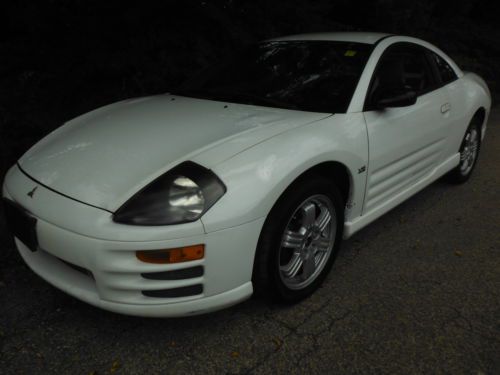

2000 Mitsubishi Eclipse Gt Coupe 3liter 6clinder With Air Conditioning on 2040-cars

Sussex, New Jersey, United States

Mitsubishi Eclipse for Sale

Mitsubishi eclipse spider convertible(US $4,000.00)

Mitsubishi eclipse spider convertible(US $4,000.00) 2007 mitsubishi eclipse spyder gt convertible - red 78,000 mi(US $10,850.00)

2007 mitsubishi eclipse spyder gt convertible - red 78,000 mi(US $10,850.00) Spyder gts 66,000 miles silver gray leather black top toyota of watertown,ma(US $9,450.00)

Spyder gts 66,000 miles silver gray leather black top toyota of watertown,ma(US $9,450.00) 2001 eclipse g/t tuner custom * super charged * priced to sell fast! *(US $3,250.00)

2001 eclipse g/t tuner custom * super charged * priced to sell fast! *(US $3,250.00) 2002 mitsubishi eclipse gs coupe 2-door 2.4l(US $2,800.00)

2002 mitsubishi eclipse gs coupe 2-door 2.4l(US $2,800.00) 2006 mitsubishi eclipse gs hatchback 2-door 3.8l

2006 mitsubishi eclipse gs hatchback 2-door 3.8l

Auto Services in New Jersey

Yonkers Honda Corp ★★★★★

White Dotte ★★★★★

Vicari Motors Inc ★★★★★

Tronix Ii ★★★★★

Tire Connection & More ★★★★★

Three Star Auto Service Inc. ★★★★★

Auto blog

Recharge Wrap-up: Japan supports hydrogen, Fools against fuel cells, BlueIndy controversy

Wed, Jun 25 2014Japan hopes to expand the use of hydrogen energy by subsidizing fuel cell vehicles, according to The Japan News. The trade ministry plans to include the subsidies in its 2015 budget to coincide with the expected launch of Toyota's Fuel Cell Vehicle and the Honda FCEV hydrogen car. By jump-starting purchases of hydrogen cars, Japan hopes that innovation and mass-production will get a boost and the cost of fuel cell vehicles will be competitive with gasoline-powered models by the year 2025. Japan plans to have 100 hydrogen fueling locations operating by March 2016, and wants to halve the cost of building those stations by 2020. The amount of the subsidies has not yet been set. Investing website The Motley Fool isn't quite as optimistic as Japan about hydrogen cars, and is instead bullish about Tesla Motors. The Fool points to Tesla's strong stock performance, and predicts future growth will come from more car models in the future - starting with the Model X - as well as the company's proposed Gigafactory for manufacturing batteries. If Tesla's charging technology continues to catch on, that only improves its financial prospects. The article has some harsh words, however, for hydrogen: "Fuel cells are an inferior automotive technology and for fundamental efficiency, cost, and infrastructure reasons always will be mere compliance gimmicks." Yeesh. As part of a program to build charging stations for the Indianapolis EV carsharing service BlueIndy, utility company Indianapolis Power & Light (IPL) wants to raise its electricity rates an average of 44 cents a month per residential customer to help pay for its share of the project. State consumer advocacy agency Indiana Office of Utility Consumer Counselor and consumer watchdog group Citizens Action Coalition oppose the plan, according to Greenfield, Indiana's Daily Reporter. The BlueIndy program, which is a partnership between the city of Indianapolis and battery manufacturer Bollore Group, will provide up to 500 cars for rent at 25 charging sites around the city. Those who oppose the rate hike call IPL a monopoly and say the amount of the increase is not allowed under state law and that the program wouldn't benefit working class and low-income citizens. A hearing regarding IPL's proposal is scheduled for July 23. A Mitsubishi Outlander PHEV will run the 2014 Asia Cross Country Rally, Hybrid Cars reports. The rally covers 1,367 miles of woods, swamps and mountains from Thailand to Cambodia.

Car owners getting more irritated with their repair experiences, study says

Thu, Mar 9 2023The J.D. Power U.S. Customer Service Index Study (CSI) is a barometer of a vehicle owner's happiness with the service experience. While it wasn't all bad in the 2023 study, the overall owner satisfaction score dropped. This year's tally of 846 out of 1,000 is two points down from 2022, the 43-year-old study's first decline in more than 28 years, and one point down from 2021. However, the overall score remains well up from the pre-pandemic scores of 821 in 2018 and 837 in 2020. The study claims the stumbling block is the horde of BEV launches. The flood into the new energy space has created a recall rate among EVs that's more than double the rate for ICE vehicles. Furthermore, dealership service department knowledge of EVs isn't on par with internal combustion engine expertise, leaving EV owners less satisfied with service advisors compared to ICE owners. Chris Sutton, VP of automotive retail at J.D. Power, said, "As training programs for service advisors and technicians evolve, EV service quality and customer experience must address both the vehicle and the unique customer needs. The EV segment has the potential to spur massive convenience improvements in how customers service their vehicles ó but we¬íre not seeing the benefits yet." Matters are slightly worse for all owners, though, with labor and parts shortages contributing to longer wait times for service appointments. The CSI study surveys owners and lessees of one- to three-year-old vehicles to gauge their happiness with¬†service at franchised dealer or aftermarket service facilities for maintenance or repair work. The criteria in order of importance are¬†service quality (32%); service advisor (19%); vehicle pick-up (19%); service facility (15%); and service initiation (15%). Lexus retains the top spot for luxury brands, giving it three wins in four years. The Japanese automaker won in 2020 as well, its run interrupted by Porsche in 2021. Cadillac, Infiniti and Acura complete the luxury top 5.¬† For mass-market cars, Mitsubishi wins again after a victory in 2021 and falling to fourth last year. It's followed by Mazda, Buick, Subaru and Mini.¬† Considering the different service needs and service experience of different body styles, the study has broken results out by segment for the first time. Lexus earned a second victory thanks to winning the premium SUV segment, and Mitsubishi earned a second victory by winning the mass-market SUV/minivan category.

Mitsubishi pondering $2B share sale?

Sun, 15 Sep 2013Mitsubishi makes the brilliantly fast, wonderfully fun Lancer Evolution. Outside of that road-going rally car, the rest of the range is pretty poor - the new Outlander isn't bad, but the subcompact Mirage looks like might've been competitive five years ago, while the Galant and Lancer have suffered from serial neglect.

This hasn't just lead to rumors of Mitsu's death in America; the subsidiary of the massive Mitsubishi Group has been in trouble at home, too. It was bailed out by three other Mitsubishi Group companies - Mitsubishi UFJ Financial, Mitsubishi Heavy Industries and Mitsubishi Corporation - between 2004 and 2005, according to Bloomberg. Now, it's attempting to extricate itself from "emergency mode," as analyst Koichi Sugimoto told the financial site, adding that "they're still in the very early stages of recovery."

As part of the bailout, Mitsubishi issued its three saviors billions of dollars of preferred shares, which don't have voting rights. The problem is, Mitsubishi hasn't issued dividend payments since 1998, and these stocks aren't exactly competing with Apple or Google, in terms of value. In other words, they're mostly worthless. With a public offering, Mitsubishi is expecting to raise 200 billion yen, or about $2 billion, in order to reduce the number of preferred shares. If all goes according to plan, it will wipe out preferred shares by March of 2014, or the end of fiscal year 2013.