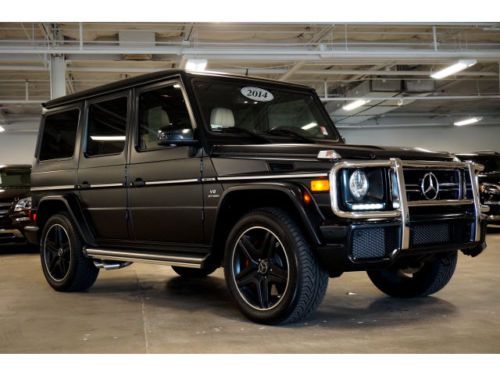

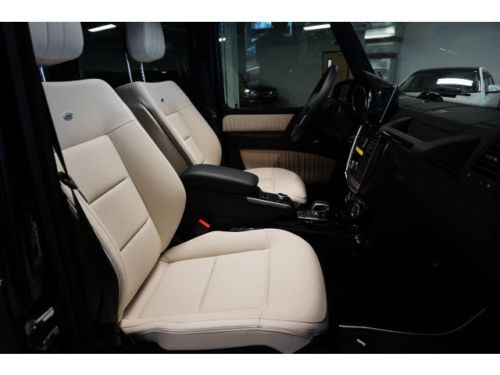

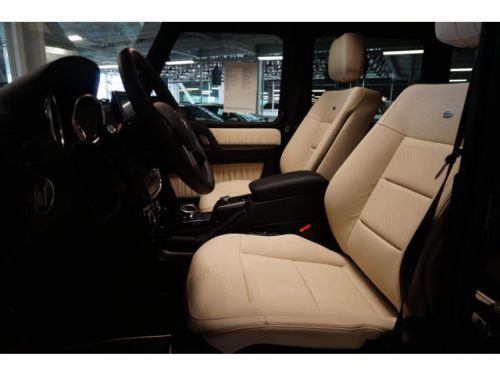

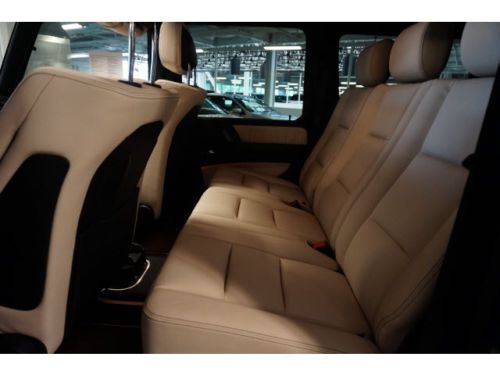

Mercedes 2014 G63 Amg Designo® Porcelain Leather Magno Night Black Low Miles on 2040-cars

Scottsdale, Arizona, United States

Fuel Type:Gasoline

For Sale By:Dealer

Engine:5.5L 5461CC V8 GAS DOHC Turbocharged

Transmission:Automatic

Body Type:SUV

Used

Year: 2014

Make: Mercedes-Benz

Power Options: Power Windows

Model: G-Class

Mileage: 1,227

Sub Model: G63

Vehicle Inspection: Inspected (include details in your description)

Exterior Color: Black

Trim: Base Sport Utility 4-Door

Interior Color: White

Number of Cylinders: 8

Drive Type: AWD

Warranty: Vehicle has an existing warranty

Mercedes-Benz G-Class for Sale

V8 4matic dvd navigation vented seats h/k 1-owner 21's(US $29,980.00)

V8 4matic dvd navigation vented seats h/k 1-owner 21's(US $29,980.00) G class, 300 gd, g 500, g 550, g 63, g wagen, g 55, g wagon, diesel, 4x4, rare(US $25,999.00)

G class, 300 gd, g 500, g 550, g 63, g wagen, g 55, g wagon, diesel, 4x4, rare(US $25,999.00) Very unique g63!!(US $139,800.00)

Very unique g63!!(US $139,800.00) 2010 mercedes benz g550 4matic awd(US $76,800.00)

2010 mercedes benz g550 4matic awd(US $76,800.00) 2010 g550 used 5.5l v8 32v automatic suv premium(US $79,950.00)

2010 g550 used 5.5l v8 32v automatic suv premium(US $79,950.00)

Auto Services in Arizona

Yates Buick Pontiac GMC ★★★★★

Valley Express Auto Repair ★★★★★

Unlimited Brakes & Auto Repair ★★★★★

The Tin Shed Auto ★★★★★

Son`s Automotive Svc ★★★★★

San Martin Tire Shop ★★★★★

Auto blog

Leaked dealer docs say Mercedes-AMG GT S to start at $129,900

Thu, Jan 22 2015The 2016 Mercedes-AMG GT exists as one of the most hotly anticipated European sports coupes to come along in quite some time. Offering some beautifully swoopy styling and a twin-turbocharged 4.0-liter V8 with 503 horsepower and 479 pound-feet of torque in S trim, there's really not much to dislike about it. However, until now, the price of this gorgeous German remained a mystery. According to a leaked letter to dealers obtained by Jalopnik, pricing for the 2016 GT S model allegedly starts at $129,900, and the coupe reportedly comes standard with a Nappa leather interior, Collision Prevention Assist Plus, Mercedes' COMAND infotainment system, Parktronic and Burmester sound system. The document also says more info about specific option pricing would be released in a few weeks. We've already compared both trims of the GT to the venerable Porsche 911 because the coupes seem like such natural competitors. Knowing the possible price adds one more factor to consider, though. In terms of performance, the GT S basically slots just below the 911 Turbo. However, if this amount is correct, then the starting cost is about $20,000 less than the turbocharged Porsche. While on paper the Mercedes lags somewhat in acceleration and power, it also arguably offers buyers a bit more style. This is definitely turning out to be an interesting fight between these two Germans. Related Video:

Fastest cars in the world by top speed, 0-60 and quarter mile

Tue, Feb 13 2024A claim for the title of “Fastest Car in the World” might seem easy to settle. ItÂ’s actually anything but: Are we talking production cars, race cars or customized monsters? And what does “fastest” even mean? For years, car publications have tended to define “fastest” in terms of an unbeatable top speed. ThatÂ’s distinct from the “quickest” car in a Usain Bolt-style dash from the starting blocks, as with the familiar 0-60 mph metric. Professionals often focus on track lap times or elapsed time-to-distance, as with a drag racer thatÂ’s first to trip the beam of light at the end of a quarter-mile; or the 1,000-foot trip of nitromethane-powered NHRA Top Fuel and Funny Car dragsters. Something tells us, however, that you're not seeking out an answer of "Brittany Force rewriting the NHRA record books with a 3.659-second pass at a boggling 338.17 mph." For most barroom speed arguments, the focus is firmly on cars you can buy in showrooms, even if many are beyond the financial means of all but the wealthiest buyers and collectors. Here are some of the enduring sources of speed claims, counter-claims, tall tales and taunting dismissals that are the lifeblood of car enthusiasts – now with EVs adding an unexpected twist to these passionate pursuits.  Fastest from the blocks: 0-60 mph Thirty years ago, any car that could clock 60 mph in five seconds or less was considered extremely quick. Today, high-performance, gasoline-powered sedans and SUVs are routinely breaking below 4 seconds. As of today, the 2023 Dodge Challenger SRT Demon 170 crushes all with a 0-60 mph time of just 1.66 seconds. That's simply absurd, but keep in mind the Demon was engineered with the single-minded purpose of going fast in a straight line. It's also important to realize that direct comparisons are difficult, because not all of these times were accomplished with similar conditions (prepped surfaces, adjustments for elevation and so on). The moral here is to take these times with a tiny grain of salt. After the Dodge, the Rimac Nevera comes in with an officially recorded 0-60 mph time of just 1.74 seconds. EVs crowd the quickest list, with the Pininfarina Battista coming in a few hundredths slower (1.79 seconds) than the Nevera and the Lucid Air sapphire (1.89 seconds) right after that. Eventually, you arrive to the Tesla Model S Plaid, which has a claimed 1.99-second 0-60 mph time, though instrumented testing by Car and Driver shows it accomplishes the deed in 2.1 seconds.

Mercedes-AMG once again joins forces with Cigarette Racing

Fri, Jan 30 2015Any time there's a new loins-quaking Mercedes-AMG introduced, you need to keep your eye on the aquatic horizon around the time of the Miami International Boat Show for the Cigarette tie-in to come roaring into port. The SLS AMG had its 2,700-horsepower, 46-foot Rider, the C63 AMG Black Series got a 1,350-hp, 50-foot Marauder, the G63 AMG got a 1,750-hp, 43-foot Huntress, and the SLS AMG E-Cell got a matching wild yellow 2,200-hp, 38-foot electric concept boat. Now that we're in 2015 with another AMG and another boat show, we have another Cigarette. Mercedes hasn't dropped the goods on this one yet, but it will be twins with the AMG GT. After that, we're guessing it will have a can't-miss-it paint job, be in the 40-foot range, and have something like 2,000 hp. The show is February 12-16, we'll have all the info for you then. Featured Gallery Mercedes-AMG and Cigarette Racing Auto News Mercedes-Benz Coupe Luxury Performance mercedes-amg mercedes-amg gt

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.032 s, 7947 u