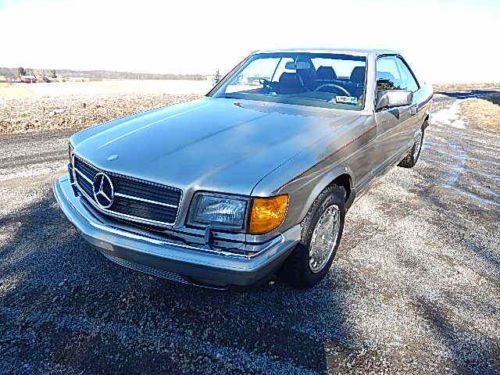

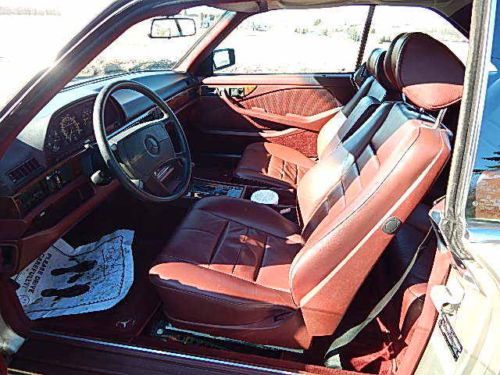

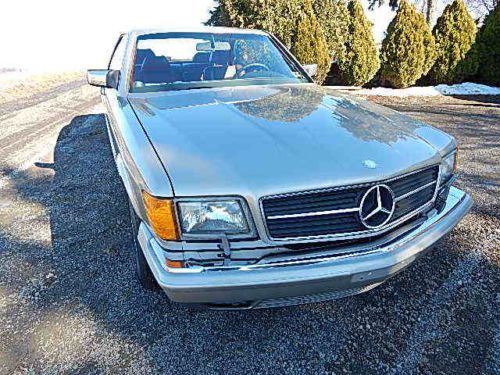

1986 Mercedes 560 Sec on 2040-cars

Harmony, Pennsylvania, United States

|

Used 1986 Mercedes 560 SEC Coupe. Same owner 25 + years, always garage kept. New front tires and brakes. Recent front end alignment and lube, oil and filter. Exceptional example of a nice original car. Call John : 412-973-4377 Shipping can be arranged Payment certified bank check or cash only. |

Mercedes-Benz 500-Series for Sale

Mercedes benz e-500(US $15,400.00)

Mercedes benz e-500(US $15,400.00) 1994 mercedes s500 only 104k original miles autocheck certified black beauty!!!

1994 mercedes s500 only 104k original miles autocheck certified black beauty!!! Mercedes s500 year 2004 color silver very good condition(US $13,000.00)

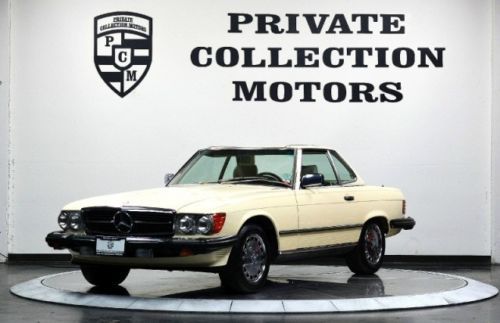

Mercedes s500 year 2004 color silver very good condition(US $13,000.00) Convertible super low miles pristine condition col(US $29,888.00)

Convertible super low miles pristine condition col(US $29,888.00) 1991 91 white mercedes benz 500 sl 500sl roadster convertible amg wheels low res

1991 91 white mercedes benz 500 sl 500sl roadster convertible amg wheels low res Excellent condition, everthing works, 176k, dent in rear left door.

Excellent condition, everthing works, 176k, dent in rear left door.

Auto Services in Pennsylvania

Young`s Auto Body Inc ★★★★★

Van Gorden`s Tire & Lube ★★★★★

Valley Seat Cover Center ★★★★★

Tony`s Transmission ★★★★★

Tire Ranch Auto Service Center ★★★★★

Thomas Automotive ★★★★★

Auto blog

2014 Mercedes-Benz S-Class revealed again in 1:18 scale

Fri, 10 May 2013There is plenty to look forward to when it comes to the 2014 Mercedes-Benz S-Class, but it could end up being a fairly anticlimactic reveal thanks to fully exposed spy shots, a leaked press photo and now images of a diecast version of the luxury sedan. Autoweek.nl has images showing a highly detailed 1:18 scale model of the redesigned S-Class that matches up with everything we've seen so far.

This isn't the first time a model car spoiled a new vehicle's reveal, as the 2014 Mercedes-Benz CLA-Class and 2013 SRT Viper were both unceremoniously revealed in toy form first. World Car Fans is reporting that the car 2014 S-Class will be officially unveiled on May 15, but at this point, all that's left to wonder about is the official on-sale date and what will be under the hood.

Mercedes and VW battling Uber and Apple to spend billions on Nokia mapping division

Tue, May 12 2015Whether for autonomous driving or simply better navigation, digital mapping is closely linked with the future of motoring. The sale of a major player in that industry is spurring a showdown between automotive behemoths and tech giants, and it's a fascinating battle to watch unfold. Nokia is selling its Here mapping division, and while the company might not have the name recognition of Google, it controls about 70 percent of the auto market. The business is valued at $785 million, according to Reuters, but is likely to sell for significantly more. Case in point: Uber reportedly submitted a $3 billion bid. Apple has also been rumored to be among those interested in purchasing Here. A trio of German automotive heavyweights is mounting a challenge to Silicon Valley, though. According to Reuters speaking to two unnamed insiders, Daimler, BMW, and Audi are teaming up to submit a joint bid for an undisclosed sum. They're worried that if Here falls under the control of tech companies, then automakers might have limited availability to these vital maps in the future. Nokia bought Here for $8.1 billion in 2007, according to Reuters. The company operates a fleet of vehicles with cameras and LIDAR that drive around the world to create high-definition maps. It also generates even more information by using the GPS data from shipping and trucking companies.

Daimler buying 12% stake in Beijing Auto

Tue, 19 Nov 2013Daimler and Beijing Automotive are officially going steady, with the German company set to take a 12-percent stake in the Chinese brand tomorrow. The two are already tied up in a Mercedes engine plant in Beijing, of which BAIC will increase its stake in, from 50 to 51 percent. Daimler will also get two seats on the Chinese company's board. BAIC may also gain the ability to produce cars on Mercedes-Benz platforms, according to Automotive News Europe.

The investment in BAIC comes ahead of that company's initial public offering, according to a report form Bloomberg, which indicates the deal will be inked tomorrow in the Chinese capital. According to the report, if the circumstances are right, BAIC may turn around and invest in the Germany company "soon."

It's not entirely clear just how much the 12-percent cut is costing Daimler, although it seems reasonable to assume that, as it's ahead of the IPO, the parent company of Mercedes is getting a bit of a bargain.