Porsche : Other 1955 Porsche 550 Spyder Replica By Beck on 2040-cars

Lake Forest, Illinois, United States

|

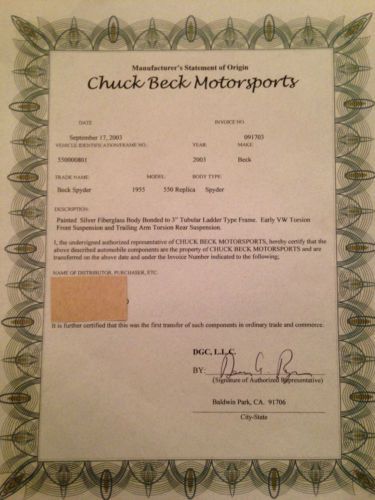

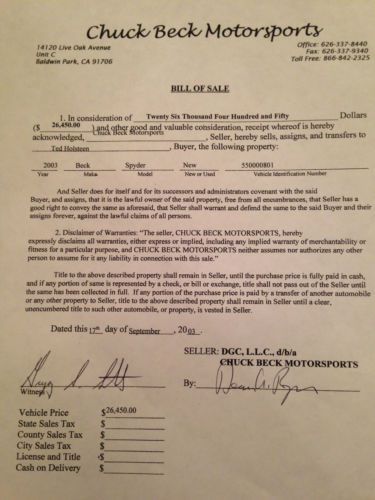

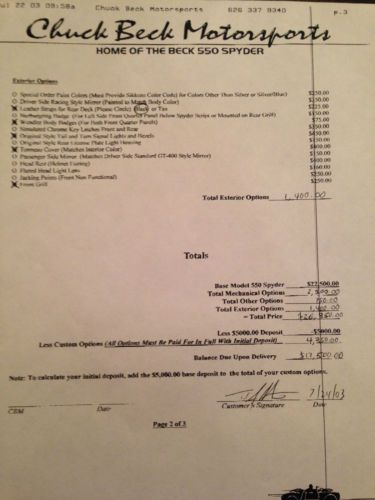

You are bidding on my Beck Spyder 550 Replica. I purchased it from original owner in 2010 when it had 2,800 miles. The car was built in 2003 and is currently registered in Illinois as a 1966 Volkswagen. The car has 3,000 miles and it is in excellent condition. I only drove it to Starbucks and a couple of car shows. All the vehicle build sheet and information is in the pictures.

|

Maserati Spyder for Sale

2003 maserati spyder cambiocorsa - 1 florida owner - only 21k miles(US $28,900.00)

2003 maserati spyder cambiocorsa - 1 florida owner - only 21k miles(US $28,900.00) 2005 toyota mr2 spyder 1 owner 6 speed sequential(US $15,500.00)

2005 toyota mr2 spyder 1 owner 6 speed sequential(US $15,500.00) 2001 toyota mr2 spyder base convertible 2-door 1.8l(US $7,000.00)

2001 toyota mr2 spyder base convertible 2-door 1.8l(US $7,000.00) 1999 mitsubishi eclipse spyder gs convertible 2-door 2.4l

1999 mitsubishi eclipse spyder gs convertible 2-door 2.4l 2005 mitsubishi eclipse spyder gs convertible 2-door 2.4l

2005 mitsubishi eclipse spyder gs convertible 2-door 2.4l Maserati cambiocorsa spyder 2002

Maserati cambiocorsa spyder 2002

Auto Services in Illinois

Woodfield Nissan ★★★★★

West Side Tire and Alignment ★★★★★

U Pull It Auto Parts ★★★★★

Trailside Auto Repair ★★★★★

Tony`s Auto & Truck Repair ★★★★★

Tim`s Automotive ★★★★★

Auto blog

Fiat Chrysler's profit boosted by Ram and Jeep in North America

Wed, Jul 31 2019MILAN/DETROIT — Fiat Chrysler took the market by surprise by sticking to its full-year profit guidance on Wednesday after a strong performance from its Ram pickup truck in North America helped it defy an industry slowdown. Chief Executive Mike Manley, in FCA's first earnings release since a failed attempt to merge with France's Renault, also left the door open to that or other deals. "We are open to opportunity," Manley said on a call with analysts. "I have no doubt why there still would be interest in it," he added, when pressed on what it would take to revive talks with Renault. Manley declined to comment further. FCA last month abandoned its $35 billion merger offer for Renault, blaming French politics for scuttling what would have been a landmark deal to create the world's third-biggest automaker. Manley said a merger was not a must-have and Fiat Chrysler's business plan was strong. The company said it remained confident its adjusted earnings before interest and tax (EBIT) would top last year's 6.7 billion euros ($7.5 billion). Given disappointing forecasts from other automakers this earnings season, FCA's confirmation of the outlook sent Milan-listed shares in the Italian-American automaker, whose other brands include Jeep, up over 4%. A broad-based auto sales downturn has rattled the sector, forcing FCA's competitors — including Renault, Daimler and Aston Martin — to cut their sales forecasts after second-quarter results, while U.S. carmaker Ford gave a weaker-than-expected 2019 profit outlook. Japan's Nissan, a long-term partner of Renault, said it would cut 12,500 jobs by 2023 after its earnings collapsed. In the second quarter FCA's adjusted EBIT totaled 1.52 billion euros, versus analysts' expectations of 1.43 billion euros, according to a Reuters poll. FCA's U.S. shipments were down 12% in the second quarter but the group said that the successful performance of its Ram brand resulted in an enhanced share of the large pickup truck market of 27.9%, up 7 percentage points from last year. Adjusted EBIT margin in North America rose to 8.9% from 6.5% in the first quarter, thanks to strong demand for the heavy-duty Ram and the new Jeep Gladiator pickup. Chief Financial Officer Richard Palmer also said FCA expected to report up to 10% margins in the region in both the third and fourth quarters.

Stellantis expects strike to cost it $795 million in third-quarter profits

Tue, Oct 31 2023MILAN — Automaker Stellantis said Tuesday that the autoworkers strike in North America is expected to cost the company around 750 million euros ($795 million) in profits — less than its North American competitors. The Europe-based maker of Jeep, Fiat and Peugeot reported a 7% boost in net revenues to 45.1 billion euros, with production halts caused by the strikes costing the company 3 billion euros in sales through October. The net revenue boost was due to higher volumes in all markets except Asia. Chief Financial Officer Natalie Knight told journalists that StellantisÂ’ strike impact was lower than the other Big Three automakers due to its global profile as well as some high-profile cost-cutting measures, calculating the hit at around 750 million euros ($795 million.) GM, the last carmaker to reach a deal to end the strike, reported an $800 million strike hit. Ford has put its impact at $1.3 billion. “We continue to be in a very strong position globally and in the U.S. This is an important market for us, and weÂ’re highly profitable and we are very committed to our future," Knight said. “But mitigation is core to how we act, and how we proceed.” Stellantis has canceled appearances at the CES technology show in Las Vegas next year as well as the LA Auto Show, due to the strike impact. Stellantis on Saturday reached a tentative agreement with the United Auto Workers Union to end a six-week strike by more than 14,000 workers at its assembly plants in Michigan and Ohio, and at parts warehouses across the nation. Stellantis does not report full earnings for the third quarter, instead providing shipments and revenues. It said that global sales of electric vehicles rose by 37% over a year earlier, powered by the Jeep Avenger and commercial vehicle sales. North America continued to be the revenue leader, contributing 21.5 billion euros, an increase of 2% over last year, and representing nearly half of global revenues. Europe, the next biggest performing region, saw revenues grow 5% to 14 billion euros, as sales rose 11%. Related video: Earnings/Financials UAW/Unions Alfa Romeo Chrysler Dodge Fiat Jeep Maserati RAM

UPDATE: Stellantis says it is not selling Maserati

Mon, Jul 29 2024In a joint statement, Stellantis and Maserati have refuted reports that the Italian brand could be sold: Stellantis has no intention of selling the Trident brand, just as there is no intention of aggregating Maserati within other Italian luxury groups. Stellantis restates its unwavering commitment to Maserati’s bright future as the unique luxury brand within the 14 Stellantis brands. Maserati is in a transition period toward electrification with its Folgore BEV program: today the Trident offers GranTurismo and GranCabrio in ICE and BEV versions, Grecale in ICE, mild-hybrid and BEV versions, while we confirm that successors of the Quattroporte and Levante are also in preparation. Maserati's mission is to write the future of mobility through the best performance in the luxury segment, focusing on the desires of its customers. To achieve its goals, the brand precisely targets a highly specific audience. Maserati is therefore setting up a series of initiatives to expand its presence in the global market, to strengthen its brand image and to underline the uniqueness of its products. Maserati is facing a major challenge and must remain focused on its objectives in the coming months. Stellantis reaffirms its commitment to its entire portfolio of 14 iconic brands and recalls that each of them has a 10-year horizon to build a profitable and sustainable business, while recognizing that market volatility and temporary situations may cause fluctuations. The original story continues: Maserati posted disappointing sales and revenue figures shortly after Stellantis CEO Carlos Tavares warned that the group can't afford to have brands that don't make money. While nothing is set in stone, one of the group's executives said that selling the brand isn't off the table. Industry trade journal Automotive News Europe (subscription required) learned that Maserati sold approximately 6,500 cars globally between January and June 2024, down from around 15,300 units during the same time period in 2023. It posted an adjusted operating loss of ˆ82 million (about $88.7 million) during the first six months of the year, compared to a profit of ˆ121 million (about $130 million) in 2023. "The first half has been disappointing," admitted Natalie Knight, the chief financial officer at Stellantis, on a call with journalists.