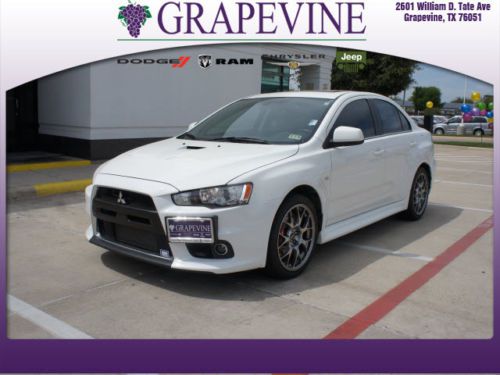

Lancer Evolution on 2040-cars

Grapevine, Texas, United States

Mitsubishi Lancer for Sale

2011 mitsubishi evolution gsr brembo brake turbo recaro awd call sam832-343-7501(US $28,991.00)

2011 mitsubishi evolution gsr brembo brake turbo recaro awd call sam832-343-7501(US $28,991.00) 4dr sdn man de mitsubishi lancer de sedan manual gasoline 2.0l dohc mivec i4 eng

4dr sdn man de mitsubishi lancer de sedan manual gasoline 2.0l dohc mivec i4 eng 2004 mitsubishi lancer evolution viii 8 ssl

2004 mitsubishi lancer evolution viii 8 ssl 2004 mitsubishi lancer ralliart sedan 4-door 2.4l(US $6,200.00)

2004 mitsubishi lancer ralliart sedan 4-door 2.4l(US $6,200.00) We finance! 34940 miles 2011 mitsubishi lancer sportback gts 2.4l i4 16v

We finance! 34940 miles 2011 mitsubishi lancer sportback gts 2.4l i4 16v No reserve nr high bidder wins !!!

No reserve nr high bidder wins !!!

Auto Services in Texas

Whatley Motors ★★★★★

Westside Chevrolet ★★★★★

Westpark Auto ★★★★★

WE BUY CARS ★★★★★

Waco Hyundai ★★★★★

Victorymotorcars ★★★★★

Auto blog

Carlos Ghosn to make first public appearance in seven weeks on Tuesday

Sat, Jan 5 2019Ousted Nissan chairman Carlos Ghosn is set to make his first public appearance in seven weeks at a Tokyo court on Tuesday after he requested an open hearing to hear the reason for his continued detention. Ghosn has been held in a detention center since his Nov. 19 arrest on allegations of financial misconduct, which was followed by re-arrests over further allegations. The hearing will take place at 10:30 local time (0130 GMT) on Jan. 8, the Tokyo District Court said on Friday. The reason behind the timing of Ghosn's request was not clear. Earlier this week, the court approved an extension to Ghosn's detention until Jan. 11, after re-arrest by prosecutors who accuse him of aggravated breach of trust in transferring personal investment losses to Nissan. Those allegations center on the use of company funds to pay a Saudi businessman who is believed to have helped him out of financial difficulties, sources said last week. According to an article from The New York Times, Ghosn and his family assert that he is innocent. In remarks Ghosn made while under detention in Japan, he is reported to have said through his lawyer, "I want to have my position heard and restore my honor in court." Former Nissan executive Greg Kelly, who has been charged with conspiring to under-report Ghosn's income, has been released on bail after the court ruled against extending his detention while he awaits trial. Ghosn's arrest was followed by his removal from roles at Nissan and Mitsubishi. The case has rocked the auto industry and strained Nissan's ties with French partner Renault where Ghosn still remains chairman and chief executive. Renault has launched a search for an interim chief to fill Ghosn's roll at the French company as he deals with these legal cases in Japan. The arrest has also put some of the practices of Japan's criminal justice system under international scrutiny, including keeping suspects in detention for long periods and prohibiting defense lawyers from being present during interrogations. (Reuters contributed to this report.)Related Video:

Mitsubishi announces new and updated models are around the corner

Wed, Jul 22 2020Mitsubishi has remained relatively quiet in 2020. It was hit hard by the ongoing coronavirus pandemic, like all of its peers and rivals, and it's caught in the middle of the cold war between opposing sister companies Renault and Nissan. It announced plans to emerge from its silence by introducing an array of new or updated models in America. The Japanese company explained its goal is to pack more value and technology into its cars. It will launch its American product offensive in late 2020 by introducing an updated Outlander PHEV. Although full details aren't available, Mitsubishi hinted the crossover will receive a new hybrid powertrain built around a bigger, more powerful gasoline-burning engine that works jointly with better electrified technology. It will be capable of driving on electricity alone for longer distances, and at higher speeds. Other revisions are planned, too. Next up is the Mirage, the firm's entry-level model and one of the smallest cars in a market that has decided bigger is better. Mitsubishi confirmed the American-spec model (pictured) will receive the same visual updates as the variant sold overseas, so it will receive a sharper-looking front end that falls in line with the rest of the range. Shortly after, Mitsubishi will continue its push by giving the Eclipse Cross comprehensive visual updates. The crossover's front end will borrow styling cues from the company's next design language, and earlier spy shots suggest stylists have smoothed out the Pontiac Aztek-like rear end. Inside, the Eclipse Cross will receive a new infotainment system, though we'll need to wait to learn about the features it will incorporate. Mitsubishi Outlander prototype View 16 Photos Finally, the next-generation Outlander (shown above in spy shots) will break cover with a new-look design that Mitsubishi characterizes as "bold, aggressive, and distinctive." Although we haven't seen the crossover without camouflage yet, peeking through the wrap suggests the model draws inspiration from the Engelberg Tourer concept introduced at the 2019 edition of the Geneva auto show. Unverified rumors claim it will switch to a Nissan-sourced architecture in the name of economies of scale, and some variants might be available with an engine plucked out of the Nissan parts bin. What's certain, at least according to Mitsubishi, is that the next Outlander will be the quietest and best-equipped car it has ever sold in the United States.

Renault-Nissan-Mitsubishi pool $200 million to invest in tech startups

Fri, Jan 5 2018PARIS — The Renault-Nissan-Mitsubishi alliance is setting up a $200 million mobility tech fund, three sources said, in the latest move by major carmakers to adapt to rapid industry change by investing in startups through their own venture capital arms. The fund, due to be unveiled by Chief Executive Carlos Ghosn at the CES tech industry show in Las Vegas next Tuesday, will be 40 percent financed by Renault, 40 percent by Nissan and 20 percent by Mitsubishi. "It will allow us to move faster on acquisitions ahead of our competition," one of the alliance sources told Reuters. Frederique Le Greves, a spokeswoman for the Renault-Nissan-Mitsubishi alliance, declined to comment. The traditional auto industry model based on individual ownership is threatened by pay-per-use services such as Uber, as well as ride- and car-sharing platforms, a challenge heightened by parallel shifts towards electrified and self-driving cars. Wary carmakers are struggling to embrace changes and technologies that some of their executives are only beginning to grasp. To accelerate the process, many are investing directly in the new services — and gaining access to intellectual property — via their own corporate venture capital (CVC) funds. BMW has purchased stakes in a plethora of ride-sharing, smart-charging and autonomous vehicle software firms through its 500 million euro ($600 million) iVentures fund, the biggest such in-house facility belonging to a carmaker. Among others that have been increasingly active are General Motors' GM Ventures, with $240 million, and Peugeot-maker PSA Group's 100 million-euro investment arm. CVC funds, a familiar feature of innovative sectors such as tech and pharmaceuticals, have become more commonplace among carmakers since the 2008-9 financial crisis. They let companies skip some of the formalities otherwise required for new investments, and pounce more swiftly on promising startups. The Renault-Nissan-Mitsubishi venture will also obviate the current need to thrash out the ownership split for each new alliance acquisition. It represents a further step in the integration of the carmakers as they pursue 10 billion euros in annual synergies by 2022. France's Renault holds a 43.4 percent stake in Nissan, which in turn controls Mitsubishi. Ghosn heads Renault and chairs all three.