1998 Mitsubishi Eclipse Spyder Gs Convertible 2-door 2.4l on 2040-cars

Orlando, Florida, United States

|

This car is 100% original. has not been modified in anyway except for rims and tires.. runs great 98k original miles it was my daily driver but my family is growing too large now. I reserve the right to drive until auction has ended .Thank you and happy bidding if any question text me serious inquires only..850-324-two 5 nine 7 pros cold ac power windows and locks leather interior no rips great gas millage new rims and tires top lets down and up low miles paints in good shape cons top will need to be replace in the future. cost 200$ on ebay small dent in passenger rear quarter panel Thank you and happy bidding if any question text me serious inquires only..850-324-two 5 nine 7 |

Maserati Spyder for Sale

2001 toyota mr2 spyder convertible sports car 63,000 miles 5 spd no reserve set

2001 toyota mr2 spyder convertible sports car 63,000 miles 5 spd no reserve set 2007 gt (2dr spyder sportronic auto gt) used 3.8l v6 24v automatic convertible

2007 gt (2dr spyder sportronic auto gt) used 3.8l v6 24v automatic convertible 2001 eclipse spyder gt (parts car or drive)(US $2,000.00)

2001 eclipse spyder gt (parts car or drive)(US $2,000.00) 1995 mitsubishi 3000gt spyder sl convertible 2-door 3.0l(US $12,995.00)

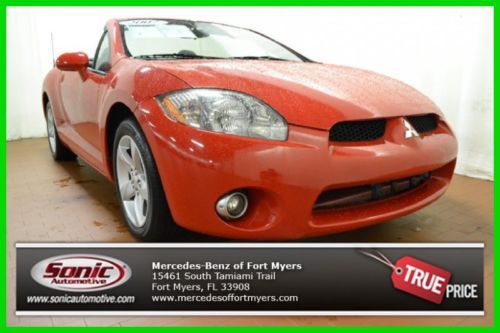

1995 mitsubishi 3000gt spyder sl convertible 2-door 3.0l(US $12,995.00) 2012 mitsubishi eclipse spyder gs sport convertible 2-door 2.4l(US $15,499.00)

2012 mitsubishi eclipse spyder gs sport convertible 2-door 2.4l(US $15,499.00) 2007 mitsubishi spyder convertible we finance gray low miles subwoofer(US $11,244.00)

2007 mitsubishi spyder convertible we finance gray low miles subwoofer(US $11,244.00)

Auto Services in Florida

Wildwood Tire Co. ★★★★★

Wholesale Performance Transmission Inc ★★★★★

Wally`s Garage ★★★★★

Universal Body Co ★★★★★

Tony On Wheels Inc ★★★★★

Tom`s Upholstery ★★★★★

Auto blog

Maserati special editions celebrate the end of the V8 at Goodwood

Wed, Jul 12 2023The Goodwood Festival of Speed is ready to cheer anything with pretensions to velocity, equally respectful to new hooligans trying to seize the day and veterans that have had theirs. Maserati's brought both to the 'sceptered isle, sometimes demonstrated in the same body. The house of the trident will start shutting down V8 production next year, bringing an end to 64 years of eight-cylinder Maseratis going back to the 5000 GT of 1959. The Ghibli 334 Ultima and Levante V8 Ultima special editions commemorate the sunset, both powered by the departing twin-turbo 3.8-liter V8 making 572 horsepower and 538 pound-feet of torque. The sedan gets the "334" designation of its top speed in kilometers per hour, known as 206.3 mph in non-metric lands. That's three miles per hour more than the Ghibli Trofeo's top speed as shown on Maserati's retail U.S. site. Performance and aero updates include a new carbon fiber spoiler, special tires made from a new compound, and 21-inch Orione wheels. The sprint to 62 miles per hour drops from 4.3 seconds to 3.9. The automaker calls this car the "current fastest internal combustion engine sedan in the world," and it's going to climb the Goodwood hill. Each special edition gets 103 examples. Maserati hasn't discussed regional allotments nor how to make a reservation. The rest of the Italian showcase in Lord March's back yard revolves around the new. The GrandTurismo Trofeo with a Nettuno V6 will be there, the 542-hp V6 stepping further out of the shadow of the V8. The battery-electric GranTurismo Folgore takes a bow as well, as does the Grecale Folgore. Artsy types will want a look at the GranTurismo Prisma, a one-off based on the Nettuno-powered GranTurismo Trofeo. Revealed a few months ago, this tips a cap to 75 years of the automaker. Artists hand-painted the body with 14 colors that nod to classic Maserati hues, then hand-painted the names of classic models like the Indy, Mistral, and Amaranto, applying more than 8,500 individual characters. Finally, a GranTurismo Folgore and an MC20 Cielo will join the Ghilbli 334 Ultima making a run up the hill. The MC20 Cielo is returning for a second run after a debut jaunt last year.

Dealer sues Maserati for fabricating sales numbers

Fri, Sep 4 2015A Maserati dealer with stores in New York, New Jersey, and Florida is suing Maserati North America for allegedly requesting that they inflate sales or receive lower incentives. The plaintiff in this case refused to participate and claims that it unfairly lost profits as a result, according to Automotive News. The lawsuit hinges on a request from FCA that its dealers move vehicles into their test-drive fleet, a practice called punching them. Most stores keep at least one example of each model in their demonstrator fleet. While they don't immediately go to a customer, a punched vehicle appears as a sale for an automaker at the end of the month. This case alleges that Maserati North America told its dealers in September 2014 to punch 2015 Ghiblis, even though the sedans hadn't been delivered yet. As a result, the Italian automaker was able to post an additional 105 sales for the month. Furthermore, the stores purportedly received additional bonuses when they later sold these models to customers, and there was possibly another request to claim vehicles as demonstrators in December 2014, Automotive News reports. Amid rapidly growing global demand, Maserati increased Ghibli and Quattroporte production to 900 cars per week in mid-2014. However, the company had to reverse course in 2015 and cut back shifts at its Grugliasco factory. The launch of the upcoming Levante crossover is expected to bring another boost.

Maserati Quattroporte custom-built wagon up for sale

Fri, May 7 2021These days, any modern station wagon is a rare machine, with models such as the Mercedes-Benz E-Class, Volvo V90, Audi RS6 Avant, and Porsche Panamera Sport Turismo selling not much more than a handful each. But combine the rarity of the wagon body style with the relative obscurity of the Maserati Quattroporte, and you have a truly unique longroof. That's exactly what you see here, a Maserati Quattroporte shooting brake, and it's coming up for sale by Historics Auctioneers in the U.K. Maserati never made a wagon version of its Quattroporte — "Cinqueporte"? — but that didn't stop one determined U.K. buyer. Inspired by the Quattroporte-based Bellagio Fastback, four of which were built by the Italian coachbuilder Touring, he had this 2016 Quattroporte converted into a shooting brake. The work was carried out by British high-end car restorer Adam Redding. The result looks like it could have come out of the factory in Modena. It's finished in Gunmetal Grey Metallic with 20-inch Mercurio alloy wheels with a black finish. The interior is Nero leather. There are no jump seats in the cargo hold, just luggage space, which again appears finished to a factory standard and is accessed via a power liftgate. Other features include navigation, parking sensors, heated seats, a backup camera, and a sunroof. As a U.K. car, this Maserati is right-hand drive. The Quattroporte's voluptuous styling lends itself to the wagon form. Too bad Maserati is unlikely ever to pick up the baton and offer such a model itself. Short of commissioning one yourself, this upcoming auction is likely to be the only chance to get one. Related video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.