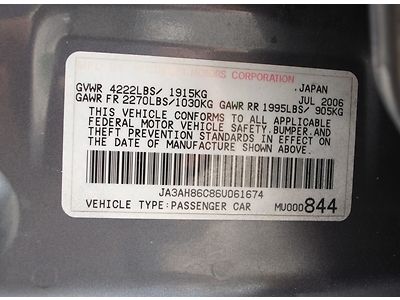

06 Lancer Evo Ix Se, 2.0l 5 Speed, Alum Roof/hood, Bbs, Hid, Recaro, No Reserve on 2040-cars

Hollywood, Florida, United States

Mitsubishi Evolution for Sale

Mitsubishi montero

Mitsubishi montero 2003 mitsubishi lancer evolution sedan 4-door 2.0l

2003 mitsubishi lancer evolution sedan 4-door 2.0l 2006 mitsubishi outlander se heated seats only 60k mi texas direct auto(US $10,780.00)

2006 mitsubishi outlander se heated seats only 60k mi texas direct auto(US $10,780.00) 2005 mitsubishi lancer evolution mr sedan 4-door 2.0l

2005 mitsubishi lancer evolution mr sedan 4-door 2.0l Automatic awd 4x4 leather sunroof two-tone paint michelin tires!(US $5,400.00)

Automatic awd 4x4 leather sunroof two-tone paint michelin tires!(US $5,400.00) 2009 mitsubishi galant es sedan 4-door 2.4l(US $8,950.00)

2009 mitsubishi galant es sedan 4-door 2.4l(US $8,950.00)

Auto Services in Florida

Youngs` Automotive Service ★★★★★

Winner Auto Center Inc ★★★★★

Vehicles Four Sale Inc ★★★★★

Valvoline Instant Oil Change ★★★★★

USA Auto Glass ★★★★★

Tuffy Auto Service Centers ★★★★★

Auto blog

Toyota, Honda, Nissan and more collaborating to increase fuel efficiency

Sun, 25 May 2014Toyota, Honda, Mazda, Nissan, Subaru, Mitsubishi, Suzuki and Daihatsu have announced an alliance that will see a push to improve fuel economy from both gas-powered and diesel-powered engines by as much as 30 percent before the end of the decade.

The newly assembled Research Association of Automotive Internal Combustion Engines put the roughly $20-million project together, with the Japanese government committing to half the cost while the eight manufacturers will chip in the rest.

According to Automotive News, the automakers will team up and share basic research on internal-combustion engines in a bid to cut costs. Eventually, the results of the research will find its way into a production vehicle, although it's unclear just when we'll see the fruits of this partnership on the road.

2022 Mitsubishi Outlander pricing, fuel economy announced

Mon, Mar 1 2021Mitsubishi has announced pricing on what is probably the most compelling — and important to the company's future — product in a decade, the 2022 Outlander. As we learned at the reveal, the base ES trim will start at $25,795, or $26,990 when the destination charge is factored in. Fuel economy figures are also in, giving the Outlander a rating of 24 miles per gallon in the city, 31 on the highway and 27 combined for the front-wheel-drive model. Mitsubishi's S-AWC all-wheel-drive system, which is available on any trim for $1,800, drops one mpg highway and combined. By way of comparison, the base 2021 Nissan Roque, which uses a similar engine and platform, gets 27 city, 35 highway and 30 combined in front-wheel drive guise. That combined figure matches that of the Honda CR-V and Toyota RAV4. It's worth noting that the Mitsubishi Outlander comes standard with a third row for seven-passenger seating, so a direct comparison with the Rogue isn't exactly fair. The ES comes with what is now an obligatory suite of tech, like automatic braking forward and rear, blind spot warnings, and Apple CarPlay/Android Auto. 18-inch alloy wheels are standard, but a $1,000 convenience package adds 20-inchers and the Mitsubishi Connect remote services smartphone link (which comes with 24 months free). That places the three-row ES below the Toyota RAV4 but above the Honda CR-V. Next up is the SE trim, ringing in at $28,845 with everything the ES offers and adding 20-inch wheels, heated front seats and side mirrors, proximity unlocking, and a leather steering wheel. Here, the tech content is boosted quite a bit, with the bird's-eye multi-view camera system, parking sensors, and wireless phone charging. You no longer need an upgrade package to get Mitsubishi Connect, and it also has MiPilot Assist which adds adaptive cruise with stop and go in traffic, lane keeping assist, and traffic sign recognition. The touchscreen gets bumped from 8 to 9 inches, and USB charging ports become available for rear passengers as well. A $2,300 SE Tech Package adds a 12.3-inch LCD instrument panel, premium sound system by Bose, and panoramic sunroof. The top-spec SEL stickers at $31,945, building upon the other trims while adding the aforementioned 12.3-inch multi-function display, leather seats, 4-way power seats key-linked to memory, three-zone climate control, roof rails, and heated rear seats.

Refreshed Mitsubishi Eclipse Cross spied, loses Aztek-style rear hatch

Tue, Jan 28 2020Despite being the brand's freshest model, the Mitsubishi Eclipse Cross is already getting a styling update. The subcompact crossover prototype shown above has a mildly updated nose, and a significantly revised rear hatchback to give it a more conventional look. The rear of the car is the biggest change, so we'll start from there. The current Eclipse Cross has a controversial hatch with slanted main window and a smaller upright window lower down. Detractors liken it to the Pontiac Aztek. This updated model removes it altogether, in favor of one large slanted window. This also helps the back of the Eclipse Cross look a little less tall and blunt. The taillights are redesigned, too, to accommodate the new hatch. They don't span the full width of the hatch, and they might not extend up the rear pillars anymore either.. At the front, changes are more subtle. The headlights that extend off the grille look thinner, and may now simply be running lights, while the larger lights underneath may be the main headlights. The grille also looks more squared off in the lower section, similar to the grilles on the new L200 pickup and Mi-Tech concept. This prototype looks close to production-ready, and since it's just a mid-cycle refresh, we're expecting it to be revealed for the 2021 model year. It will likely continue to come with a turbocharged 1.5-liter inline-4 engine, a CVT and either front-wheel drive or all-wheel drive. Related Video: Â Â