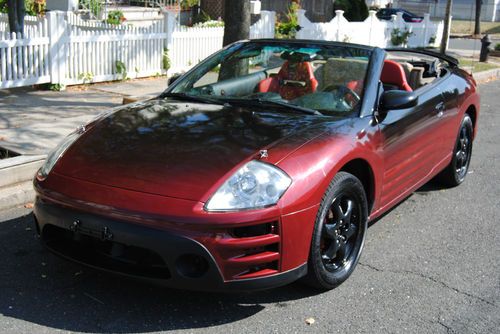

2002 Mitsubishi Eclipse Spyder Gs Convertible 2-door 2.4l on 2040-cars

Staten Island, New York, United States

Body Type:Convertible

Vehicle Title:Clear

Engine:2.4L 2351CC l4 GAS SOHC Naturally Aspirated

Fuel Type:GAS

For Sale By:Private Seller

Make: Mitsubishi

Model: Eclipse

Warranty: Vehicle does NOT have an existing warranty

Trim: Spyder GS Convertible 2-Door

Options: Leather Seats, CD Player, Convertible

Drive Type: FWD

Safety Features: Driver Airbag, Passenger Airbag

Mileage: 155,814

Power Options: Air Conditioning, Cruise Control, Power Windows

Sub Model: Spider

Exterior Color: Burgundy

Disability Equipped: No

Interior Color: Black and Tan

Number of Cylinders: 4

Number of Doors: 2

Mitsubishi Eclipse for Sale

2006 mitsubishi eclipse gt hatchback 2-door 3.8l manual

2006 mitsubishi eclipse gt hatchback 2-door 3.8l manual 2007 mitsubishi eclipse gs coupe 2dr.(US $10,500.00)

2007 mitsubishi eclipse gs coupe 2dr.(US $10,500.00) Mitsubishi eclipse no reserve stick rear spoiler wing

Mitsubishi eclipse no reserve stick rear spoiler wing 2000 mitsubishi eclipse gs coupe 2-door 2.4l

2000 mitsubishi eclipse gs coupe 2-door 2.4l 2003 mitsubishi eclipse rs coupe 2-door 2.4l silver(US $4,300.00)

2003 mitsubishi eclipse rs coupe 2-door 2.4l silver(US $4,300.00) 2007 mitsubishi eclipse gs coupe 2-door 2.4l(US $7,850.00)

2007 mitsubishi eclipse gs coupe 2-door 2.4l(US $7,850.00)

Auto Services in New York

Tones Tunes ★★★★★

Tmf Transmissions ★★★★★

Sun Chevrolet Inc ★★★★★

Steinway Auto Repairs Inc ★★★★★

Southern Tier Auto Recycling ★★★★★

Solano Mobility ★★★★★

Auto blog

Mitsubishi mulling Mirage sedan for US [w/videos]

Tue, 15 Oct 2013

Mitsubishi is bringing the Mirage hatchback to the US this fall, carrying a price tag of $12,995, not including the $725 destination charge. Mitsunori Kitao, COO of Mitsubishi Motors Thailand Co., says that the Japanese automaker might consider releasing the sedan version of the Thailand-built compact - called the Attrage in Thailand and the Mirage G4 in the Phillipines - if the little hatchback takes off in the US market, Automotive News reports.

Weight is a key concern with importing the sedan. The non-US Mirage hatchback weighs just 1,900 pounds, but its naturally aspirated 1.2-liter three-cylinder engine makes just 79 horsepower and 78 pound-feet of torque, which can only manage a 0-62 miles-per-hour time of 11.2 seconds. The heavier sedan would take even longer.

Nissan may take control of struggling Mitsubishi Motors

Wed, May 11 2016Update: The reports were largely correct. Nissan will take a 34 percent stake in Mitsubishi for roughly $2.2b. Read all about it here. Reports say Nissan will buy a controlling stake in Mitsubishi Motors, either 30 or 34 percent, for about 200 billion yen or $1.84 billion. Nissan and Mitsubishi motors are currently part of a joint venture, NMKV, to build minicars together. Nissan is also responsible for reporting fuel-economy discrepancies with cars built under the joint-venture agreement, which put Mitsubishi in its current weakened state. Earlier today, reports surfaced that the fuel-economy issues were wider ranging than originally thought. Mitsubishi now admits that all of its Japanese-market cars sold since 1991 could have had faked fuel-economy data. Shares of Mitsubishi Motors have dropped by about half since the scandal was uncovered, opening the door for a takeover. While Nissan is a much larger company, it can benefit from Mitsubishi's 60-percent share of Japan's minicar market. The two companies also had plans to build electric vehicles together in the joint venture. Japan's Nikkei reports that talks are ongoing between the company and that a decision could be made Thursday by the companies' boards. Related Video: News Source: Nikkei Green Mitsubishi Nissan

Nissan posts $6.2 billion annual loss and unveils plan to cut costs

Thu, May 28 2020TOKYO — Nissan outlined a new plan on Thursday to become a smaller, more cost-efficient carmaker after the coronavirus pandemic exacerbated a slide in profitability that culminated in its first annual loss in 11 years. Under a new four-year plan, the Japanese manufacturer will slash its production capacity and model range by about a fifth to help cut 300 billion yen from fixed costs. It will shut plants in Spain and Indonesia, leave the South Korean market and pull its Datsun brand from Russia as part of a strategy unveiled on Wednesday to share production globally with its partners Renault and Mitsubishi. "I will make every effort to return Nissan to a growth path," Nissan Chief Executive Makoto Uchida said, adding that the company had learned from its past mistakes of chasing global market share at all costs. "We must admit failures and take corrective actions," he said, adding that starting with top-level managers, the company had to break its inward-looking culture which in the past has stymied efforts to deepen cooperation with France's Renault. Uchida said improving the company's cash flow was its biggest challenge. He reiterated that Nissan's cash liquidity was good even though it had negative free cash flow of 641 billion yen in the year ended in March. Nissan declined to give any forecasts for its current financial year which started in April due to the uncertainty created by the coronavirus pandemic. It also declined to give details on how many jobs it was cutting. In what is Nissan's second recovery plan in less than a year, Uchida pledged a return to profitability with a core operating profit margin above 5% and a sustainable global market share of 6%. Nissan posted an annual operating loss of 40.5 billion yen for the year to March 31, its worst performance since 2008/09. Its operating profit margin was -0.4%. The automaker said on Thursday that it sold 4.9 million vehicles last year, up from an earlier estimate of 4.8 million. That was still the second decline in a row and a fall of 11% from the previous period but meant Nissan clung on to its position as Japan's second biggest carmaker, just ahead of Honda and a long way behind Toyota. Pandemic pressure Even before the spread of the novel coronavirus, Nissan's slumping profits had forced it to row back on an aggressive expansion plan pursued by ousted leader Carlos Ghosn. The pandemic has only piled on the urgency to downsize.