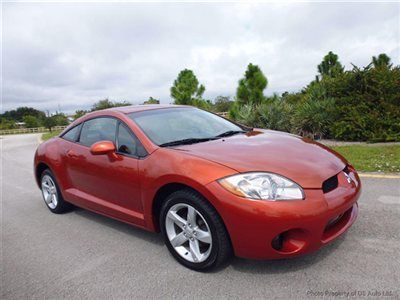

No Reserve 2003 Mitsubishi Eclipse Gs 1 Owner No Accidents Super Clean Runs Grt on 2040-cars

Hampton, New Jersey, United States

Vehicle Title:Clear

Engine:2.4L 2351CC l4 GAS SOHC Naturally Aspirated

For Sale By:Dealer

Body Type:Coupe

Fuel Type:GAS

Year: 2003

Make: Mitsubishi

Warranty: Vehicle does NOT have an existing warranty

Model: Eclipse

Trim: GS Coupe 2-Door

Options: Sunroof

Power Options: Power Locks

Drive Type: FWD

Mileage: 183,030

Number of Doors: 2

Sub Model: 3dr Cpe GS 2

Exterior Color: Silver

Number of Cylinders: 4

Interior Color: Black

Mitsubishi Eclipse for Sale

2007 mitsubishi eclipse gs coupe 2-door 2.4l(US $7,300.00)

2007 mitsubishi eclipse gs coupe 2-door 2.4l(US $7,300.00) 06 eclipse gs 5-speed one owner clean carfax dealer serviced hatchback financing

06 eclipse gs 5-speed one owner clean carfax dealer serviced hatchback financing 1997 mitsubishi eclipse gs hatchback 2-door 2.0l(US $1,650.00)

1997 mitsubishi eclipse gs hatchback 2-door 2.0l(US $1,650.00) Mitsubishi eclipse gsx race rally drift drag ralliart evo talon laser dsm 4g63

Mitsubishi eclipse gsx race rally drift drag ralliart evo talon laser dsm 4g63 2001 mitsubishi eclipse spyder gt(US $7,500.00)

2001 mitsubishi eclipse spyder gt(US $7,500.00) 2003 mitsubishi eclipse gs coupe 2-door 2.4l(US $2,500.00)

2003 mitsubishi eclipse gs coupe 2-door 2.4l(US $2,500.00)

Auto Services in New Jersey

World Class Collision ★★★★★

Warren Wylie & Sons ★★★★★

W & W Auto Body ★★★★★

Union Volkswagen ★★★★★

T`s & Son Auto Repair ★★★★★

South Shore Towing ★★★★★

Auto blog

Federal prosecutor fights bail for men accused of helping Carlos Ghosn escape

Tue, Jun 23 2020BOSTON — A U.S. prosecutor on Monday urged a judge to keep a former Green Beret and his son locked up as Japan prepares to formally seek their extradition on charges that they helped former Nissan boss Carlos Ghosn flee the East Asian country. Assistant U.S. Attorney Stephen Hassink argued during a virtual hearing that Michael Taylor and his son, Peter Taylor, have a "clear and present reason to flee" after being accused of helping Ghosn, who faces financial misconduct charges in Japan. "They're actually some of the best defendants that IÂ’m sure this court has seen positioned to actually succeed in that flight," Hassink said. He argued the men, who have been held without bail since being arrested in Massachusetts last month, helped smuggle Ghosn out of Japan in a box on Dec. 29, 2019. Ghosn then allegedly fled to Lebanon, his childhood home, which has no extradition treaty with Japan. Ghosn, Nissan's former chief executive, was charged with engaging in financial wrongdoing by understating his compensation in Nissan's financial statements. He denies wrongdoing. The Taylors' lawyers countered that had they wished to avoid prosecution they could have remained in Lebanon, where they were in January when Japan said it would seek their arrest, rather than return to Massachusetts. "If he's an expert of escape, he would not have returned to the United States," Robert Sheketoff, a lawyer for Michael Taylor, argued. He and other defense lawyers argued the case against their clients was flawed and that Michael Taylor, a U.S. Army Special Forces veteran and private security specialist, is at heightened risk of complications from COVID-19, which could spread in the jail. The hearing itself was held through a Zoom videoconference because of the coronavirus pandemic. U.S. Magistrate Judge Donald Cabell said he hoped to rule "as quickly as I can." Related Video:

No one wants to buy Mitsubishi's only US plant

Fri, Jan 8 2016Mitsubishi Motors will very likely close its factory in Normal, IL, later this year after failing to find another company in the auto market to take over its only manufacturing site in the US. "We have given up looking for an automaker to buy the plant, but we are looking for possible buyers from other industries," a Mitsubishi spokesperson told Reuters. Mitsubishi announced plans to leave the site in 2015 to shift its business strategy toward Asia. The factory started as a joint venture with Chrysler in 1988 and was the only plant from a Japanese automaker in the US with a UAW-represented workforce. This was allegedly a sticking point when finding a buyer because other companies in the industry didn't want to take on the union employees' contract. The Normal factory ended assembly of the Outlander Sport in November 2015 and laid off 1,000 workers at that time. The site will continue to make car parts until May, and then Mitsubishi will let go of the remaining 250 employees. The costs of shutting down the factory could be as high as 30 billion yen ($255 million), but a company spokesperson wouldn't confirm that figure to Reuters. Mitsubishi's fortunes seem on the upswing in the US as of late. The company's deliveries jumped 22.8 percent in 2015 to a total of 95,342 vehicles, and the last fiscal year brought the automaker's first operating profit in this region in seven years. Related Video:

Mitsubishi Outlander PHEV faces longer delays, might not arrive until 2016

Thu, 22 May 2014It seems every time the Mitsubishi Outlander PHEV makes the news the information concerns a delay, and the reason always centers on its batteries. Four months ago the culprit was restricted battery supply from Lithium Energy Japan, pushing the arrival to 2015. This time it's no different, with Automotive News reporting that a battery-related request made by California state regulators will push the Outlander PHEV arrival back to "late 2015 or early 2016."

CA authorities want all plug-in hybrids to be fitted with a monitor for the lithium-ion batteries that will be on the lookout for degradation, the concern being that diminished batteries could change the vehicle's emissions. Getting the technology fitted and tested means something like a 16- to 22-month delay.

The extra time, however, should let Mitsubishi figure out what it's going to do about its battery supply since the current level of 4,000 per month isn't enough to support a US launch; the Automotive News article says Mitsubishi expects a volume of 63,000 plug-ins for 2016. The company hasn't said how it plans to make up the balance.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.028 s, 7971 u