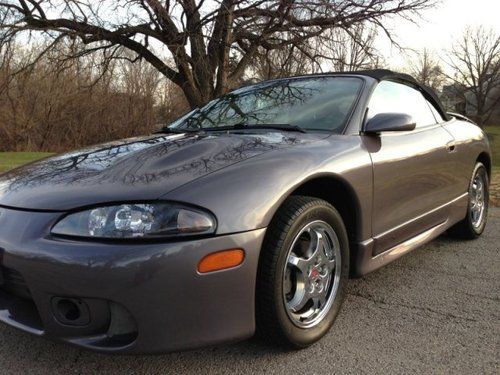

Not Running. Running Great When Parked In December. Field Mice Chewed Wiring. on 2040-cars

Columbus, Mississippi, United States

Vehicle Title:Clear

Engine:2.4L

Number of Cylinders: 4

Make: Mitsubishi

Model: Eclipse

Trim: GS Coupe 2-Door

Options: Sunroof, CD Player

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Drive Type: FWD

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows

Mileage: 160,000

THIS IS A NO RESERVE AUCTION!!!!!! I can load this vehicle and deliver it within a 3 hr drive of my location for $1.20 a loaded mile, or I will help your transporter load. I bought this car May 2012 from a dealer in Jasper Alabama and never got it titled. The vehicle was rarely driven, last time in January and then parked. The next time I went to drive it it had a flat (L rear), then next time I the battery was dead, so the car has sat ever since. Now I thought I had a buyer for it and I couldn't get it to crank. Field mice had nested and chewed through the wiring harness. Also, the hood, fenders and front bumper took some horse damage at some time (I tried to get pics). Interior is in good condition. This vehicle could probably be a quick fix for somebody with some patience and time. The odometer is digital and cant get it pulled up now, I'm gna charge the battery and update the exact mileage tomorrow.

Mitsubishi Eclipse for Sale

2001 mitsubishi eclipse gs coupe 2-door 2.4l(US $3,900.00)

2001 mitsubishi eclipse gs coupe 2-door 2.4l(US $3,900.00) Beautiful 2007 mitsubishi eclipse bronze auto 4 cyl sunroof no reserve auction

Beautiful 2007 mitsubishi eclipse bronze auto 4 cyl sunroof no reserve auction 1997 mitsubishi eclipse gst hatchback 2-door 2.0l 300hp

1997 mitsubishi eclipse gst hatchback 2-door 2.0l 300hp Gs-t turbo spyder convertible 2.0l(US $7,000.00)

Gs-t turbo spyder convertible 2.0l(US $7,000.00) 2000 mitsubishi eclipse rs auto parts or repair tons of new parts(US $1,499.99)

2000 mitsubishi eclipse rs auto parts or repair tons of new parts(US $1,499.99) 1994 mitsubishi eclipse green 4 cyl 5 spd 149529 miles

1994 mitsubishi eclipse green 4 cyl 5 spd 149529 miles

Auto Services in Mississippi

Welch Car Crushing Inc Scales ★★★★★

Tupelo Tint ★★★★★

Southland Auto Service Center ★★★★★

South Haven Auto & Truck Service ★★★★★

PDR-MAN | Paintless Dent Removal ★★★★★

Neill`s Radiator Service ★★★★★

Auto blog

Renault invests in sailing ships to reduce its carbon footprint

Tue, Nov 27 2018Renault is taking a page from the golden age of sailing as the company looks towards reducing its carbon footprint through the use of cargo sailing ships. The French automaker recently announced its partnership with Neoline, a start-up enterprise based in the west of France. The firm specializes in reducing the cost and emissions of typical cargo ships, by reintroducing sailing into the transportation equation. Renault's goal is to reduce its global carbon footprint by 25 percent in 2022, as compared to where they were in 2010. This plan also includes a separate target, to lower supply chain emissions - which includes shipping methods such as trucks, trains, and cargo ships - by 6 percent, compared to levels in 2016. Two prototype cargo vessels, complete with a full set of sails, will be introduced by 2021-22. These two ships will travel between the U.S. eastern seaboard (exact locations are TBD) and the French port cities of Saint-Nazaire and Saint-Pierre & Miquelon. Specifics about what exactly the ships will be carrying has not been released, though Renault is part of an extensive global auto alliance that includes Nissan and Mitsubishi. "For nearly 10 years, we have been working to identify the most environmentally sustainable solutions," said Jean-Francois Salles, Alliance global director, production control. "For example, optimizing the fill rates of the containers and trucks, producing eco-friendly packaging, and implementing a multi-modal system." The current demonstration vessel measures in at 446 feet in total length and has more than 45,000 square-feet of sail. For all you big ship fans out there, the Titanic was about double this size, stretching about 882-feet in length. When powered solely by the wind, Neoline CEO, Jean Zanuttini, says that total emissions drop by as much as 90 percent, versus the carbon footprint of a traditional cargo vessel. Related Video: Green Mitsubishi Nissan Renault Green Culture Technology renault-nissan greenhouse gases shipping ship cargo ship

Carlos Ghosn was on verge of release — so prosecutors file new allegation

Fri, Dec 21 2018TOKYO — Japanese prosecutors added a new allegation of breach of trust against Nissan's former chairman Carlos Ghosn on Friday, dashing his hopes for posting bail quickly. Ghosn and another former Nissan executive, Greg Kelly, were arrested Nov. 19 and charged with underreporting Ghosn's income by about 5 billion yen ($44 million) in 2011-2015. They also face the prospect of more charges of underreporting Ghosn's income for other years by nearly 10 billion ($80 million) in total. The breach of trust allegations were filed a day after a court rejected prosecutors' request for a longer detention of both men. The new allegation only applies to Ghosn, and Kelly could still be bailed out. A request for bail by Kelly's lawyer is pending court approval, according to the Tokyo District Court, but his release will have to wait until next week since the request was still in process after office hours Friday. Prosecutors in a statement Friday alleged that Ghosn in 2008 transferred a private investment loss worth more than 1.8 billion yen ($16 million) to Nissan by manipulating an unspecified "swap" contract. Ghosn also profited by having the company transfer a total of $14.7 million to another company to benefit himself and that company's owner, who helped in the contract manipulation, prosecutors said. Shin Kukimoto, deputy chief prosecutor at the Tokyo District Prosecutors Office, refuse to say if the two transactions were related or how Ghosn illegally profited. He also declined to identify the collaborator or whether the transactions were made overseas. Ghosn and Kelly are only charged with underreporting Ghosn's pay over five years, in violation of the Financial Instruments and Exchange Act. They have not been formally charged with an additional allegation of underreporting another 4 billion yen ($36 million) for 2016-2018, for which their first 10-day detention was to expire Thursday. Prosecutors have been criticized for separating the allegations as a tactic to detain Ghosn and Kelly longer. They say Ghosn and Kelly are flight risks. The maximum penalty for violating the financial act is up to 10 years in prison, a 10 million yen ($89,000) fine, or both. Breach of trust also carries a similar maximum penalty. The conviction rate in Japan is more than 99 percent for any crime. Ghosn was sent by Renault in 1999 to turn around Nissan, then on the verge of bankruptcy, and he led its rise to become the world's second-largest automaker.

France tries to dodge blame for blowing up FCA-Renault merger deal

Thu, Jun 6 2019PARIS — France sought to fend off a hail of criticism on Thursday after it was blamed for scuppering a $35 billion-plus merger between carmakers Fiat-Chrysler and Renault only 10 days after it was officially announced. Shares in Italian-American FCA and France's Renault fell sharply in early trading after FCA pulled out of talks, saying "the political conditions in France do not currently exist for such a combination to proceed successfully." French finance minister Bruno Le Maire said the government, which has a 15% stake in Renault, had engaged constructively, but had not been prepared to back a deal without the endorsement of Renault's current alliance partner Nissan. Nissan had said it would abstain at a Renault board meeting to vote on the merger proposal. However, a source close to FCA played down the significance of Nissan's stance in the discussions, believing French President Emmanuel Macron was looking for a way out of the deal after coming under pressure at home. Context The FCA-Renault talks were conducted against the backdrop of a French public outcry over 1,044 layoffs at a General Electric factory. The U.S. company had promised to safeguard jobs there when it acquired France's Alstom in 2015. The collapse of the deal, which would have created the world's third-biggest carmaker behind Japan's Toyota and Germany's Volkswagen, revives questions about how both FCA and Renault will meet the challenges of costly investments in electric and self-driving cars on their own. The merger had aimed to achieve 5 billion euros ($5.6 billion) in annual synergies, with FCA gaining access to Renault's and Nissan's superior electric drive technology and the French firm getting a share of FCA's lucrative Jeep and Ram brands. FCA has long been looking for a merger partner, and some analysts say its search for a deal is becoming more urgent as it is ill-prepared for tougher new regulations on emissions. It previously held unsuccessful talks with Peugeot maker PSA Group, in which the French state also owns a stake. French budget minister Gerald Darmanin said the door should not be closed on the possibility of a deal with Renault, adding Paris would be happy to re-examine any new proposal from FCA. "Talks could resume at some time in the future," he told FranceInfo radio.