1990 Mitsubishi Mighty Max Base Standard Cab Pickup 2-door 2.4l on 2040-cars

Boiling Springs, South Carolina, United States

|

Description coming soon.

On Jun-23-14 at 16:08:11 PDT, seller added the following information: 1990 Mitsubishi Mighty Max. It is a 2.4L 4cyl 5spd. It runs and shifts great. It has manual windows and locks. It gets great gas mileage and is quite powerful for a four cylinder. No smoking at all, possible rebuilt head, etc. The previous owner has had a switch installed for the A/C button. It has good glass, tires and has been repainted. It also has an aftermarket CD player. Thanks for looking! You must pick up the truck at our dealership in Boiling Springs, SC. We collect sales tax of 5% for South Carolina residents. We do collect sales tax for some other states too; we do not collect sales tax for NC. You may pick up the truck once your payment clears. If you have negative feedback you bid will be canceled. Thanks! |

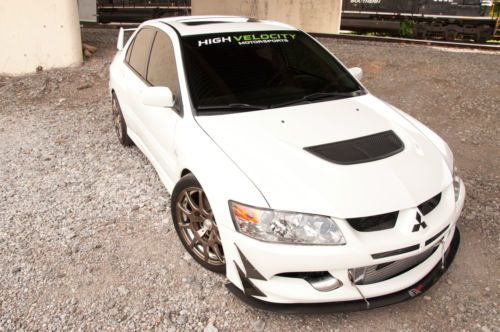

Mitsubishi Evolution for Sale

2003 mitsubishi lancer evolution evo 8 turbo ams custom built(US $28,000.00)

2003 mitsubishi lancer evolution evo 8 turbo ams custom built(US $28,000.00) 2006 mitsubishi lancer evolution gsr sedan 4-door 2.3l(US $30,000.00)

2006 mitsubishi lancer evolution gsr sedan 4-door 2.3l(US $30,000.00) 2010 mitsubishi lancer evolution x gsr, 5 speed, 17,000 miles, phantom black(US $24,900.00)

2010 mitsubishi lancer evolution x gsr, 5 speed, 17,000 miles, phantom black(US $24,900.00) Built 2008 mitsubishi evo x gsr(US $28,000.00)

Built 2008 mitsubishi evo x gsr(US $28,000.00) Mitsubishi fuso box truck w/ side door !!! hydraulic lift gate !! 58,600 miles !

Mitsubishi fuso box truck w/ side door !!! hydraulic lift gate !! 58,600 miles ! 2003 mitsubishi montero xls sport utility 4-door 3.8l

2003 mitsubishi montero xls sport utility 4-door 3.8l

Auto Services in South Carolina

X-Treme Audio Inc ★★★★★

Window Tinting by David Fields Tires And Brakes ★★★★★

Whetzels Automotive, Inc ★★★★★

Volkswagen Of South Charlotte ★★★★★

T & W Motors ★★★★★

T & W Motors ★★★★★

Auto blog

New Ford Mustang incoming; driving the Tesla Model S Plaid | Autoblog Podcast #746

Fri, Sep 9 2022In this episode of the Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Road Test Editor Zac Palmer. We're fast approaching the reveal of the 2024 Ford Mustang, and we talk about what we know so far. We also discuss what's next for the Chrysler 300, McLaren is mulling an electric crossover, we've got more Civic Type R details, and Mitsubishi's Ralliart sub-brand is making its return to America. We've been driving a Tesla Model S Plaid, Kia Sportage X-Pro and Kia EV6, and we give our final thoughts on our long-term loan of a Hyundai Palisade. Finally, we dip into the mailbag to help a listener choose a new sporty car in the "Spend My Money" segment. Send us your questions for the Mailbag and Spend My Money at: Podcast@Autoblog.com. Autoblog Podcast #746 Get The Podcast Apple Podcasts – Subscribe to the Autoblog Podcast in iTunes Spotify – Subscribe to the Autoblog Podcast on Spotify RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Everything we know about the 2024 Ford Mustang 2023 Chrysler 300 updated. What's next? McLaren pulls U-turn, now mulling (possibly electric) luxury crossover 2023 Honda Civic Type R power figures and more revealed Ralliart returns to America for 2023 Cars we're driving Tesla Model S Plaid (and what the interior looks like after 19,000 miles) Kia Sportage X-Pro Kia EV6 Hyundai Palisade Spend My Money Feedback Email – Podcast@Autoblog.com Review the show on Apple Podcasts Autoblog is now live on your smart speakers and voice assistants with the audio Autoblog Daily Digest. Say “Hey Google, play the news from Autoblog” or "Alexa, open Autoblog" to get your favorite car website in audio form every day. A narrator will take you through the biggest stories or break down one of our comprehensive test drives. Related video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Green Podcasts Chrysler Ford Hyundai Kia McLaren Mitsubishi Tesla Coupe Crossover SUV Electric Future Vehicles Luxury Performance Sedan

2015 Mitsubishi Outlander Sport recalled for leaky transmission

Mon, Aug 15 2016The Basics: Mitsubishi Motors is recalling 45,731 Outlander Sport crossovers from model year 2015. Built between June 25, 2014 and November 25, 2015, the affected vehicles use the base 2.0-liter four-cylinder engine and continuously variable transmissions. The Problem: A clamp on the CVT hose may have been installed incorrectly. If the hose comes off, transmission fluid can leak out. While the transmission will start acting up – and eventually grind to a halt – the bigger concern is what happens if the transmission fluid comes into contact with hot surfaces: fire. Injuries/Deaths: Thankfully, it doesn't sound any owners have crashed, caught fire, or been injured or killed due to loss of transmission fluid. Mitsubishi didn't list injuries or fatalities in its recall paperwork with NHTSA, but the chronology only describes "warranty claims," which sounds like the vehicles never caught fire. The Fix: Dealers will inspect the hose clamps on all 45,000 Outlander Sports and reinstall them if there's a problem. Repairs are free of charge. If you own one: Since NHTSA's bulletin doesn't advise owners on whether they should or shouldn't drive their vehicles, we recommend looking for leaks and checking your transmission fluid level as soon as possible. If it's low or leaking, you probably shouldn't drive. Featured Gallery 2015 Mitsubishi Outlander Sport View 9 Photos News Source: NHTSAImage Credit: Mitsubishi Recalls Mitsubishi Crossover Economy Cars

Carlos Ghosn vows to 'restore my honor' in first remarks since arrest

Fri, Dec 21 2018TOKYO — Nissan Motor's jailed ex-chairman, Carlos Ghosn, vowed to restore his good name in court after a month in detention, Japanese public broadcaster NHK said on Friday. "Things as they stand are absolutely unacceptable," Ghosn was quoted as saying via his lawyer. "I want to have my position heard and restore my honor in court." It was Ghosn's first comment since his arrest on Nov 19 for allegedly understating his income by about half over a five-year period from 2010. He was later charged with the same alleged crime covering the past three years. A call to the office of his lawyer, Motonari Otsuru, went unanswered outside business hours early on Friday. The lawyer has previously declined to return calls for comment on the Ghosn case. A Tokyo court on Thursday unexpectedly rejected prosecutors' request to extend Ghosn's detention, which Japanese media said means he could go free on bail as early as Friday. Ghosn wants to hold a news conference after he is released, NHK quoted his lawyer as saying. The executive, who formed a carmaking alliance among Nissan, Mitsubishi Motors Corp and France's Renault SA, said he is not a flight risk and wants to be able to travel abroad, the report said. The Ghosn case has put Japan's criminal justice system under international scrutiny and sparked criticism for some of its practices, including keeping suspects in detention for long periods and prohibiting defense lawyers from being present during interrogations, which can last eight hours a day. Japan has also come under fire for its 99.9 percent conviction rate. The Tokyo court unexpectedly ruled not to extend Ghosn's detention. It said it had also decided against extending detention for Greg Kelly, a former Nissan executive who was arrested along with Ghosn on Nov. 19. It later overruled an appeal by prosecutors against the decision, clearing the way for the possible release of the two men as early as Friday. The court did not disclose reasons for its decision, and NHK said it was "extremely rare" for it to reject the prosecutors' request to extend detention. If Ghosn and Kelly are granted bail, conditions may require them to apply for permission to travel overseas. They could also be barred from contacting Nissan officials. Both executives had not been able to make any public statements since their arrest, although local media have reported that they have denied wrongdoing. Ghosn was indicted on Dec.