2001 Gold Galant, 4 Dr Sedan, With Many Options Including Sun Roof, And All Powe on 2040-cars

Quincy, Massachusetts, United States

|

MUST HAVE A PLACE FOR AAA TO TOW MONDAY (or pay storage) I can have towed it towed by AAA to any autobody within 100 miles of

Quincy (officer wouldn't let me drive because the windshield crack is

illegal, the accident doesn't affect mechanics).

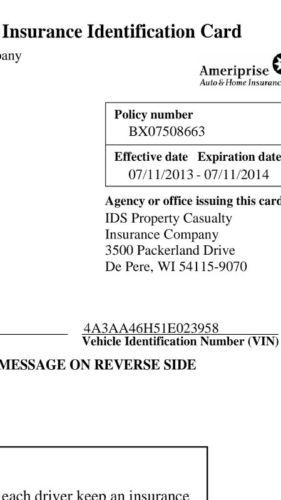

Asking price is $1,500, but will consider all offers. 2002 Galance 60k miles. You're probably confused by the pics- they're all I have available at the moment (may update with more tomorrow when I get the chance to go to the tow place. My brakes locked up and I had a low impact with this truck. I didn't have collision, and the storage is costing $40/day. This was my second car, so I feel it's better to liquidate it then deal with figuring everything out. The car has a clean title, but is being sold "as is" for obvious reasons. Cars been good to me, and you get the fortune of a lot of recent upgrades including many belts and hoses. Ebay isn't recognizing the vin so I included a pic from my insurance, but it's 4A3AA46H51E023958. Let me know if you have any questions. I accept paypal, and require immediate payment because the auctions so short and need the car sold before I incur more storage charges. |

Mitsubishi Evolution for Sale

2004 mitsubishi eclipse gts 3.0l manual clean carfax!(US $7,750.00)

2004 mitsubishi eclipse gts 3.0l manual clean carfax!(US $7,750.00) Evo x mr hks exhaust k sport coilovers work emotion wheels wicked white must see(US $29,950.00)

Evo x mr hks exhaust k sport coilovers work emotion wheels wicked white must see(US $29,950.00) 2001 mitsubshi eclipsie gt coupe , pearl white exterior , tan interior

2001 mitsubshi eclipsie gt coupe , pearl white exterior , tan interior 2000 mitsubishi eclipse rs coupe red low reserve

2000 mitsubishi eclipse rs coupe red low reserve 2003 mitsubishi eclipse gs coupe - lots of extras - modded - sound system +(US $4,200.00)

2003 mitsubishi eclipse gs coupe - lots of extras - modded - sound system +(US $4,200.00) 2007 mitsubishi eclipse gs coupe 2-door 2.4l(US $10,000.00)

2007 mitsubishi eclipse gs coupe 2-door 2.4l(US $10,000.00)

Auto Services in Massachusetts

Westover Auto Salvage ★★★★★

Watertown Towing ★★★★★

Total Auto Repair ★★★★★

Tom`s Automotive ★★★★★

Supreme Auto Body ★★★★★

Squire Road Auto Repair ★★★★★

Auto blog

Mitsubishi's 2024 updates include free maintenance, new trim levels

Wed, Jul 5 2023Mitsubishi is making several changes to its portfolio for the 2024 model year. It's expanding its range with new trim levels that benefit from a longer list of standard features and several specific styling cues, and it's giving buyers free maintenance for two years or 30,000 miles. Starting at the top of the range, the hybrid and non-electrified variants of the Outlander get a new Platinum Edition variant characterized by Black Diamond paint, a roof panel finished in Alloy Silver for a two-tone look, a Light Gray interior, and silver-colored interior trim, among other accents. Mitsubishi will fully detail the trim level later in 2023. The Black Edition package offered during the 2023 model year returns for 2024. It's compatible with the SE and SEL trim levels, and the latter gets black exterior trim as well as black leather upholstery. SE and SEL variants of the Eclipse Cross receive a power-operated hatch with a kick-motion sensor, while the SE's list of standard features grows further with adaptive cruise control, a USB port for rear-seat passengers, and a leather-upholstered steering wheel. The LE model gets a free two-year subscription to Mitsubishi Connect and FAST-Key keyless entry technology. The range will expand later in 2023 with a Special Edition model that will feature "rugged, off-road-inspired styling enhancements," according to the Japanese company. Positioned as Mitsubishi's entry-level crossover, the Outlander Sport highlights Mitsubishi's off-road heritage with a Trail Edition model that's characterized by black graphics on the hood, black exterior trim, mud flaps, and all-weather floor mats. Photos of the model haven't been released yet, however. And, don't look for a 2024 Outlander Sport GT on your local dealer's lot: Mitsubishi changed the trim's name to SEL. Updates to the Mirage hatchback and the Mirage G4, which are both nearing the end of their life cycle, are relatively minor. The LE trim level positioned near the bottom of the range benefits from a longer list of standard features, including a driver's armrest, automatic headlights, and rain-sensing wipers. Graphite Gray and Jet Black join the color palette to replace Mercury Gray and Mystic Black, respectively. Every member of Mitsubishi's 2024 range regardless of size, price, and trim level benefits from free maintenance for two years or 30,000 miles, whichever comes first.

Mitsubishi i-MiEV reportedly reaches the end of the road this year

Fri, Oct 2 2020It looks like the Mitsubishi i-MiEV is completely out of juice. News outlet Nikkei reports that Mitsubishi will completely end production of its tiny electric car this year. While the i-MiEV had been discontinued in the U.S. for a few years already, it was apparently still on sale elsewhere. That didn't mean it was doing well, as Nikkei notes that global sales were only a little over 30,000 units over its lifetime. It's not hard to see why the i-MiEV struggled. While its kei-car size and funky styling made it a unique city car, it was compromised in other ways. It only made 66 horsepower and had an official range of 62 miles. While the limited range was augmented somewhat by DC fast charging capability, but it didn't take long for competitors to launch larger, more powerful, longer-range cars for not a whole lot more money. And the gulf between the i-MiEV only expanded over the years. According to Nikkei, the reason the i-MiEV went so long unchanged was a lack of funding and resources. But now that Mitsubishi is part of the Renault-Nissan Alliance, the news outlet reports that there will be a successor to the bubbly EV co-developed with Nissan to be launched in 2023. Whether this next small electric Mitsubishi appears in the U.S. seems like a toss-up. We wouldn't have expected the kei-car based i-MiEV to have been brought here originally, simply because of the cost of making such a tiny car pass safety regulations, let alone appeal to American buyers that like size. Those issues haven't changed, and if anything, American buyers are even more keen on trucks and SUVs than before. But maybe if fuel economy and emissions regulations get stiff enough, Mitsubishi might see a benefit to offering a full EV here, even if it's an odd size. Related Video:

Mitsubishi profits in North America for first time in seven years

Fri, Apr 24 2015Well, this is a change of pace. Mitsubishi has actually made some money in North America. It's the company's first operating profit in seven years, and while it might only be $4.18 million – yes, Mitsubishi made less in 2014 than some professional athletes – it's definitely a start. Sales in the US were up 19 percent between January and March, to 32,000 units, while 2014's overall sales jumped 21 percent to 117,000 units, Automotive News reports. Perhaps more impressively, the company is predicting a bountiful 2015, with sales up to 128,000 units and operating profits climbing to $58.5 million. If Mitsubishi is doing this with cars like the ancient Lancer and the awful Mirage, we should probably expect some good things when newer, more competent vehicles like the new Outlander hit dealers.