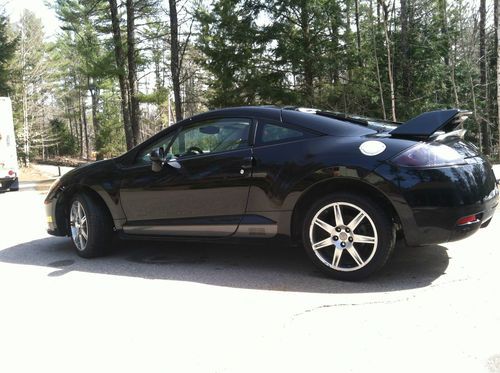

2003 Mitsubishi Eclipse Gs Coupe 2-door 2.4l, No Reserve on 2040-cars

Orange, California, United States

Engine:2.4L 2351CC l4 GAS SOHC Naturally Aspirated

Transmission:Automatic

Body Type:Coupe

Vehicle Title:Clear

Make: Mitsubishi

Number of Doors: 2

Model: Eclipse

Mileage: 184,646

Trim: GS Coupe 2-Door

Exterior Color: Black

Interior Color: Black

Drive Type: FWD

Number of Cylinders: 4

Warranty: Vehicle does NOT have an existing warranty

Mitsubishi Eclipse for Sale

1997 mitsubishi eclipse gs hatchback 2-door 2.0l

1997 mitsubishi eclipse gs hatchback 2-door 2.0l Gs sport hatchback 2.4l beverage holder (s) anti-lock braking system (abs)

Gs sport hatchback 2.4l beverage holder (s) anti-lock braking system (abs) 2003 mitsubishi eclipse gs coupe hatchback cold ac gas saver power everything

2003 mitsubishi eclipse gs coupe hatchback cold ac gas saver power everything 2008 mitsubishi eclipse se coupe 2-door 3.8l(US $13,250.00)

2008 mitsubishi eclipse se coupe 2-door 3.8l(US $13,250.00) 2007 mitsubishi eclipse c

2007 mitsubishi eclipse c Not running. running great when parked in december. field mice chewed wiring.

Not running. running great when parked in december. field mice chewed wiring.

Auto Services in California

Z Best Auto Sales ★★★★★

Woodland Hills Imports ★★★★★

Woodcrest Auto Service ★★★★★

Western Tire Co ★★★★★

Western Muffler ★★★★★

Western Motors ★★★★★

Auto blog

Mitsubishi Evolution nameplate evolves into an electric SUV

Wed, Sep 20 2017Let's imagine a Mitsubishi enthusiast awakens after having slept a decade. At first he isn't alarmed at all, since the Lancer he last saw before taking a long nap still looks the same. The Galant is long gone, but that doesn't bother him much. The first shock he experiences is when he realizes the Eclipse name has been reserved for a 2018 crossover — so would it be best not to tell him the vaunted Evolution nameplate will be used in an electric SUV? That's the plan according to Mitsubishi, as the carmaker announced it will show its e-Evolution Concept at the 45 th Tokyo Motor Show next month. Mitsubishi speaks of a watershed moment taking place at the show, as it "will wave the flag under new circumstances to usher a new era of longterm growth and sustainable development, returning to where it belongs to better embrace the future." In short, electric SUVs. According to Mitsubishi, the e-Evolution is a preview for a "low-slung aerodynamic SUV Coupe," and it will be a high-performance, all-wheel-drive vehicle with electric power. Of course, the very name Evolution stands for continuously evolving vehicles, so a change of approach from turbocharging winged Lancers isn't that ill-advised. The included photo was distributed under the file name "1st Teaser," so perhaps we will see more photos as the showtime gets nearer. Related Video:

Mitsubishi Mirage will reportedly get the axe in 2025

Sat, Aug 19 2023The Mitsubishi Mirage, the car that everyone loves to hate, might not be long for the U.S. market. Reports have it exiting stage left by the end of 2025 with no successor in the works. The compact has the ignominy of being the cheapest new car available in the U.S., with an MSRP starting at $17,340 including destination charges. The report comes from an unnamed source who spoke to Automotive News. However, Mitsubishi spokesperson Jeremy Barnes declined to comment on whether the Mirage is getting the axe in two years. "It's a vehicle that we still see as having a role in our portfolio at this time," Barnes told AN. "It fulfills the role of an entry-level vehicle." The Mirage comes in either hatchback or sedan profiles and is powered by a 1.2-liter 3-cylinder making 78 horsepower and 74 lb-ft of torque. While it is often panned for its low power and basic interior, the Mirage does offer a brand spanking new car with a 10-year,100,000-mile powertrain warranty. Also, it comes standard with features like Apple CarPlay/Android Auto, Bluetooth, remote keyless entry, power windows, cruise control, and USB port – none of which are necessary to go from point A to point B but are nice to have. Plus, it's rated at 39 mpg combined and comes in fun colors. While options like the Nissan Versa and Kia Rio still exist, Cox Automotive reported that the only car to actually sell below $20,000 in July was the Mirage. Nevertheless, Mirage sales are down 44% in the first half of 2023. The list of affordable cars grows ever shorter, with options like the Toyota Yaris, Ford Fiesta, and the excellent Honda Fit all having exited the market in recent years. Meanwhile, the average new car price has increased by 47.7% since the pandemic, partially due to supply chain issues. A recent iSeeCars study found that even the pool of late-model used cars below $20,000 has shrunken dramatically, from 49.3% of sales in 2019 to just 12.4% today. All this while the number of more expensive, larger and more luxurious cars continues to expand. Once the Mirage is gone, Mitsubishi will have, like Ford and GM, a zero-sedan lineup. Like many, Mitsubishi is preparing for an all-electric push, with plans to debut nine new BEV models globally by 2030.

Minnesota couple puts 414k miles on a 2014 Mitsubishi Mirage

Tue, Dec 1 2020A couple in Minnesota just traded in their 414,000-mile 2014 Mitsubishi Mirage, which is notable for any car, topping many of the Junkyard Gems we've featured. We were also impressed because that's a lot of miles in a car that we weren't especially fond of. But the couple that owned it, Jerry and Janice Huot, clearly liked it. Dubbed the "Purple Won" in a nod to Prince, the subcompact endured six upper Midwest winters as an all-purpose utility and delivery vehicle. "I always loved the comments at gas stations and grocery stores and waves from people as I’d drive by," Jerry said. "Kids would always stop and point. Everybody seemed to love that car; it would make everyone smile whenever they saw it." The Huots were repeat Mitsubishi buyers in search of something with better fuel efficiency than their Cadillac. While Mitsubishi didn't specify which model the Huots traded in, it's safe to say that whatever it was, the 2014 Mirage would have been a significant upgrade in that respect, as it was rated at 37 mpg in the city, 44 on the highway and 40 combined when it was sold new; the EPA has since re-rated it at 36/42/39.  "Right in the middle of the showroom was this little purple Mirage that got 44 mpg," Janice told Mitsubishi. "IÂ’d had an Outlander Sport and Montero Sport before and loved them, so it seemed like a good choice. We drove the Mirage home that day, right off the showroom floor." "Janice drove it mostly for the first 7,000 miles or so, but when winter came, she wanted all-wheel-drive, so she got a 2015 Mitsubishi Outlander Sport," Jerry says. "But then I started using the Mirage for my business. I am a courier. I deliver samples from various doctorsÂ’ offices to labs, so I drive up and down the state and around town in Minneapolis all the time. The Mirage never missed a beat. It got me up and out of our gravel driveway, even in the middle of winter, when others got stuck in the snow." According to the Huots, the Mirage only needed two noteworthy repairs on its way to 414,000 miles: a replacement starter motor between 200,000 and 300,000 miles and a new set of wheel bearings some time after 150k, both of which they say were addressed under warranty. We checked with Mitsubishi, who confirmed that the Huots purchased an extended warranty from the dealership, hence the coverage of failed items at such high mileage. Apart from that, the Huots say it has needed only regularly scheduled maintenance. What replaced it? Another Mirage, predictably.