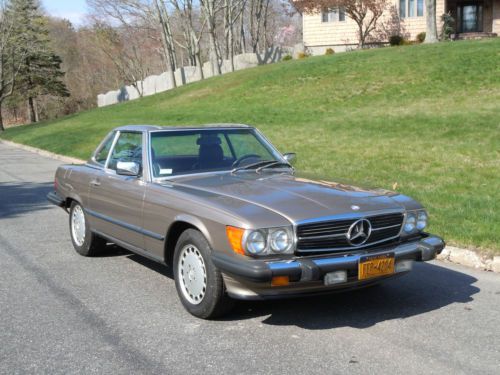

Immaculate 1987 Mercedes 560sl Convertible. Taupe/brown Interior. Low Miles. on 2040-cars

Valley Stream, New York, United States

|

Immaculate 1987 Mercedes 560 SL Convertible with Hard-top. 17,586 original miles. Desert Taupe Metallic Paint with Dark Brown Leather Interior. Meticulously maintained and always garage kept. Second owner within the same family. Includes original tool roll, first aid kit, car cover, manuals, papers and has four brand new Cooper tires. It has never been in an accident.

|

Mercedes-Benz 500-Series for Sale

1987 mercedes benz 560 sl- convertible 2 dr- includes both hard top and rag top

1987 mercedes benz 560 sl- convertible 2 dr- includes both hard top and rag top 91 tan 560-sel -power heated front + rear leather seats -low mi-73k - arizona

91 tan 560-sel -power heated front + rear leather seats -low mi-73k - arizona 1987 mercedes-benz 560sl project car or resto candidate(US $2,500.00)

1987 mercedes-benz 560sl project car or resto candidate(US $2,500.00) 2002 mercedes benz ml500

2002 mercedes benz ml500 1986 mercedes benz 560 sl with 70k! 1 owner! time capsule!(US $19,900.00)

1986 mercedes benz 560 sl with 70k! 1 owner! time capsule!(US $19,900.00) Mercedes 560sl 1989 roadster conv red only 47k orig miles all service records

Mercedes 560sl 1989 roadster conv red only 47k orig miles all service records

Auto Services in New York

Youngs` Service Station ★★★★★

Whos Papi Tires ★★★★★

Whitney Imports ★★★★★

Wantagh Mitsubishi ★★★★★

Valley Automotive Service ★★★★★

Universal Imports Of Rochester ★★★★★

Auto blog

The Mercedes-Maybach Pullman Guard is a limo with a bulletproof vest

Thu, Sep 22 2016As fabulously plush as the Mercedes-Maybach Pullman is, there is a certain class of individual for which luxury is only part of the equation. Oligarchs, dictators, kingpins of questionable businesses, and probably some legitimate world leaders all love luxury, but they sometimes face some hairy commutes that demand a bit more protection. For them, the answer to their luxury car needs is the armored Pullman Guard. The Mercedes-Maybach Pullman Guard tops the line of S-Class Guard models that also includes the Mercedes-Benz S600 Guard and the Mercedes-Maybach S600 Guard. Like the non-armored Pullman it packs loads of leather, seats with practically infinite adjustability, and redundant gauges for rear passengers. It is also by far the longest S-Class vehicle available, stretching more than 40 inches longer than the next-longest Mercedes-Maybach. This tremendous length allows the Pullman Guard to have four-passenger seating in the rear, with two seats facing two others. It's the perfect place to sign treaties or entertain diplomats. Or, if foreign affairs aren't your speed, it would also be a convenient place to carve up territory, issue ultimatums to enemies, and intimidate dissidents. The Pullman Guard was developed alongside the standard Pullman, and because of that, the added armor does not sacrifice interior space. The armor does affect weight, though. The Pullman Guard weighs over 11,000 pounds. But, in return, the steel plates on the sides and floor, non-Kevlar-brand high-strength fabrics, and polycarbonate-backed windows protect occupants from bullets and explosives. Plus, the Pullman Guard features a twin-turbo V12 that produces 530 horsepower and 612 lb-ft of torque to haul the added ballast around. If a recognized authority is ordering a Pullman Guard, Mercedes also offers sirens, flashing lights, two-way radios, an emergency starter battery, and a loudspeaker system. These items are sure to be useful when trying to navigate seas of protestors in the streets. All of this extra protection will cost you though, and if you have to ask, you definitely can't afford it. But we'll tell you the price anyway. A standard Pullman will run around $500,000 at current exchange rates. For the Guard model, be prepared to shell out about $1.56 million. It's a steep price for sure, but for those whose pampered lives are in danger, it's probably worth it.

Daimler rebuffs Geely offer to buy stake

Wed, Nov 29 2017HONG KONG/BEIJING - Daimler AG has turned down an offer from China's Geely to take a stake of up to 5 percent via a discounted share placement, as the German automaker has long been reluctant to see existing shareholdings diluted, sources with knowledge of the talks said. A stake of that size would be worth $4.5 billion at current market prices. Although Daimler declined the offer, it told Geely it was welcome to buy shares in the open market, the sources added. Carmakers in China have embarked on a flurry of dealmaking, as they scramble to boost production of electric and plug-in hybrid vehicles ahead of tough new quotas to be imposed by Beijing, which wants to reduce urban smog and lower the country's reliance on oil. People with knowledge of Geely's thinking said the company was keen to access Daimler's electric car battery technology and wanted to establish an electric car joint venture in Wuhan, the capital of Hubei province. Geely, which also owns Swedish car maker Volvo, is still hopeful it can secure a deal in some form over the coming weeks, they added. The two automakers met in Beijing in recent weeks at Geely's behest. There, the Chinese firm, formally known as Zhejiang Geely Holding Group, offered to take a stake of between 3 percent and 5 percent if Daimler would issue new shares at a discount, the sources said. It was not immediately clear what kind of discount for the shares Geely had in mind or whether Geely was interested in buying the shares on the open market. A spokesman for Geely declined to comment. A spokesman for Daimler said the company was "very happy with our shareholder structure at present", but added that it would welcome new investors with a long-term interest in the company. Shares in Daimler were up 1 percent in early Wednesday trade, in line with the broader market.DAIMLER ALREADY TIED TO BAIC, BYD Geely, which has a market value of some $32 billion, is the leading domestic brand in China with a 5 percent market share, according to an analysis by Nomura Securities. A stake of 5 percent would establish it as Daimler's third-largest shareholder behind the Kuwait Investment Authority and BlackRock, who hold 6.8 percent and 6 percent respectively, according to Reuters data.

Mercedes-Benz to boost stake in Aston Martin to 20%, lend it some tech

Wed, Oct 28 2020Daimler unit Mercedes-Benz is to lift its stake in Britain's Aston Martin to up to 20% by 2023, making it one of the struggling British carmaker's largest shareholders, Aston said on Tuesday. Aston Martin, popular for being James Bond's carmaker of choice, has suffered a torrid time since it went public two years ago, with its shares losing two-thirds of their value this year. The 107-year-old firm hired Tobias Moers, former CEO of Mercedes-AMG, as its new boss from August. Aston said the increase in Mercedes-Benz's stake, from 2.6% currently, would take place in several stages as part of a wider issue of 250 million shares at 50 pence each. The stock issued to the German group will have a maximum value of 286 million pounds ($372.7 million), it said. The deal will see an existing supply agreement between the two firms, in place since 2013, expanded to give Aston Martin access to key Mercedes' technology, including hybrid and electric drive systems. "We take another major step forward as our long-term partnership with Mercedes-Benz AG moves to another level, with them becoming one of the company's largest shareholders," said Aston's chairman and biggest shareholder Lawrence Stroll. The German firm will get the right to nominate one non-executive director to Aston Martin's board after its first shareholding increase, the London-listed firm said. Aston, which has started deliveries of its first sport utility vehicle, the DBX, said on Tuesday it swung into an adjusted core loss of 29 million pounds in the third quarter, versus a profit of 43 million pounds last year. Revenue in the period nearly halved to 124 million pounds, it said. Aston Martin is targeting annual capex of 250 million pounds to 300 million pounds per year between 2021 and 2025. It envisages production volumes of about 10,000 units, revenues of about 2 billion pounds and adjusted core profit of 500 million pounds by financial years 2024 or 2025.