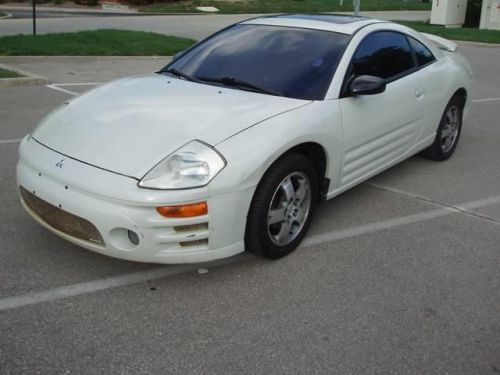

1997 Mitsubishi Eclipse Rs on 2040-cars

1849 S Woodland Blvd, Deland, Florida, United States

Engine:2.0L I4 16V MPFI DOHC

Transmission:4-Speed Automatic

VIN (Vehicle Identification Number): 4A3AK34YXVE004919

Stock Num: 04919

Make: Mitsubishi

Model: Eclipse RS

Year: 1997

Exterior Color: Green

Interior Color: Gray

Options: Drive Type: FWD

Number of Doors: 2 Doors

Mileage: 173163

Visit our website http://www.richardbellautosales.com/ for more information and photos on this or any of our other vehicles or call us today for a test drive at 888-517-4373. You are looking at a clean economical 1997 Mitsubishi Eclipse. She has cold air and it runs great. It has a new set of 20 inch chrome wheels with new tires. Nice cd player and more. Dont miss it, call 888-517-4373 today for our internet special!! All Trades Considered including Cars/Trucks/Vans/Motorcycles/ATV's and more! Carfax report available. Shipping to your Door is available! Cash Customers Welcome! Visit our website http://www.richardbellautosales.com/ for more information and photos on this or any of our other vehicles or call us today for a test drive at 888-517-4373. Shipping to your door is available. All Trades Considered including Cars/Trucks/Vans/Motorcycles/ATV's and more! Cash Customers Welcome! Call 888-517-4373 for our internet special! Please call 888-517-4373 today!

Mitsubishi Eclipse for Sale

2006 mitsubishi eclipse gs(US $8,995.00)

2006 mitsubishi eclipse gs(US $8,995.00) 2011 mitsubishi eclipse spyder gs sport(US $10,995.00)

2011 mitsubishi eclipse spyder gs sport(US $10,995.00) 1999 mitsubishi eclipse rs(US $3,999.00)

1999 mitsubishi eclipse rs(US $3,999.00) 2006 mitsubishi eclipse gs(US $8,999.00)

2006 mitsubishi eclipse gs(US $8,999.00) 2012 mitsubishi eclipse gs(US $15,483.00)

2012 mitsubishi eclipse gs(US $15,483.00) 2003 mitsubishi eclipse gs(US $3,900.00)

2003 mitsubishi eclipse gs(US $3,900.00)

Auto Services in Florida

Workman Service Center ★★★★★

Wolf Towing Corp. ★★★★★

Wilcox & Son Automotive, LLC ★★★★★

Wheaton`s Service Center ★★★★★

Used Car Super Market ★★★★★

USA Auto Glass ★★★★★

Auto blog

Scrapyard Gem: 2007 Mitsubishi Colt CZ2 5-door hatchback

Sat, Feb 3 2024YORK, England — Remember the Dodge and Plymouth Colts of 1971 through 1994? The Colt name stayed alive after that on Mitsubishis sold elsewhere in the world, and I've found a 21st-century example in a self-service wrecking yard near York, England. This generation of Colt served as the basis for the Smart ForFour, so (as promised) I'm following up a ForFour Junkyard Gem with this article about its sibling in the same knacker's yard. Like the ForFour, this car was built at the NedCar assembly plant in the Netherlands. Mitsubishi began using the Colt name in Japan back in 1962, then killed the name at home in favor of the Mirage when that car debuted in 1978. Export-market Mirages got Colt (or Champ, or Lancer and many others) badging at that point. For 2002, the Colt returned to Japan with a brand-new platform, and that's the generation we have here. The engine here is a 1.5-liter Mercedes-Benz turbodiesel, rated at 95 horsepower and 155 pound-feet. A 148-horse turbocharged gasoline-burning Mitsubishi 1.5 was available in the UK as well. The transmission is a five-speed manual. A six-speed automatic was an option. It's a small car but not microscopic; its wheelbase is just over 98" and its curb weight is about 2,500 pounds. The tall roof gives it great storage capacity, a trick often seen in kei vans. This generation of Colt continues to be sold in Taiwan through the present day, as the Colt Plus. In Europe, an all-new Colt based on the Renault Clio was launched last year. It was cheap. In Japan, cuteness was played up in Colt commercials. Â

Carlos Ghosn freed from jail after four months

Wed, Mar 6 2019TOKYO — Wearing a mask, cap and what looked like a construction worker's outfit, the former chairman of Nissan Motor Co., Carlos Ghosn, left a Tokyo detention center Wednesday after posting 1 billion yen ($8.9 million) bail. Although his face was obscured as he left the facility, Ghosn's identity was apparent as he smiled after arriving at a building in downtown Tokyo, having removed his jacket, mask and hat. There was a scramble by media to follow Ghosn after he boarded a small Suzuki van, topped with a ladder, and traveled from the Tokyo Detention Center toward downtown. Motorcycles trailed the van in formation as it passed through city streets to one of the defense lawyer's offices. Ghosn later left in another car, which was mobbed by media. Ghosn, the former head of the Renault-Nissan-Mitsubishi Motors alliance was arrested on Nov. 19. He is charged with falsifying financial reports and with breach of trust. The Tokyo District Court confirmed the 1 billion yen ($8.9 million) bail was posted earlier in the day, after a judge rejected an appeal from prosecutors requesting his continued detention. That cleared the way for Ghosn to leave the facility after spending nearly four months since his arrest. Before his release, Ghosn, who turns 65 on Saturday, issued a statement reasserting his innocence. "I am innocent and totally committed to vigorously defending myself in a fair trial against these meritless and unsubstantiated accusations," he said. A date for his trial has not yet been set. Suspects in Japan often are detained for months, especially those who insist on their innocence, like Ghosn. Some legal experts, including Junichiro Hironaka, one of his lawyers, have criticized the system as "hostage justice," saying the long detentions tend to encourage false confessions. Ghosn's lawyer in France, Jean-Yves Le Borgne, said the lawyers in Japan will be leading the defense but he was in touch with them. "He is catching his breath and settling in," Le Borgne said of Ghosn. French Finance Minister Bruno Le Maire said a presumption of innocence for Ghosn was crucial, while noting the importance to France of the alliance between Nissan and French automaker Renault SA. "It is a good thing that Carlos Ghosn can defend himself freely and serenely, and his release will permit Carlos Ghosn to defend himself freely and serenely," he said. The French government owns about 15 percent of Renault SA, making it an influential voice in the future of the alliance.

Mitsubishi to sell only EVs, hybrids by mid-2030s

Fri, Mar 10 2023TOKYO — Mitsubishi Motors Corp plans for hybrid and battery electric vehicles to account for all new car sales by the middle of the next decade, beefing up its electrification strategy for staying competitive in key markets. Mitsubishi, which is also a junior partner in an alliance with France's Renault SA and Nissan Motor Co, said it will roll out 16 new models over the next five years. The Japanese automaker, known for its Outlander sport utility vehicle, stuck to a previous goal of having half of its new car sales electrified by fiscal 2030 and on Friday newly pledged to raise that further to 100% by fiscal 2035. Mitsubishi considers plug-in hybrids (PHEV), hybrid electric vehicles and battery electric vehicles (BEV) as electrified vehicles. Electrified vehicles accounted for about 7% of the company's total new car sales in fiscal 2021. "Among our existing models, we'll expand the geographical areas where our flagship PHEV Outlander is being offered and build out the sales of the Minicab-MiEV light commercial EV that was relaunched last year," Chief Executive Takao Kato said. Among the 16 new models Mitsubishi plans to roll out, one will be a BEV Renault alliance model, while another will be a Nissan alliance model, Mitsubishi said in presentation materials that were part of its fiscal 2023-2025 business plan. Mitsubishi, an early mover in EVs in the early 2010s, currently has no BEVs in its line-up in Europe. Its new BEV for Europe would mark a comeback in a highly competitive market where new entrants such as Tesla have already rapidly won market share. The model could be a variant of the Renault electric MPV Scenic made in France and expected in 2024, or a variant of the Renault electric city cars R5 or R4 expected respectively in 2024 and 2025 and also made in France, a source close to the matter said. Mitsubishi Europe declined to comment on the matter. Of the other 14 models Mitsubishi plans to launch, seven will be purely combustion engine-powered ones, five will be hybrids and the remaining two will be BEV, the company said. (Reporting by Daniel Leussink and Gilles Guillaume; Additional reporting by Elaine Lies; Editing by Chang-Ran Kim, Shounak Dasgupta and Christina Fincher) Related video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Green Mitsubishi Electric Hybrid