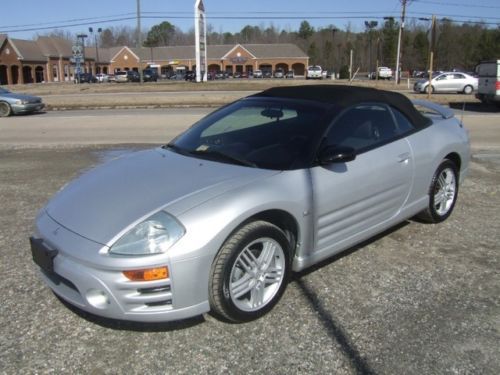

2012 Mitsubishi Eclipse Gs Sport Spyder Htd Leather 21k Texas Direct Auto on 2040-cars

Stafford, Texas, United States

Mitsubishi Eclipse for Sale

2005 mitsubishi eclipse spyder v6 gt convertible at

2005 mitsubishi eclipse spyder v6 gt convertible at 2007 mitsubishi eclipse gs coupe 2-door 2.4l(US $7,988.00)

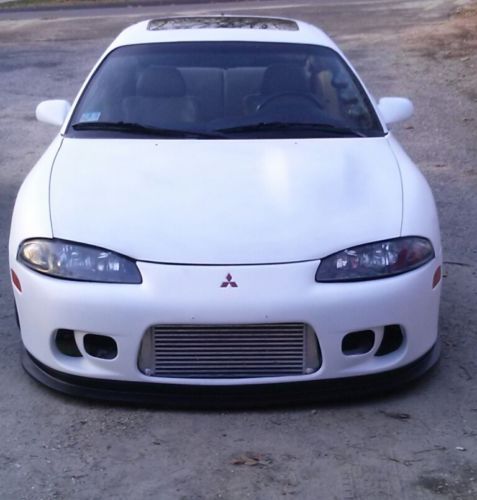

2007 mitsubishi eclipse gs coupe 2-door 2.4l(US $7,988.00) 1997 mitsubishi eclipse gsx awd dsm fully built(US $25,000.00)

1997 mitsubishi eclipse gsx awd dsm fully built(US $25,000.00) 1999 mitsubishi eclipse rs hatchback 2-door 2.0l(US $1,000.00)

1999 mitsubishi eclipse rs hatchback 2-door 2.0l(US $1,000.00) 1997 mitsubishi eclipse rs hatchback 2-door 2.0l(US $2,500.00)

1997 mitsubishi eclipse rs hatchback 2-door 2.0l(US $2,500.00) Dsm turbo awd package. 2 cars for the price of one!

Dsm turbo awd package. 2 cars for the price of one!

Auto Services in Texas

Zepco ★★★★★

Xtreme Motor Cars ★★★★★

Worthingtons Divine Auto ★★★★★

Worthington Divine Auto ★★★★★

Wills Point Automotive ★★★★★

Weaver Bros. Motor Co ★★★★★

Auto blog

Mitsubishi mulling Mirage sedan for US [w/videos]

Tue, 15 Oct 2013

Mitsubishi is bringing the Mirage hatchback to the US this fall, carrying a price tag of $12,995, not including the $725 destination charge. Mitsunori Kitao, COO of Mitsubishi Motors Thailand Co., says that the Japanese automaker might consider releasing the sedan version of the Thailand-built compact - called the Attrage in Thailand and the Mirage G4 in the Phillipines - if the little hatchback takes off in the US market, Automotive News reports.

Weight is a key concern with importing the sedan. The non-US Mirage hatchback weighs just 1,900 pounds, but its naturally aspirated 1.2-liter three-cylinder engine makes just 79 horsepower and 78 pound-feet of torque, which can only manage a 0-62 miles-per-hour time of 11.2 seconds. The heavier sedan would take even longer.

Mitsubishi to showcase eX crossover concept in Tokyo

Fri, Oct 9 2015The Tokyo Motor Show is coming up at the end of the month, and Mitsubishi isn't about to sit it out. That's where the Diamond Star automaker will unveil the eX Concept pictured here. The electric crossover concept packs what the company terms as a "next-generation EV system" into what looks at first blush like a rather dramatic design. Mitsubishi is telling us next to nothing about the eX and its specifications. However, it indicates that the concept incorporates an all-electric powertrain, all-wheel drive, an automated driving system, vehicle connectivity, and active safety systems. The automaker has also only revealed the one rendering above, but it bears all the hallmarks of a modern Mitsubishi concept like the ones we've seen in recent years. That includes the company's signature Diamond Shield front grille, flanked by narrow, angular headlights and oversized running lamps. Naturally, this concept rides on oversized wheels and boasts spindly little mirrors, all in an effort to tell us this is a bonafide show car and not a pre-production prototype. We'll look forward to seeing more in the near future, but in the meantime you can delve into what little Mitsubishi is telling us at this point in the press release below. Related Video: MITSUBISHI MOTORS LINEUP AT 44TH TOKYO MOTOR SHOW – ANOTHER STEP FORWARD WITH SUVS AND ELECTRIC POWER 08/10/15 from Mitsubishi Motors in the UK Print this page Add this release to Your Downloads TOKYO — Mitsubishi Motors Corporation (MMC) will unveil the Mitsubishi eX1 Concept, a compact SUV concept car, with a next-generation EV system at the 44th Tokyo Motor Show 20152. The concept car showcases MMC's next-generation electric vehicle (EV) technologies, a new take on the Dynamic Shield front design concept, and a vast range of other technologies for superior driving pleasure in a compact crossover package. MMC's display reflects the main theme of "Driving Beyond" – another step forward with SUVs and electric power. ELEGANCE & SUV & 100% ELECTRIC The Mitsubishi eX Concept is a vision for a unique all electric powered compact SUV aimed at the fast growing compact SUV market. It uses MMC's state-of-the art EV and all-wheel control technologies combined with automated driving, connected car, and active safety systems. Both exterior and interior design indicate the direction MMC Design is taking.

2023 Mitsubishi Triton coming after the Ford Ranger overseas

Sat, Jun 24 2023The next-generation Mitsubishi Triton is coming soon to a trail near you — assuming you live outside of the United States. Known as the L200 in some global markets, the truck was shaped by a new, more rugged-looking design language that Mitsubishi calls "Beast Mode." Dark preview images published by the Japanese brand depict a pickup that has been reinvented from the ground up. While the current Triton features rather unusual proportions characterized by a slanted shut line and a super-sized rear overhang, its successor looks a little more conventional, though we'll make the final call when we see it in the metal. We spot a tall, upright front end with LED accents that Mitsubishi describes as "resembling the sharp gaze of a hawk" and a rectangular grille with both "Mitsubishi" lettering and the company's emblem. 2023 Mitsubishi Triton View 4 Photos We're curious to find out what's under the sheet metal. Mitsubishi recently expanded its European range with badge-engineered Renault models, such as the Clio-based Colt. Nothing suggests that the Triton is a badge-engineered version of another truck, and the current-generation Nissan Navara (which is unrelated to our Frontier) is likely too old to provide its platform. Could it be the other way around? Mitsubishi is part of the Renault-Nissan alliance, and the group strives to achieve economies of scale, so the Triton could also preview the next Navara. Of course, this is pure speculation. Nothing is official at this stage, and Mitsubishi isn't ready to release technical details. It hasn't published images of the interior yet, but a preview video embedded above suggests that upmarket models will receive a free-standing touchscreen for the infotainment system and a dial to select one of the transfer case's different options. Broadly speaking, we're expecting that the next Triton will offer a more SUV-like interior to reflect the fact that, even outside of America, buyers are increasingly using pickups as daily drivers. Mitsubishi will unveil the next-generation Triton in Thailand, where the model will be built, on July 26. The truck will be sold in a long list of nations, including several countries in Latin America and in the Middle East, but it doesn't sound like it will be offered in the United States. Elsewhere, the Triton will compete in an increasingly crowded ring against the Ford Ranger, the Volkswagen Amarok, and the Toyota Hilux. Related Video: This content is hosted by a third party.