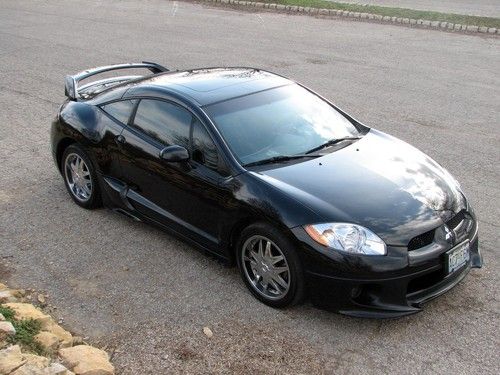

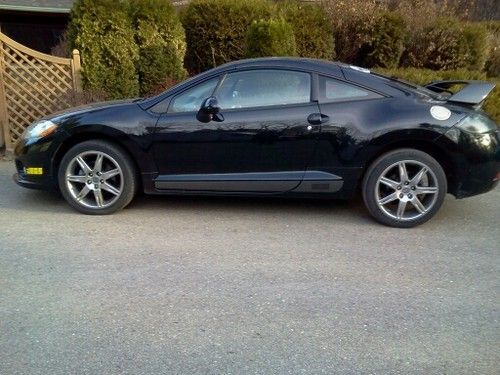

2007 Mitsubishi Eclipse Se One Owner Customized Loaded on 2040-cars

Saint Joseph, Missouri, United States

Vehicle Title:Clear

Engine:4

For Sale By:Private Seller

Transmission:Automatic

Make: Mitsubishi

Warranty: Vehicle does NOT have an existing warranty

Model: Eclipse

Options: Sunroof, Leather Seats, CD Player

Mileage: 84,000

Safety Features: Driver Airbag

Sub Model: SE

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Exterior Color: Black

Interior Color: Black

Inspection: Vehicle has been inspected (include details in your description)

Drivetrain: FRONT WHEEL DRIVE

Mitsubishi Eclipse for Sale

2008 mitsubishi eclipse se coupe 2-door 3.8l

2008 mitsubishi eclipse se coupe 2-door 3.8l 2003 black gt!(US $7,000.00)

2003 black gt!(US $7,000.00) Gs coupe auto keyless entry aluminum wheels aux input jack one owner cd player

Gs coupe auto keyless entry aluminum wheels aux input jack one owner cd player 2000 mitsubishi eclipse gt coupe 2-door 3.0l red. loaded, must see!

2000 mitsubishi eclipse gt coupe 2-door 3.0l red. loaded, must see! 2003 mitsubishi eclipse gs w 82k well cared for miles / 4 cyl w auto trans(US $5,800.00)

2003 mitsubishi eclipse gs w 82k well cared for miles / 4 cyl w auto trans(US $5,800.00) 2007 mitsubishi eclipse gs 3dr(US $7,995.00)

2007 mitsubishi eclipse gs 3dr(US $7,995.00)

Auto Services in Missouri

Wodohodsky Auto Body ★★★★★

West County Nissan ★★★★★

Wayne`s Auto Body ★★★★★

Superior Collision Repair ★★★★★

Superior Auto Service ★★★★★

Springfield Transmission Inc ★★★★★

Auto blog

FCA-Renault merger faces tall odds delivering on cost-cutting promises

Thu, May 30 2019FRANKFURT/DETROIT — Fiat Chrysler Automobiles and Renault promise huge savings from a mega-merger, but such combinations face tall odds because of the industry's long product cycles and problems translating deal blueprints into real world success, industry veterans told Reuters. BMW's 1994 purchase of Rover, and Daimler's 1998 merger with Chrysler both made sense on paper. The companies promised to hike profits by combining vehicle platforms and engine families. Both combinations proved unworkable in reality, and were unwound. Renault and Nissan, which have been in an alliance since 1999 designed to share vehicle components, have only managed to use common vehicle platforms in 35% of Nissan's products despite an original target of 70%, according to Morgan Stanley. FCA and Renault have raised the stakes for themselves by ruling out plant closures. That increases the pressure to achieve more than $5 billion in promised annual savings from pooling procurement and research investments. The two companies have yet to fill in many of the blanks in the merger plan put forward by Fiat Chrysler. Renault's board is expected to act soon to accept the proposal, but that would lead only to a memorandum of understanding to pursue detailed operational and financial plans. A final deal and the legal combination of the two companies could take months to complete if all goes well. Pressure to cut automotive pollution is driving the latest round of consolidation. Automakers are looking at multibillion-dollar bills to develop electric and hybrid cars and cleaner internal combustion engines. Fiat Chrysler and Renault are betting they can design common electric vehicle systems, then sell more of them through their respective brands and dealer networks, cutting the cost per car. Developing all-new electric vehicles can bring more opportunities to share costs from the outset, industry experts said. "With the emergence of connected, autonomous, electric and shared vehicles, carmakers face immediate investments, so new opportunities for sharing costs have emerged," said Elmar Kades, managing director at Alix Partners. However, most electric vehicles lose money. This is a challenge for city car brands in Europe in particular. Both Renault and Fiat rely heavily on this segment for sales.

Automakers Renault, Nissan will become equals, with equal stakes in each other

Mon, Jan 30 2023TOKYO — Nissan and Renault have agreed to equalize the stakes they hold in each other, both sides said Monday, ironing out a source of conflict in the Japan-French auto alliance. Up to now, Renault Group has held a 43.4% stake in Nissan Motor Co., potentially giving it a larger say in how the Japanese automaker is run. It will transfer shares equivalent to a 28.4% stake to a French trust so each side will hold the same 15% stake in the other, according to the companies. The disparity between the holdings was a cause of friction, especially after Nissan became far more profitable than Renault. The agreement on the change is still being finalized and needs board approval from both companies. The companies said the shares in the French trust can eventually be sold but did not say to whom or how. They said the sale will be carried out in a “coordinated and orderly process” if a deal makes commercial sense to Renault Group, and that there is no time deadline. Until then, the voting rights would be “neutralized” for most managerial decisions, but the economic rights, such as dividends, will continue to go to Renault, the companies said. The top shareholder in Renault is the French government. Japanese Prime Minister Fumio Kishida met with French President Emmanuel Macron earlier this month. The alliance has had its ups and downs since it began in 1999, when Renault sent one of its executives, Carlos Ghosn, to then-struggling Nissan to lead a turnaround. Ghosn first served as Nissan's chief executive and later its chairman before he was arrested in late 2018 on various financial misconduct charges. The alliance, which also includes smaller Japanese automaker Mitsubishi Motor Corp. and remains one of the world's top auto groups, has been eager to put the Ghosn scandal behind it. Allegations against Ghosn include underreporting income, using investment funds for personal gain and illicit use of company expenses, including overseas homes and a yacht. Ghosn said he is innocent of all charges. He jumped bail in late 2019 and is now in Lebanon, which has no extradition treaty with Japan. The equalization of the crossholdings has been speculated about for some time. The companies called the move “an important milestone.” “The ambition is to strengthen the ties of the alliance and maximize value creation for all stakeholders,” said Nissan, based in the port city of Yokohama.

Renault names new leaders as jailed Carlos Ghosn bows out

Thu, Jan 24 2019PARIS — Renault appointed Michelin boss Jean-Dominique Senard as its new chairman on Thursday, after Carlos Ghosn was forced to resign in the wake of a financial scandal that has rocked the French carmaker and its alliance with Japan's Nissan. Senard will become chairman immediately, the company said, with deputy chief executive Thierry Bollore taking over Ghosn's other Renault role as full CEO. The appointments may begin to ease a Renault-Nissan leadership crisis that erupted after Ghosn's Nov. 19 arrest in Japan and swift dismissal as Nissan chairman. Senard, 65, now faces the task of soothing relations with Renault's Japanese partner and resuming talks on a new alliance structure to cement the 20-year-old partnership. "It's important that this alliance remain extremely strong," Senard told reporters after a board meeting - citing the mounting investment demands of new vehicle technologies. "It is our compulsory duty to go forward together." Ghosn's exit also marks a clear end to one of the auto industry's most feted careers, two decades after he was despatched by former Renault boss Louis Schweitzer to rescue newly acquired Nissan from near-bankruptcy — a feat he pulled off in two years. After 14 years as Renault CEO and a decade as chairman, Ghosn formally resigned from both roles on the eve of the board meeting. Ghosn's arrest and indictment for financial misconduct has strained the Renault-Nissan relationship, threatening the future of the industrial partnership he transformed into a global carmaking giant over two decades. For two months, the tensions deepened as Renault and the French government stuck by Ghosn despite the revelation he had arranged to be paid tens of millions of dollars in additional income, unbeknownst to shareholders. Ghosn has been charged with failing to disclose more than $80 million in additional compensation for 2010-18 that he had agreed to be paid later. Nissan director Greg Kelly and the Japanese company itself have also been indicted. Both men deny the deferred pay was illegal or required disclosure, while not contesting the agreements' existence. Ghosn has denied a separate breach of trust charge over personal investment losses he temporarily transferred to Nissan in 2008. Ghosn had agreed in recent days to step down from Renault, Reuters reported on Tuesday — but only after the French government, Renault's biggest shareholder, called for leadership change and his bail requests were rejected.