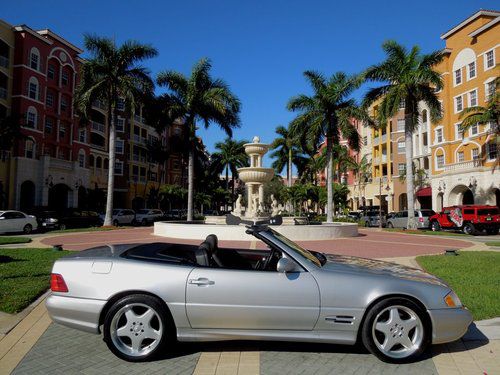

2009 Mercedes Sl550*only 19k Miles*amg*ex Cond*we Finance*we Trade! on 2040-cars

Houston, Texas, United States

For Sale By:Dealer

Engine:5.5L 5461CC V8 GAS DOHC Naturally Aspirated

Body Type:Convertible

Transmission:Automatic

Fuel Type:GAS

Warranty: Vehicle has an existing warranty

Make: Mercedes-Benz

Model: SL550

Trim: Base Convertible 2-Door

Disability Equipped: No

Doors: 2

Drive Type: RWD

Drive Train: Rear Wheel Drive

Mileage: 19,532

Inspection: Vehicle has been inspected

Sub Model: SL550 AMG SP

Number of Doors: 2

Exterior Color: Black

Interior Color: Tan

Number of Cylinders: 8

Cab Type (For Trucks Only): Other

Mercedes-Benz SL-Class for Sale

1969 mercedes benz 280 sl expertly restored california car pagoda(US $134,900.00)

1969 mercedes benz 280 sl expertly restored california car pagoda(US $134,900.00) 1999 mercedes-benz sl500**rare low miles**fl(US $34,995.00)

1999 mercedes-benz sl500**rare low miles**fl(US $34,995.00) 1967 mercedes 250sl!! off white on black!! collectors piece!! gorgeous!!(US $52,999.00)

1967 mercedes 250sl!! off white on black!! collectors piece!! gorgeous!!(US $52,999.00) 1987 mercedes-benz 560sl**low miles**fl(US $19,995.00)

1987 mercedes-benz 560sl**low miles**fl(US $19,995.00) 2009 mercedes benz sl550 silver arrow ed w/ 23k miles(US $58,777.00)

2009 mercedes benz sl550 silver arrow ed w/ 23k miles(US $58,777.00) 2011 mercedes benz sl550, p1, diamond white w/ 21k miles(US $70,444.00)

2011 mercedes benz sl550, p1, diamond white w/ 21k miles(US $70,444.00)

Auto Services in Texas

Zeke`s Inspections Plus ★★★★★

Value Import ★★★★★

USA Car Care ★★★★★

USA Auto ★★★★★

Uresti Jesse Camper Sales ★★★★★

Universal Village Auto Inc ★★★★★

Auto blog

Mercedes considering Audi Allroad rival

Fri, Jun 19 2015The Audi Allroad is something of an anomaly in the automotive world. Its competitors are limited to the recently released Volvo V60 Cross Country and perhaps the far cheaper Subaru Outback. The lifted premium wagon hasn't exactly done great for Audi, only selling a few hundred examples each month. Its best sales year was 2013, and even then, only 5,300 left US showrooms. Despite these limited prospects, word from Australia is that Mercedes-Benz is looking at launching its own competitor to the Allroad. "We are looking at every single niche, so we are studying this [Allroad] at the moment, but it is not confirmed," Matthias Luhrs, VP of sales and a member of the product management at MB, told Motoring.com.au. "We are looking obviously at C-Class and E-Class, but no confirmation at the moment." Fortunately, Luhrs recognizes that the Allroad isn't exactly a smash in the US. "In the US, no matter how long, short, high ... they don't like station wagons," Luhrs said, while adding that the Allroad concept is "developing quite successfully" in Italy and southern Europe. And for those hoping for a lifted C- or E-Class sedan, Luhrs also put the kibosh on that, saying, "We are not studying that." So what does this tell us? Well, it's still far from a sure thing that Mercedes will launch a lifted C-Class or E-Class Estate. And even if the company does go ahead with it, like the rest of the brand's long roofs (E-Class aside), don't expect to see it on US roads.

Mercedes G63 vs. BMW i8: Our silly drag race between the past and future

Tue, Nov 17 2015You see, we were just trying to conserve resources. We had Milan Dragway rented for a test of the AMS Alpha 10 Audi R8, and there was some extra track time, so we brought these two along. That's called saving money. Or something. Aside from being German, the G63 and i8 couldn't really be much more different – one is a prehistoric military vehicle with a nutty twin-turbo V8, the other a vision of the near future of efficient sports cars. So what did we do? We lined them up against each other, editor-in-chief Michael Austin in the i8 and me in the G-Wagen. Though we had a good idea of the likely winner – note which car the boss is driving – the results were still surprising. Watch for yourself above. Green Humor BMW Mercedes-Benz Coupe SUV Hybrid Luxury Performance Videos Original Video drag race milan dragway

VW, Fiat, Mercedes could be CNG winners in Europe

Fri, Dec 12 2014Fiat ads in the US try to play up the exotic, sexy side of Italian culture. On the home front in Italy, however, passenger-vehicle sales are marked by something less edgy and quite a bit more practical: the growth of compressed-natural-gas (CNG) powered car sales. In fact, Italy is leading a group of European countries where CNG sales are on the upswing and may be benefiting automakers like VW, Fiat and Mercedes-Benz, according to Automotive News. VW started sales of its Golf TGI natural-gas vehicle this year – the company's fourth in Europe – while Mercedes-Benz added a natural-gas B-class model. Fiat accounts for about 50 percent of CNG vehicles sold on the continent. In all, Europe's CNG sales through September totaled about 67,000, up seven percent from a year earlier, Automotive News Europe says, citing research firm JATO Dynamics. And the number of CNG vehicles on Europe's roads could jump tenfold within the next decade. The draw is a combination of lower refueling prices and a CNG drivetrain that typically emits less CO2 than diesel vehicles. As for Italy, about five percent of new-vehicle sales are CNG. To put that into perspective, hybrids, battery-electric vehicles, plug-in hybrids and diesels combined to account for about 4.2 percent of US vehicle sales last year. News Source: Automotive News - sub. req.Image Credit: Volkswagen Green Fiat Mercedes-Benz Volkswagen Natural Gas Vehicles CNG