1999 Mitsubishi Montero Sport Limited No Reserve on 2040-cars

Troutman, North Carolina, United States

Vehicle Title:Clear

For Sale By:Dealer

Engine:3.5L 3497CC 215Cu. In. V6 GAS SOHC Naturally Aspirated

Body Type:Sport Utility

Fuel Type:GAS

Make: Mitsubishi

Warranty: No

Model: Montero Sport

Trim: Limited Sport Utility 4-Door

Doors: 4

Drive Type: RWD

Fuel: Gasoline

Mileage: 204,685

Drivetrain: RWD

Sub Model: Sport Limited

Exterior Color: Green

Number of Cylinders: 6

Interior Color: Tan

Mitsubishi Evolution for Sale

2010 mitsubishi lancer evolution mr

2010 mitsubishi lancer evolution mr 1986 mitsubishi pajero 2.3 turbo diesel low kilometer very clean 4x4 5speed hilo(US $8,500.00)

1986 mitsubishi pajero 2.3 turbo diesel low kilometer very clean 4x4 5speed hilo(US $8,500.00) 4dr sdn es 2.4l cd power windows power door locks tilt wheel cruise control(US $7,595.00)

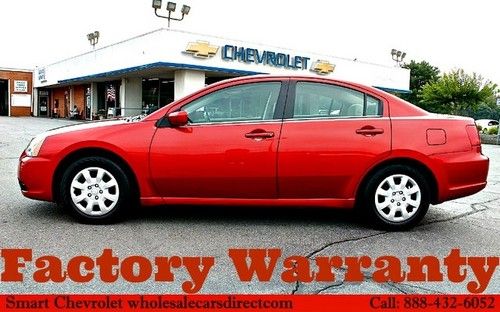

4dr sdn es 2.4l cd power windows power door locks tilt wheel cruise control(US $7,595.00) Used 2012 mitsubishi galant es import automatic 4dr sedan we finance gas saver

Used 2012 mitsubishi galant es import automatic 4dr sedan we finance gas saver 08 mitsubishi lancer gts, loaded with nav and all options. super clean!(US $10,988.00)

08 mitsubishi lancer gts, loaded with nav and all options. super clean!(US $10,988.00) 2008 mitsubishi lancer evolution mr(US $27,000.00)

2008 mitsubishi lancer evolution mr(US $27,000.00)

Auto Services in North Carolina

Wheel Works ★★★★★

Vintage & Modern European Service ★★★★★

Victory Lane Quick Oil Change ★★★★★

Valvoline Instant Oil Change ★★★★★

University Ford North ★★★★★

University Auto Imports Inc ★★★★★

Auto blog

2021 Mitsubishi Outlander PHEV Road Test Review | Improved but falling behind

Wed, Jul 7 2021You canít tell by looking at it, but the 2021 Mitsubishi Outlander PHEV is a thoroughly upgraded version of the plug-in crossover that initially debuted in the United States for the 2018 model year. Yes, despite the fact that there is a completely new, from-the-ground-up version of the gas-only Outlander for 2022, the previous generation soldiers on in its plug-in hybrid form for at least the next couple of model years as the engineering team puts the finishing touches on an edition based on the new platform. Still, there¬ís a lot of new bits and pieces under the skin that make this a better and more useful electrified SUV than before. A new 2.4-liter four-cylinder engine replaces the previous 2.0-liter, bumping power to 126 horsepower and 148 pound-feet of torque. It join forces with upgraded electric motors to send as much as 221 hp to all four wheels. That's a 31-horsepower increase over the old Outlander PHEV.¬† Most of the time, the gasoline engine sends its power to the battery pack, leaving motive force to come from the two electric motors. Up front is a motor that delivers 60 kilowatts (around 80 hp) and 101 lb-ft; at the rear is a second motor that spins out 70 kilowatts (94 hp) and 144 lb-ft. That rear motor is up 10 kilowatts over the old version, which is significant. Electric range is boosted from 22 to 24 miles thanks to a 13.8-kWh battery in place of the old 12-kWh pack. These powertrain enhancements make the 2021 Outlander PHEV feel quicker around town than the old one while simultaneously improving its efficiency. Win/win. There are Eco, Save, Charge, Normal, and Sport driving modes, and they all make sense with the possible exception of Sport, since this is very much not a sporty sport utility vehicle. Save mode preserves the battery pack¬ís current state of charge in case you want to choose when to unleash your electrons (stop-and-go city driving after a lengthy highway commute, for instance), and Charge mode keeps the engine running to top off the battery pack while the vehicle is driven. We mostly left the vehicle in Normal mode and let it choose how to dole out the power. The overlying theme of the 2021 Outlander PHEV is one of peace and serenity. It¬ís quiet inside, and the electric motors provide a smooth driving experience with softish initial power that gains steam as the vehicle gets to normal around-town speeds. There aren¬ít any gear changes, so the powertrain always feels smooth.

Junkyard Gem: 1990 Mitsubishi Mirage Sedan

Sun, Oct 16 2022In the early 1970s, Chrysler (lacking funds to develop a brand-new subcompact for the American market) began importing Mitsubishi Colt Galants and putting Dodge Colt badges on them. Chrysler's relationship with Mitsubishi deepened over subsequent decades, with numerous Mitsubishis sold here with Dodge, Plymouth, Chrysler, and Eagle badging. That didn't stop Mitsubishi Motors from selling some of the very same vehicles, though, once sales of Mitsubishi-badged cars and trucks began here in the 1983 model year. Starting in 1979, Colt badges moved over to the front-wheel-drive Mirage, with the Mirage itself appearing here for the 1985 model year. Here's one of those cars, a rare 1990 sedan in a Denver self-service yard. In 1990, Americans could choose between four near-identical versions of this car sold by different marques: the Mitsubishi Mirage, Dodge Colt, Plymouth Colt, and Eagle Summit. The MSRP on the '90 Mirage sedan was $8,559 (about $15,015 in 2022 dollars) and the prices of the other three were so close as to make no real difference; customers could just shop for the best rebates and financing. Americans couldn't get this generation of the Dodge/Plymouth Colt as a sedan, though Canadians could. Most of the Mirages and Summits sold here were hatchbacks, but Mitsubishi and Eagle dealers probably wanted something to compete with the Civic and Corolla sedans of the era. Mitsubishi certainly got its money's worth out of the 4G aka Orion engine family! This is a 1.5-liter SOHC 4G15, rated at 81 horsepower. The early Hyundai Excel (and its Mitsubishi-badged twin, the Precis) got a version of this engine. If you bought the Mirage Turbo, you got a DOHC version displacing 1.6 liters and blasting out 135 horses (but it was only available here until 1989 and just as a hatchback). That 81 horsepower was even less fun than it sounds, in this case, because the original buyer of this Mirage skipped the standard-equipment five-speed manual and paid extra for the three-speed automatic. It has air conditioning, with the "Econo" mode that was so popular among 1980s Japanese cars. Not quite 100,000 miles passed beneath its wheels during 32 years of service. At some point, a set of Mercury Tracer hubcaps was slapped on the unsightly steel wheels. The lug holes don't line up, but who's going to notice? Sold out of the now-defunct Ehrlich dealership in Greeley, Colorado, back when you could buy an Isuzu or a Nissan on the same lot.

Mitsubishi Ground Tourer Concept will show next-gen PHEV ideas in Paris

Tue, Jun 28 2016Mitsubishi still hasn't released the Outlander PHEV here in the US, but we're already going to get a potential preview of the company's next large plug-in hybrid at the Paris Motor Show this fall. Mitsubishi has released a side-profile teaser image of the Ground Tourer Concept, which the company says "further expresses" Mitsubishi's flagship PHEV technology. It's got a floating red roof with sharp angles on the back and a cool silver body. It's certainly early for a Paris tease, but we'll take what we can get when it comes to more large plug-in vehicles. Related Video: Mitsubishi Ground Tourer Concept To Be Unveiled At Paris Motor Show / June 27, 2016 ó CYPRESS, CALIF. Mitsubishi Motors Corporation (MMC) today announced the debut of the all-new "Ground Tourer Concept" at the 2016 Paris Motor Show this fall. An up-market SUV, the Ground Tourer Concept is aimed to be the latest expression of Mitsubishi Motors' design ambitions, expressed through four powerful elements: Augmented Possibilities, Functional Beauty, Solid Thrust and Japanese Craftsmanship. The newest concept further expresses Mitsubishi Motors' plug-in hybrid electric (PHEV) flagship technology. The combination of advanced driving technologies packaged using the latest Japanese design trends and quality will propel the Ground Tourer Concept for effortless cruising in all driving conditions on and off road; all while accommodating passengers in a quiet, comfortable and luxuriously crafted interior. The Ground Tourer concept is a continuance of MMC's design philosophy and showcases the commitment to its role in the SUV/CUV segment. About Mitsubishi Motors North America, Inc. Mitsubishi Motors North America, Inc., (MMNA) is responsible for all research & development, manufacturing, marketing, sales and financial services for Mitsubishi Motors in the United States. MMNA sells sedans and crossovers/SUVs through a network of approximately 380 dealers. MMNA is a leading the way in development of highly-efficient, affordably priced new gasoline-powered automobiles while using its industry-leading knowledge in battery electric vehicles to develop future EV and PHEV models. For more information, contact the Mitsubishi Motors News Bureau at (888) 560-6672 or visit media.mitsubishicars.com.