2010 Range Rover Hse Supercharged Black/black Loaded!! on 2040-cars

Walled Lake, Michigan, United States

Body Type:SUV

Vehicle Title:Clear

Engine:5.0L SUPERCHARGED V8

Fuel Type:Gasoline

For Sale By:Private Seller

Make: Land Rover

Model: Range Rover

Trim: HSE SUPERCHARGED

Options: Sunroof, 4-Wheel Drive, Leather Seats, CD Player

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Drive Type: 4WD

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Mileage: 44,928

Exterior Color: Santorini Black

Interior Color: Jet Black

Number of Doors: 4

Number of Cylinders: 8

Warranty: Vehicle has an existing warranty

Up for sale is a 2010 Land Rover Range Rover HSE Supercharged FULLY LOADED! This vehicle has an MSRP of over 104K. This has been a One Owner/Non Smoking vehicle. There are over 9K in upgrades/options on this vehicle. These upgrades include: Audio System Upgrade - $1350, Black Lacquer Finish - $350, Surround Camera System - $900, HD Digital Radio - $350, Jet Headliner - $400, Rear Recline Seat Pack 2 - $1250, Rear Seat Entertainment - $2500, Wood Leather Steering Wheel - $1000, and 4 Zone Climate Control - $1000. A $1000 Non-Refundadble deposit is due within 24 hrs of auction ending. Remaining balance is due within 7 days of auction ending. Buyer must contact to arrange pick-up/shipping. I will deliver this vehicle up to 500 miles from 48390 for a FEE. Feel free to ask any questions. SERIOUS OFFERS ONLY! Good Luck and Thank You.

Specifications

6ft 1.9in

0ft 9.1in

Exterior Measurements

| 6 ft. 8.1 in. (80.1 in.) | 6 ft. 1.9 in. (73.9 in.) |

| 16 ft. 3.8 in. (195.8 in.) | 0 ft. 9.1 in. (9.1 in.) |

| 5 ft. 4.1 in. (64.1 in.) | 5 ft. 4 in. (64 in.) |

| 9 ft. 5.3 in. (113.3 in.) |

Interior Measurements

| 39.3 in. | 38.9 in. |

| 61.4 in. | 38.3 in. |

| 35.5 in. | 60.0 in. |

Fuel

| Gas | Premium unleaded (required) |

| 27.6 gal. | 331.2/496.8 mi. |

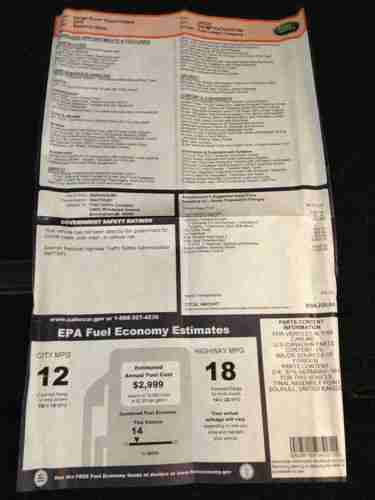

| 12/18 mpg |

Weights and Capacities

| 7716 lbs. | 1164 lbs. |

| 7055 lbs. | 5891 lbs. |

| 34.0 degrees | 26.6 degrees |

| 74.2 cu.ft. | |

** When adequately equipped, which may require engine and/or other drivetrain upgrades. | |

DriveTrain

| Four wheel drive | 6-speed shiftable automatic |

Engine & Performance

| 5.0 L | Double overhead cam (DOHC) |

| V8 | 32 |

| Variable | 461 ft-lbs. @ 2500 rpm |

| 510 hp @ 6500 rpm | 39.4 ft. |

Suspension

|

|

|

|

Warranty

| 4 yr./ 50000 mi. | 4 yr./ 50000 mi. |

| 1 yr./ 7500 mi. | 4 yr./ 50000 mi. |

Features

Interior Features

Front Seats

|

|

|

|

|

|

|

|

|

|

Rear Seats

|

|

|

Power Features

|

|

|

|

|

|

Instrumentation

|

|

|

|

|

|

Convenience

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comfort

|

|

|

|

|

|

|

|

|

|

|

|

|

Memorized settings

|

|

In Car Entertainment

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Telematics

|

|

|

Exterior Features

Roof and Glass

|

|

|

|

|

|

Tires and Wheels

|

|

|

|

|

|

|

Doors

|

|

Towing and Hauling

|

|

Safety Features

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Land Rover Range Rover for Sale

2011 land rover range rover hse, baltic blue over ivory,navigation,rear view cam(US $61,900.00)

2011 land rover range rover hse, baltic blue over ivory,navigation,rear view cam(US $61,900.00) 2004 land rover ranger rover hse 99k miles navigation clean low mile(US $15,995.00)

2004 land rover ranger rover hse 99k miles navigation clean low mile(US $15,995.00) Land rover range rover supercharged awd dvd entertainment navigation camera hk(US $41,995.00)

Land rover range rover supercharged awd dvd entertainment navigation camera hk(US $41,995.00) (US $11,900.00)

(US $11,900.00) * supercharged 5.0l * certified 100k warranty * 1,200 watt audio * full history

* supercharged 5.0l * certified 100k warranty * 1,200 watt audio * full history 2010 land rover range rover hse silver

2010 land rover range rover hse silver

Auto Services in Michigan

Z Tire Center Of Grand Haven ★★★★★

Williams Volkswagon & Audi ★★★★★

Warren Auto Ctr ★★★★★

Warehouse Tire Stop ★★★★★

Van Dam Auto Sales & Leasing ★★★★★

Uncle Ed`s Oil Shoppe ★★★★★

Auto blog

Jaguar Land Rover to badge vehicles based on horsepower

Wed, Sep 27 2017Add Jaguar and Land Rover to the list of automakers changing their nomenclature due to the realities of engine downsizing. Spy photos of an unreleased Jaguar F-Type model show a badge reading P380 AWD. The letter P evidently refers to Petrol (British for gasoline), and 380 is the engine's horsepower. According to Auto Express, the entry-level F-Type will be badged P300, indicating the power output of its 2.0-liter turbocharged four-cylinder engine. Land Rover is expected to follow suit with the new badging nomenclature. Diesel models will get a D instead of a P, while electric and hybrid models will get an E badge, along with a number corresponding to total system power. So, expect the I-Pace to sport an E400 badge on its hind end. One question we have, though, is how the disparity between mechanical, metric and imperial horsepower will be dealt with. While such power-specific badges are arguably unnecessary, we expect the trend to proliferate as engines continue to get smaller but turbocharging and electrification keep horsepower climbing. At least JLR's badges are easier to understand than the messy way Audi plans to rename its models or the way BMW completely dismisses actual engine size in its naming convention. Related Video: News Source: Auto ExpressImage Credit: Simon Dawson/Bloomberg via Getty Design/Style Green Jaguar Land Rover Convertible Crossover Hatchback SUV Wagon Luxury Performance Sedan jaguar land rover

Jaguar reportedly prepping fully electric F-Pace

Thu, Feb 19 2015Tesla might want to take a look over its shoulder because there could be a cat catching its Model X in a few years. Jaguar reportedly has a fully electric vehicle under development that is possibly based on the upcoming F-Pace crossover, and it could be on sale in Europe as soon as 2018. Autocar cites anonymous "well-placed industry sources" as the foundation for the rumor and believes that Jag's future CUV would be the most likely recipient of the new powertrain. The battery electric technology would reportedly be shared with the brand's partners at Land Rover to keep costs down, and a range of around 300 miles would be the target. The F-Pace is reportedly already being prepped with a number of drivetrain options. JLR's latest 2.0-liter turbocharged four-cylinder and supercharged 3.0-liter V6 are likely choices. However, a hybrid version is rumored, as well. JLR has been taking baby steps towards electrification for quite some time. Perhaps the biggest example was the introduction of the Range Rover Hybrid, but Land Rover has also been rumored to have an EV version of its flagship SUV under development too. The company already tested several electric Defenders, as well. From Jaguar's camp, the automaker recently trademarked the EV-Type name in the US and Europe, and its C-X75 concept had a very interesting hybrid system. The reason for all of this EV development from the Brit brands is to adhere to constricting emissions rules around the world, according to Autocar. The EU is moving to real world testing possibly as soon as 2017, and US regulators continue to work towards cleaning up the cars here, too. News Source: Autocar Green Jaguar Land Rover Emissions Crossover Electric Luxury jaguar land rover jaguar f-pace jlr

Regulators consider adding more carmakers to Takata recall

Tue, Sep 29 2015Volkswagen's diesel emissions scandal has been getting a lot of press recently, but the Takata airbag inflator affair could be grabbing headlines again soon. According to Bloomberg, the National Highway Traffic Safety Administration is contemplating an expansion to the campaign that could add seven automakers to the 12 already affected. They are Jaguar Land Rover, Mercedes-Benz, Spartan Motors, Suzuki, Tesla, Volvo Trucks, and VW Group. To be clear, there's no recall for any of these automakers, yet. The government is simply asking for a full list of vehicles that each of them have with Takata-supplied inflators containing ammonium nitrate propellant. The agency is concerned this substance could play a roll in the ruptures. "NHTSA is considering not only whether to issue an administrative order that would coordinate the remedy programs associated with the current Takata recalls, but also whether such an order should include expansion of the current recalls," the letters say. All seven can be viewed, here. From a report supplied by Takata, the government already knows that the company supplied 887,055 inflators with ammonium-nitrate propellant to VW and 184,926 of them to Tesla. In an incident during the summer, a side airbag allegedly burst in a 2015 VW Tiguan. In early September, NHTSA put out a revised report that there were 23.4 million inflators to be replaced in 19.2 million vehicles in the US. An earlier accounting from the agency had about 34 million of the parts in 30 million cars. High humidity is still believed to be among the biggest risk factors for the ruptures. Although, if ammonium nitrate also gets the blame, some already recalled models might need to be repaired again. Related Video: