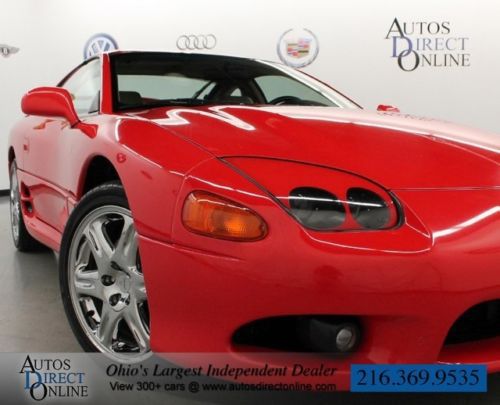

Sl 2dr Hatch Hatchback Antenna Type - Power Cassette Center Console Rear Spoiler on 2040-cars

South El Monte, California, United States

|

$$$ 3,500.00- Please see pictures or in person. Runs very good, smooth & fast.

|

Mitsubishi 3000GT for Sale

1 owner we ship leather bucket seats cd audio spoiler low miles sunroof chromes(US $16,000.00)

1 owner we ship leather bucket seats cd audio spoiler low miles sunroof chromes(US $16,000.00) 1999 mitsubishi 3000gt base coupe 2-door 3.0l - perfect project car.(US $3,000.00)

1999 mitsubishi 3000gt base coupe 2-door 3.0l - perfect project car.(US $3,000.00) 1994 mitsubishi 3000gt vr-4 coupe 2-door 3.0l

1994 mitsubishi 3000gt vr-4 coupe 2-door 3.0l 1993 mitsubishi 3000gt vr4 twin turbo all wheel drive sunroof 73k chrome wheels(US $10,977.00)

1993 mitsubishi 3000gt vr4 twin turbo all wheel drive sunroof 73k chrome wheels(US $10,977.00) 515whp mitsubishi 3000gt vr-4 lots mods(US $16,500.00)

515whp mitsubishi 3000gt vr-4 lots mods(US $16,500.00) 1995 mitsubishi 3000gt vr-4 – mechanics only(US $3,500.00)

1995 mitsubishi 3000gt vr-4 – mechanics only(US $3,500.00)

Auto Services in California

Zip Auto Glass Repair ★★★★★

Z D Motorsports ★★★★★

Young Automotive ★★★★★

XACT WINDOW TINTING & 3M CLEAR BRA PAINT PROTECTION ★★★★★

Woodland Hills Honda ★★★★★

West Valley Machine Shop ★★★★★

Auto blog

Mitsubishi pondering $2B share sale?

Sun, 15 Sep 2013Mitsubishi makes the brilliantly fast, wonderfully fun Lancer Evolution. Outside of that road-going rally car, the rest of the range is pretty poor - the new Outlander isn't bad, but the subcompact Mirage looks like might've been competitive five years ago, while the Galant and Lancer have suffered from serial neglect.

This hasn't just lead to rumors of Mitsu's death in America; the subsidiary of the massive Mitsubishi Group has been in trouble at home, too. It was bailed out by three other Mitsubishi Group companies - Mitsubishi UFJ Financial, Mitsubishi Heavy Industries and Mitsubishi Corporation - between 2004 and 2005, according to Bloomberg. Now, it's attempting to extricate itself from "emergency mode," as analyst Koichi Sugimoto told the financial site, adding that "they're still in the very early stages of recovery."

As part of the bailout, Mitsubishi issued its three saviors billions of dollars of preferred shares, which don't have voting rights. The problem is, Mitsubishi hasn't issued dividend payments since 1998, and these stocks aren't exactly competing with Apple or Google, in terms of value. In other words, they're mostly worthless. With a public offering, Mitsubishi is expecting to raise 200 billion yen, or about $2 billion, in order to reduce the number of preferred shares. If all goes according to plan, it will wipe out preferred shares by March of 2014, or the end of fiscal year 2013.

Mitsubishi teases new compact crossover that could be called Eclipse

Tue, Jan 24 2017Does the world need another compact crossover? No, not really. But Mitsubishi could certainly use another vehicle in the hottest segment in America. And the Japanese automaker is about to show off a brand-new model at the upcoming Geneva Motor Show that will slot between the Outlander Sport and the larger Outlander. Rumors suggest that this new compact crossover might revive a well-known name from the past: Eclipse. While that's undeniably better than a random series of numbers or letters, or another riff on the Outlander moniker, Mitsubishi would surely alienate some of its hardcore fans by christening a CUV with the name of an old sport coupe. Here's hoping those rumors stay exactly that. Moving past the potentially controversial name, what we're looking at is a pretty conventional coupe-like two-box shape. The sloping roofline looks current, and the steeply raked rear glass adds a sporty flare. We've got a little over a month before we see the new 'ute in all its glory, and probably about a year before it's in US showrooms. In the meantime, check out the dark teaser above or click to enlarge it down below. Related Video:

Mitsubishi hopes to raise $2.5B with stock sale

Wed, 22 Jan 2014Mitsubishi, which dates all the way back to 1870, is one of the oldest business collectives in Japan. Today, the various businesses that share the Mitsubishi name are largely independent of each other. The automotive unit, however, has fallen on hard times over the past few years.

Back in 2004 and 2005, Mitsubishi Motors sold billions of preferred shares to sister companies like Mitsubishi UFJ Financial Group, Mitsubishi Heavy Industries and Mitsubishi Corp. Now the automaker is preparing to buy back those shares, only to raise the capital, it's selling $2.5 billion worth of shares, simultaneously paying stock dividends for the first time in over 16 years.

The stock issue will reportedly include as many as 241 million shares at a value of $10.73 each. The move is part of a long-term reorganization being implemented by the automaker's president Osamu Masuko, and is expected to help the company double its net income and eliminate all outstanding preferred shares by the end of the fiscal year closing in March.