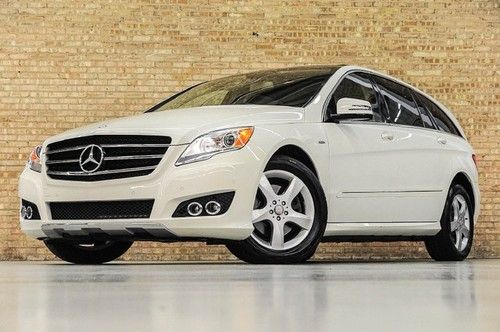

08 R320 Cdi, Diesel, 1 Owner, Service Records, Heated Seats, We Finance! on 2040-cars

Dallas, Texas, United States

Vehicle Title:Clear

For Sale By:Dealer

Engine:3.0L 2987CC V6 DIESEL DOHC Turbocharged

Body Type:Wagon

Fuel Type:DIESEL

Make: Mercedes-Benz

Model: R320

Trim: CDI Wagon 4-Door

Disability Equipped: No

Doors: 4

Drive Type: AWD

Drivetrain: All Wheel Drive

Mileage: 67,200

Sub Model: 3.0L CDI

Number of Cylinders: 6

Exterior Color: White

Interior Color: Tan

Mercedes-Benz R-Class for Sale

2010 mercedes-benz r350(US $29,900.00)

2010 mercedes-benz r350(US $29,900.00) 2011 mercedes r350 bluetec 4-matic

2011 mercedes r350 bluetec 4-matic 2011 mercedes benz r350 4matic! bluetec! 1ownr! premium! rear camera/dvd! svcd!(US $41,900.00)

2011 mercedes benz r350 4matic! bluetec! 1ownr! premium! rear camera/dvd! svcd!(US $41,900.00) 2007 mercedes r320 cdi turbocharged awd

2007 mercedes r320 cdi turbocharged awd R350 mercedes 2006 champagne 82,000 great shape.

R350 mercedes 2006 champagne 82,000 great shape. Panorama roof heated seats sport pkg trunk closure parktronic navigation mp3

Panorama roof heated seats sport pkg trunk closure parktronic navigation mp3

Auto Services in Texas

Youniversal Auto Care & Tire Center ★★★★★

Xtreme Window Tinting & Alarms ★★★★★

Vision Auto`s ★★★★★

Velocity Auto Care LLC ★★★★★

US Auto House ★★★★★

Unique Creations Paint & Body Shop Clinic ★★★★★

Auto blog

Weekly Recap: Ferrari looks to reclaim old success with new manager

Sat, Nov 29 2014Clearly, Ferrari doesn't race for fourth place, and this week, major changes continued at the Scuderia. It was a rough year for Ferrari, and the Scuderia conducted its season-ending tests in Abu Dhabi this week with a view toward a fresh start in 2015 with new leaders and a new ace driver. Though plenty of other Formula One teams were disappointed with their finishes in 2014, Ferrari was perhaps the most eager to put this season in its rear-view mirror. The Scuderia finished a distant fourth in the Constructors standings with 216 points, well behind No. 1 Mercedes (701 points), and Ferrari failed to win a single race as the Silver Arrows dominated the grid. It was an especially bitter pill for a team that claims 16 Constructors championships and 15 Drivers titles – the most in history – and is the only surviving team from F1's first season, 1950. Clearly, Ferrari doesn't race for fourth place, and this week, major changes continued at the Scuderia. Ferrari named Philip Morris executive Maurizio Arrivabene as team principal. He replaced Marco Mattiacci, who held the job for only seven months after taking over for Stefano Domenicali, who resigned in April amid the Scuderia's early-season struggles. Phillip Morris (through its Marlboro brand) is a key Ferrari sponsor, and that played a role in Arrivabene's ascension. Still, he's no stranger to F1, and has been intimately involved in the Ferrari-Marlboro partnership. He also has served as the sponsors' representative on the FIA's F1 Commission since 2010. In a statement, new Ferrari chairman Sergio Marchionne said: "We decided to appoint Maurizio Arrivabene because, at this historic moment in time for the Scuderia and for Formula One, we need a person with a thorough understanding not just of Ferrari, but also of the governance mechanisms and requirements of the sport." Arrivabene's background is primarily in marketing and communication, and most recently he held the title of vice president of consumer channel strategy and event marketing for Philip Morris. He has been with the company since 1997. Arrivabene now leads a team that's rife with change. Marchionne took over in October when longtime boss Luca di Montezemolo quit in a disagreement about Ferrari's future, and the company itself will be spun off from parent Fiat Chrysler Automobiles in 2015.

A car writer's year in new vehicles [w/video]

Thu, Dec 18 2014Christmas is only a week away. The New Year is just around the corner. As 2014 draws to a close, I'm not the only one taking stock of the year that's we're almost shut of. Depending on who you are or what you do, the end of the year can bring to mind tax bills, school semesters or scheduling dental appointments. For me, for the last eight or nine years, at least a small part of this transitory time is occupied with recalling the cars I've driven over the preceding 12 months. Since I started writing about and reviewing cars in 2006, I've done an uneven job of tracking every vehicle I've been in, each year. Last year I made a resolution to be better about it, and the result is a spreadsheet with model names, dates, notes and some basic facts and figures. Armed with this basic data and a yen for year-end stories, I figured it would be interesting to parse the figures and quantify my year in cars in a way I'd never done before. The results are, well, they're a little bizarre, honestly. And I think they'll affect how I approach this gig in 2015. {C} My tally for the year is 68 cars, as of this writing. Before the calendar flips to 2015 it'll be as high as 73. Let me give you a tiny bit of background about how automotive journalists typically get cars to test. There are basically two pools of vehicles I drive on a regular basis: media fleet vehicles and those available on "first drive" programs. The latter group is pretty self-explanatory. Journalists are gathered in one location (sometimes local, sometimes far-flung) with a new model(s), there's usually a day of driving, then we report back to you with our impressions. Media fleet vehicles are different. These are distributed to publications and individual journalists far and wide, and the test period goes from a few days to a week or more. Whereas first drives almost always result in a piece of review content, fleet loans only sometimes do. Other times they serve to give context about brands, segments, technology and the like, to editors and writers. So, adding up the loans I've had out of the press fleet and things I've driven at events, my tally for the year is 68 cars, as of this writing. Before the calendar flips to 2015, it'll be as high as 73. At one of the buff books like Car and Driver or Motor Trend, reviewers might rotate through five cars a week, or more. I know that number sounds high, but as best I can tell, it's pretty average for the full-time professionals in this business.

Daimler rebuffs Geely offer to buy stake

Wed, Nov 29 2017HONG KONG/BEIJING - Daimler AG has turned down an offer from China's Geely to take a stake of up to 5 percent via a discounted share placement, as the German automaker has long been reluctant to see existing shareholdings diluted, sources with knowledge of the talks said. A stake of that size would be worth $4.5 billion at current market prices. Although Daimler declined the offer, it told Geely it was welcome to buy shares in the open market, the sources added. Carmakers in China have embarked on a flurry of dealmaking, as they scramble to boost production of electric and plug-in hybrid vehicles ahead of tough new quotas to be imposed by Beijing, which wants to reduce urban smog and lower the country's reliance on oil. People with knowledge of Geely's thinking said the company was keen to access Daimler's electric car battery technology and wanted to establish an electric car joint venture in Wuhan, the capital of Hubei province. Geely, which also owns Swedish car maker Volvo, is still hopeful it can secure a deal in some form over the coming weeks, they added. The two automakers met in Beijing in recent weeks at Geely's behest. There, the Chinese firm, formally known as Zhejiang Geely Holding Group, offered to take a stake of between 3 percent and 5 percent if Daimler would issue new shares at a discount, the sources said. It was not immediately clear what kind of discount for the shares Geely had in mind or whether Geely was interested in buying the shares on the open market. A spokesman for Geely declined to comment. A spokesman for Daimler said the company was "very happy with our shareholder structure at present", but added that it would welcome new investors with a long-term interest in the company. Shares in Daimler were up 1 percent in early Wednesday trade, in line with the broader market.DAIMLER ALREADY TIED TO BAIC, BYD Geely, which has a market value of some $32 billion, is the leading domestic brand in China with a 5 percent market share, according to an analysis by Nomura Securities. A stake of 5 percent would establish it as Daimler's third-largest shareholder behind the Kuwait Investment Authority and BlackRock, who hold 6.8 percent and 6 percent respectively, according to Reuters data.