1997 Mitsubishi Eclipse Rs Hatchback 2-door 2.0l Mechanics Special on 2040-cars

Blacksburg, Virginia, United States

|

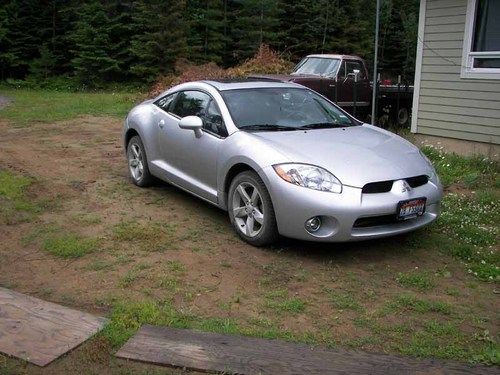

This is a 1997 Mitsubishi eclipse. It does have a sunroof, and it has a aftermarket stereo that is a CD player. The front tires are in good tread, but the rear tires are worn.The body is red and has scratches on the driver side rear Fender and the rear bumper has damage. It also has aftermarket lights. It has aftermarket wheels on it. The rear tires are worn. The interior is inherent in fairly good shape. The racket that goes around the driver's merit adjustment lever is missing. The owner says the AC was working and the heater was working. It is a five-speed. Both the power steering and brakes are in good working order. And it was being driven until very recently. The motor does start and run, but has a very notable rattle to it. And should not be driven. This car will need to be towed. If you have any more questions please ask.

|

Mitsubishi Eclipse for Sale

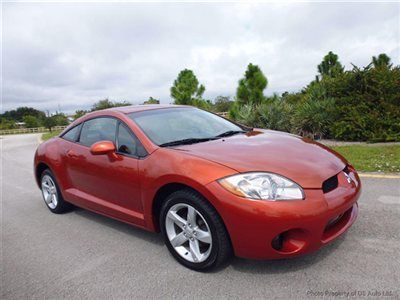

2007 mitsubishi eclipse gs coupe 2-door 2.4l(US $8,600.00)

2007 mitsubishi eclipse gs coupe 2-door 2.4l(US $8,600.00) No reserve 2003 mitsubishi eclipse gs 1 owner no accidents super clean runs grt

No reserve 2003 mitsubishi eclipse gs 1 owner no accidents super clean runs grt 2007 mitsubishi eclipse gs coupe 2-door 2.4l(US $7,300.00)

2007 mitsubishi eclipse gs coupe 2-door 2.4l(US $7,300.00) 06 eclipse gs 5-speed one owner clean carfax dealer serviced hatchback financing

06 eclipse gs 5-speed one owner clean carfax dealer serviced hatchback financing 1997 mitsubishi eclipse gs hatchback 2-door 2.0l(US $1,650.00)

1997 mitsubishi eclipse gs hatchback 2-door 2.0l(US $1,650.00) Mitsubishi eclipse gsx race rally drift drag ralliart evo talon laser dsm 4g63

Mitsubishi eclipse gsx race rally drift drag ralliart evo talon laser dsm 4g63

Auto Services in Virginia

West Broad Hyundai ★★★★★

Virginia Tire & Auto Of Falls Church ★★★★★

Virginia Auto Inc ★★★★★

Total Auto Service ★★★★★

Shorty`s Garage ★★★★★

Rosner Volvo Of Fredericksburg ★★★★★

Auto blog

Renault-Nissan-Mitsubishi pool $200 million to invest in tech startups

Fri, Jan 5 2018PARIS — The Renault-Nissan-Mitsubishi alliance is setting up a $200 million mobility tech fund, three sources said, in the latest move by major carmakers to adapt to rapid industry change by investing in startups through their own venture capital arms. The fund, due to be unveiled by Chief Executive Carlos Ghosn at the CES tech industry show in Las Vegas next Tuesday, will be 40 percent financed by Renault, 40 percent by Nissan and 20 percent by Mitsubishi. "It will allow us to move faster on acquisitions ahead of our competition," one of the alliance sources told Reuters. Frederique Le Greves, a spokeswoman for the Renault-Nissan-Mitsubishi alliance, declined to comment. The traditional auto industry model based on individual ownership is threatened by pay-per-use services such as Uber, as well as ride- and car-sharing platforms, a challenge heightened by parallel shifts towards electrified and self-driving cars. Wary carmakers are struggling to embrace changes and technologies that some of their executives are only beginning to grasp. To accelerate the process, many are investing directly in the new services — and gaining access to intellectual property — via their own corporate venture capital (CVC) funds. BMW has purchased stakes in a plethora of ride-sharing, smart-charging and autonomous vehicle software firms through its 500 million euro ($600 million) iVentures fund, the biggest such in-house facility belonging to a carmaker. Among others that have been increasingly active are General Motors' GM Ventures, with $240 million, and Peugeot-maker PSA Group's 100 million-euro investment arm. CVC funds, a familiar feature of innovative sectors such as tech and pharmaceuticals, have become more commonplace among carmakers since the 2008-9 financial crisis. They let companies skip some of the formalities otherwise required for new investments, and pounce more swiftly on promising startups. The Renault-Nissan-Mitsubishi venture will also obviate the current need to thrash out the ownership split for each new alliance acquisition. It represents a further step in the integration of the carmakers as they pursue 10 billion euros in annual synergies by 2022. France's Renault holds a 43.4 percent stake in Nissan, which in turn controls Mitsubishi. Ghosn heads Renault and chairs all three.

Geely and Renault joint venture will develop internal combustion and hybrid tech

Tue, Jul 11 2023China's Geely Automobile Holdings and French car maker Renault SA on Tuesday said they will invest up to 7 billion euros ($7.71 billion) in a new equally held joint venture to develop gasoline engines and hybrid technology for automobiles. The JV is aimed at manufacturing more efficient internal combustion engines and hybrid systems at a time when the focus of much of the automobile industry has been on the capital-intensive transition to purely electric vehicles. "We are pleased to be embarking on this journey to become a global leader in hybrid technologies, providing low-emission solutions for automakers around the world," said Eric Li, Geely Holding Group chairman. The new company will employ 19,000 people at 17 engine plants and five research and development hubs, Renault said. At launch, it is expected to supply to multiple industrial customers including Volvo, Proton, Nissan, Mitsubishi Motors, and PUNCH Torino. The JV aims to have an annual production capacity of up to five million internal combustion, hybrid and plug-in hybrid engines and transmissions, Renault added. Reuters reported in March that the new venture will see 15 billion euros ($16.53 billion) in annual revenue. Saudi Aramco, which signed a letter of intent with Renault and Geely in March, is evaluating a strategic investment in the new company, Renault said. The Saudi oil producer has been involved in advanced discussions to take a stake of up to 20% in the JV, sources said earlier this year. Big oil firms have worked with automakers to develop sustainable fuels and hydrogen engines in recent years. But a deal here would make Aramco the first major oil producer to invest in the car business. The joint venture is expected to be launched in the second half of 2023. Earnings/Financials Green Mitsubishi Nissan Volvo Renault

10 automakers shack up in Detroit hotel to talk Takata airbags

Sun, Dec 14 2014Since Takata has decided not to take the lead concerning potential issues with its airbag inflators, the automakers have. Perhaps that's unsurprising, since it's the automakers, not Takata, that will take a beating on the dealership floor if consumers decide its models are a health hazards. The Detroit News reports that Toyota, Honda, General Motors, Ford, Chrysler, Mazda, BMW, Nissan, Mitsubishi and Subaru met in a hotel conference room near the Detroit Metropolitan Airport last week to sort out a way to understand the technical issues involved. So far, faulty airbag inflators have been ruled the cause of five deaths and 50 injuries around the world, but neither Takata nor investigators understands exactly why the inflators are malfunctioning. The National Highway Traffic Safety Administration recently asked Takata to issue a national recall, Takata declined, citing a minuscule failure rate and the fact that it's still investigating the issue. Toyota and Honda then made an industry-wide appeal for "a coordinated, comprehensive testing program" that would pinpoint the problem inflators and get them replaced, and that's what the Detroit meeting was about. Numerous issues, however, will make this a long row to hoe: simply getting the parts to replace the nearly 20 million inflators in cars recalled around the world so far - even working with other suppliers - will take a years, but more importantly, no one knows if the replacement inflators currently being installed will suffer the same issue. Answers will hopefully come quickly with Takata, the ten automakers and NHTSA all independently investigating the problem.