Coupe Red Ferrari 1998 on 2040-cars

Ramona, California, United States

|

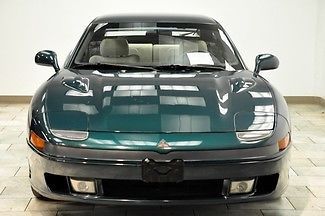

MITSUBISHI 3000 GT 1998, GREAT CONDITION SOME SCRATCHES ON THE PAINT BUT NOTHING MAJOR, ONE DENT NO VBIGGER THAN 3 INCHS!, LEATHER INTERIORS BEIGE COLOR AND A GREAT CONDITIONS, NEW TIRES, BRAKES LINE UP! SMOG CHECK PAPER ON HAND AND TITLE CLEAN UPDATE, 104,600 ORIGINAL MILES NO ALTERATIONS OR TRANSFORMATIONS. 2014 STICKERS UPDATE,ELECTRIC WINDOWS,AIR BAGS ORIGINALS NOT SUBSTITUTIONS.

|

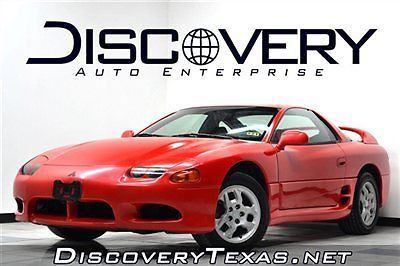

Mitsubishi 3000GT for Sale

1992 mitsubishi 3000gt 3000 5speed(US $3,400.00)

1992 mitsubishi 3000gt 3000 5speed(US $3,400.00) *3000gt* free 5-yr warranty / shipping! v6 auto alloys must see!(US $8,995.00)

*3000gt* free 5-yr warranty / shipping! v6 auto alloys must see!(US $8,995.00) 1998 mitsubishi 3000gt base coupe 2-door 3.0l

1998 mitsubishi 3000gt base coupe 2-door 3.0l 92' mitsubushi 3000gt vr4 entire car as is for parts(US $500.00)

92' mitsubushi 3000gt vr4 entire car as is for parts(US $500.00) 1999 mitsubishi 3000gt sl coupe 2-door 3.0l

1999 mitsubishi 3000gt sl coupe 2-door 3.0l 1996 mitsubishi 3000gt sl coupe 2-door 3.0l

1996 mitsubishi 3000gt sl coupe 2-door 3.0l

Auto Services in California

Young`s Automotive ★★★★★

Yas` Automotive ★★★★★

Wise Tire & Brake Co. Inc. ★★★★★

Wilson Motorsports ★★★★★

White Automotive ★★★★★

Wheeler`s Auto Service ★★★★★

Auto blog

Nissan posts $6.2 billion annual loss and unveils plan to cut costs

Thu, May 28 2020TOKYO — Nissan outlined a new plan on Thursday to become a smaller, more cost-efficient carmaker after the coronavirus pandemic exacerbated a slide in profitability that culminated in its first annual loss in 11 years. Under a new four-year plan, the Japanese manufacturer will slash its production capacity and model range by about a fifth to help cut 300 billion yen from fixed costs. It will shut plants in Spain and Indonesia, leave the South Korean market and pull its Datsun brand from Russia as part of a strategy unveiled on Wednesday to share production globally with its partners Renault and Mitsubishi. "I will make every effort to return Nissan to a growth path," Nissan Chief Executive Makoto Uchida said, adding that the company had learned from its past mistakes of chasing global market share at all costs. "We must admit failures and take corrective actions," he said, adding that starting with top-level managers, the company had to break its inward-looking culture which in the past has stymied efforts to deepen cooperation with France's Renault. Uchida said improving the company's cash flow was its biggest challenge. He reiterated that Nissan's cash liquidity was good even though it had negative free cash flow of 641 billion yen in the year ended in March. Nissan declined to give any forecasts for its current financial year which started in April due to the uncertainty created by the coronavirus pandemic. It also declined to give details on how many jobs it was cutting. In what is Nissan's second recovery plan in less than a year, Uchida pledged a return to profitability with a core operating profit margin above 5% and a sustainable global market share of 6%. Nissan posted an annual operating loss of 40.5 billion yen for the year to March 31, its worst performance since 2008/09. Its operating profit margin was -0.4%. The automaker said on Thursday that it sold 4.9 million vehicles last year, up from an earlier estimate of 4.8 million. That was still the second decline in a row and a fall of 11% from the previous period but meant Nissan clung on to its position as Japan's second biggest carmaker, just ahead of Honda and a long way behind Toyota. Pandemic pressure Even before the spread of the novel coronavirus, Nissan's slumping profits had forced it to row back on an aggressive expansion plan pursued by ousted leader Carlos Ghosn. The pandemic has only piled on the urgency to downsize.

Mitsubishi struggling to sell doomed plant due to union workers

Sat, Oct 3 2015Mitsubishi is about to end vehicle production in the US, but the company is having serious problems finding a buyer for its Normal, IL, factory that currently assembles the Outlander Sport. A major sticking point, according to a report by The Wall Street Journal, is the plant's workforce of over 900 United Auto Workers members. The automaker has been trying to find another company to take over the site for months and has set November as the point to stop manufacturing there. The Normal, IL, factory is unique because it's the only plant in the country that's run by a Japanese automaker with a UAW-represented workforce, after starting as a joint venture with Chrysler. That makes Ford, General Motors, and FCA the preferred buyers because they could conceivably take over the union contract. However, the Blue Oval and the General likely aren't interested. According to plant officials speaking to The Wall Street Journal, FCA and some unnamed car companies are potential buyers, but there's absolutely nothing final, yet. Proponents argue that buying the location is cheaper than building a new one. Making matters harder is that the UAW and Mitsubishi are currently negotiating a new union contract, and the factory's next owner might have to take over the deal, according to the WSJ. The workers were ready to vote whether to strike recently, but that was averted when an announcement on the local's webpage said a tentative agreement was expected Sunday. Of course, the Big Three have been experiencing their own, similar issues with crafting deals, too. Related Video:

Nissan shares slide 5% after report Renault exploring stake reduction

Mon, Apr 25 2022TOKYO — Shares of Nissan Motor Co slumped 5% on Monday, their biggest fall in more than a month, following a report that top shareholder Renault may consider lowering its stake in the Japanese automaker. Bloomberg reported on Friday that Renault may consider lowering its Nissan shareholding as part of plans to separate its electric vehicle business. The French car maker has been pushing ahead with plans to split its electric and combustion-engine businesses in an attempt to catch rivals such as Tesla and Volkswagen On Friday, Renault said all options were on the table for separating the electric vehicle business, including a possible public listing in the second half of 2023. Any plans would be subject to approval from alliance partner Nissan, Renault finance chief Thierry Pieton said, adding the Japanese automaker was "in the loop" as Renault weighed up its options. Renault and Nissan have declined to comment on the report. Shares of Nissan fell to 509.8 yen in Tokyo, marking their biggest one-day decline since early March and underperforming an almost 2% drop in the Nikkei index. The car makers' two-decade-old alliance, which includes Mitsubishi Motors, was rocked by the 2018 ouster of alliance founder Carlos Ghosn amid a financial scandal. They have since pledged to pool more resources. In January they said they would work more closely together to make electric cars. They detailed a $26 billion investment plan for the next five years. But their unequal relationship has long been a source of friction in Japan. Renault owns 43.4% of Nissan, which in turn has a 15% non-voting stake in its shareholder. Renault bailed out Nissan two decades ago, but is now the smaller automaker by sales. Related video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Earnings/Financials Green Mitsubishi Nissan Renault