords and Camrys. The Galant DE even came with air conditioning at no extra cost. The factory wing on the GT-Z is serious. Collectible today? Hardly, but an interesting bit of automotive history. This content is hosted by a third party.