2021 Mazda 3 Premium Plus on 2040-cars

Remsen, New York, United States

Fuel Type:Gasoline

For Sale By:Private Seller

Vehicle Title:Clean

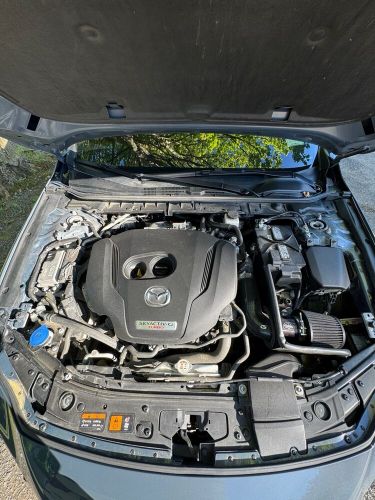

Engine:2.5L Gas I4

Year: 2021

VIN (Vehicle Identification Number): JM1BPBNY8M1347624

Mileage: 46100

Trim: PREMIUM PLUS

Number of Cylinders: 4

Make: Mazda

Drive Type: AWD

Model: 3

Exterior Color: Grey

Mazda 3 for Sale

2009 mazda 3 i(US $3,500.00)

2009 mazda 3 i(US $3,500.00) 2007 mazda 3 i(US $850.00)

2007 mazda 3 i(US $850.00) 2015 mazda 3 touring(US $18,000.00)

2015 mazda 3 touring(US $18,000.00) 2014 mazda 3 touring(US $5,700.00)

2014 mazda 3 touring(US $5,700.00) 2016 mazda 3 grand touring(US $7,400.00)

2016 mazda 3 grand touring(US $7,400.00)

Auto Services in New York

Xtreme Auto Sales ★★★★★

WaLo Automotive ★★★★★

Volkswagon of Orchard Park ★★★★★

Urban Automotive ★★★★★

Trombley Tire & Auto ★★★★★

Tony`s Boulevard Service Center ★★★★★

Auto blog

Mazda's first profit in five years in sight due to weak yen

Fri, 05 Apr 2013Automotive News reports Mazda is set to turn a profit for the first time in five years. The automaker is more dependent on exports from Japan than other automakers based in that country, and as a result, it has long suffered at the hands of a strong yen. But the currency has declined in value by some 16 percent over the past six months and Mazda's shares have tripled in value to their highest level since 2008. Contrast this situation to a year ago when Mazda printed 1.22 billion new shares to raise cash. The move was equivalent to 70 percent of the company's then-outstanding stock, and values tumbled to record lows as a result.

Now that the yen has fallen to a value of around 96 per dollar, Mazda operations in the US are more profitable and the company now projects it will earn around $279 million for the next fiscal year. Automotive News says a one yen change against the dollar can have a 9.1 percent impact on Mazda operating profit compared to 4.7 percent at Subaru parent Fuji Heavy Industries or 3.1 percent at Toyota. Those automakers better insulate themselves from currency fluctuations with overseas manufacturing facilities.

2015 SEMA Show Recap | Autoblog Minute

Fri, Nov 6 2015We take a trip to Las Vegas for a preview of the 2015 SEMA Show, the trade show for automotive aftermarket professionals and enthusiasts. Autoblog's Eddie Sabatini reports on this edition of Autoblog Minute, with commentary from Senior editor, Greg Migliore. Chevrolet Ford Honda Mazda Autoblog Minute Videos Original Video galpin

Why Mazda’s Skyactiv-X compression-ignition engine is a smart hedge bet

Tue, Aug 8 2017Mazda has cracked the code on a compression-ignition engine, called Skyactiv-X (which utilizes SCCI, or Spark Controlled Compression Ignition). That's a neat engineering accomplishment, sure, but why is the tiny company investing big dollars in fancy tech that's frustrated the much larger companies who've investigated it? In this case, Mazda is peering into a crystal ball to consider how best to flow with a few troubling tides. One is the premature handwringing about the death of the internal combustion engine, another is Europe's swing away from diesel engines. Skyactiv-X seems, at this juncture, a hedge bet against both aspects. EV infrastructure lags massively behind our petroleum infrastructure — no shock there. Mazda claims the tech will net 20-30 percent gains in fuel efficiency over its current gasoline engines and about matching its diesel engine. And that's without any onboard hybrid tech, so that staves off the inevitable necessity to fully adopt electrification for a while — this is assuming that, at some point, it won't be practical to sell a non-hybrid or non-EV. At what date that happens is open to debate, but as I said above, technology like this kicks that decision point down the road a bit. Mazda is here translating research dollars into time, allowing its engine factories a few more years of probably profitable production of internal-combustion engines before retooling, and before somebody needs to pour a massive amount of money into a broad EV charging infrastructure to replace gas stations. None of this is happening fast enough for a wholesale transition to EVs anytime soon. So, that's one bet hedged. The next is Europe's declining interest in diesel engines for mainly health reasons. Just about a week ago, The New York Times posted an excellent primer on this issue, which is somewhat controversial in Europe. Germany's auto industry, a huge portion of its economy, is heavily invested in diesel tech and seriously opposed to proposals in Britain and France to eliminate the technology, which creates unhealthy diesel particulate emissions. The German industry is hoping Band-Aids like pollution-reducing measures will help them, but after a massive and widespread emission cheating scandal, its credibility is at a nadir. It seems like consumers have sensed which way the wind is blowing, and it has hurt sales. The NYT reports that diesel sales in Germany alone — remember, bastion and originator of diesel technology — are down 13 percent.